June brought MISO a peak 2 GW lower than anticipated and unchanged real-time and fuel prices from last year, the RTO said in its monthly operations report.

MISO encountered a 113-GW peak on June 24 as a sustained heat wave sent temperatures into the high 90s across the Central and South portions of the footprint. However, the month’s peak was lower than MISO’s 115-GW probable demand forecast for June that it published in the days leading up to the season.

The peak demand for June this year was higher than last year’s 111-GW apex but well below 2022’s 121 GW. Load averaged 82 GW, slightly higher than last June’s 81-GW average.

The RTO’s average natural gas and coal prices did not budge from last June, staying about $2/MMBtu. Similarly, real-time LMPs reflected no change year over year, hovering at $28/MWh.

MISO matched a 6.2-GW all-time solar peak it set in May on June 14, when the collective panels of the footprint managed about 12% of load for a brief period.

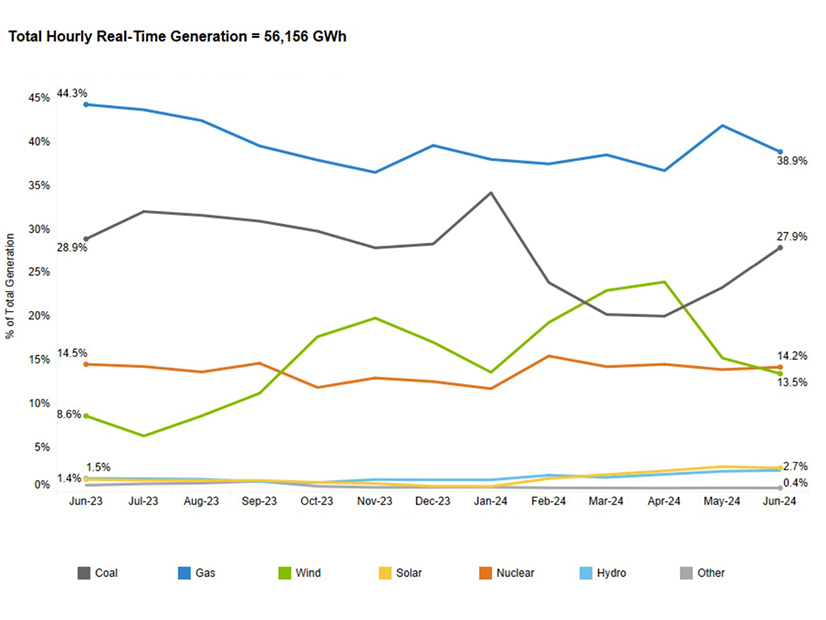

The RTO’s approximately 56 TWh of production for the month were supplied 39% by natural gas generation, 28% by coal generation, and about 14% apiece by wind and nuclear generation. Hydro and solar power each contributed almost 3%.

Daily generation outages stood at an average of 35 GW, lower than 2022 and 2021’s 40 GW and 2023’s 38 GW.

MISO ultimately issued conservative operations instructions for its North region on June 25 and for its North and Central regions on June 28 because of above-normal temperatures.

However, MISO has yet to issue emergency instructions this summer. Although MISO issued a capacity advisory for its North and Central regions and conservative operations for the entire footprint on July 15, the combination of forced generation outages, hot weather and transfer capability issues did not rise to an emergency level.

MISO is navigating a capacity advisory for its Central and North regions and conservative operations for the entire footprint through July 31 because of heat, forced generation outages and higher-than-forecasted load.

On July 30, MISO relied heavily on its coal (41 GW) and gas (44 GW) resources to meet a 115-GW peak. Prices ranged from $39 to $49/MWh.