MISO doesn’t believe autumn will prove much trouble for it to tackle, though it faces a capacity shortfall in Missouri.

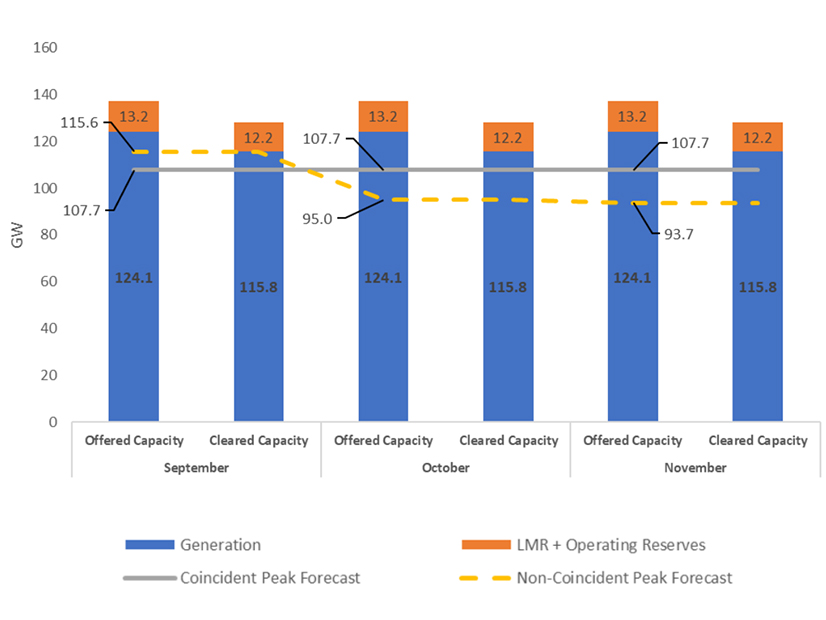

According to its seasonal outlook, the grid operator likely will come the closest to calling on its load-modifying resources in September, when it predicts a 115.6-GW systemwide peak. Over the fall, MISO will have 115.8 GW of cleared capacity on hand. MISO noted that 124 GW was offered but didn’t clear the fall capacity auction.

Subsequent fall months don’t seem any cause for concern. MISO predicts a 95-GW peak in October and a nearly 94-GW peak in November, which should be handled easily by cleared capacity totals.

The systemwide numbers are despite a projected capacity shortfall in portions of Missouri for the season.

Per MISO’s capacity auction held in spring, Zone 5 — which contains local balancing authorities Ameren Missouri and the city of Columbia, Mo.’s Water and Light Department — should experience an 872-MW capacity deficit over the next few months. The zone came up short on its local clearing requirements in the auction and cleared at the $719.81/MW-day cost of new entry for generation in the fall and upcoming spring.

Ameren leadership has said the effects of the scarcity likely will go unnoticed, not impacting reliability nor customers’ bills. (See Ameren: MISO Missouri Capacity Shortfall Likely Inconsequential.)

July Peak Prediction Unfulfilled

Meanwhile, MISO reported its operators contended with a 118-GW peak in July, lower than the 123-GW peak it anticipated before the start of the season.

MISO’s peak occurred July 15, while MISO Midwest was under conservative operations as hot and stormy weather passed through. July’s peak registered lower than the 121-GW peak in July 2023. Load averaged about 86 GW per day in July, in line with last July’s average load. Real-time prices also closely tracked last year, coming in at $30/MWh compared to last July’s $31/MWh. Gas and coal prices were identical year-over-year in MISO, holding at $2/MMBtu apiece.

MISO said average generation outages in July totaled 31 GW per day, a 2-GW improvement over last year.

MISO leadership and stakeholders are set to review summertime performance during a quarterly MISO Board Week meetup in mid-September in Indianapolis.

Ramp Deficit Triggers VOLL

MISO and stakeholders dissected a mid-June price spike due to inadequate ramping at an Aug. 22 Market Subcommittee meeting.

MISO’s system-wide energy price shot up to $3,500/MWh for two intervals on June 16 after several units powered down around 9 p.m. MISO said the ramping ability available on its remaining dispatchable resources “was insufficient to meet emerging risks.”

Stakeholders asked how MISO didn’t see the ramp needs coming when the units’ exit that night was planned. They also questioned how prices could soar to the $3,500/MWh value of lost load briefly then almost instantaneously settle back to the usual, approximately $25/MWh.

“We’ve seen a number of these real-time price spikes related to operating reserves and not having enough ramp,” Market Evaluation Manager Dustin Grethen said. “We ended up in a situation where available dispatchable generation was insufficient.”

Grethen said the value of lost load was necessary because ramping capability went into a deficit and demand couldn’t be met systemwide.

Grethen said multiple times this summer, MISO has been “trying to run lean” and use reserves. However, he said in this instance MISO experienced an under-forecast in wind output paired with some uninstructed deviation on the part of other generators.

“Things are tighter than they used to be. Some of these risks that before went under the boat are now bumping the bottom,” Grethen said.