Stakeholders Reject Revised Cost of New Entry Inputs

VALLEY FORGE, Pa. — Consumers and electric distributors in PJM last week opposed a proposal to revise two financial parameters used to calculate the cost of new entry (CONE) input to the 2027/28 Base Residual Auction (BRA). (See “PJM Proposes Increased CONE Parameters,” PJM MRC Briefs: July 24, 2024.)

The measure would have increased the after-tax weighted average cost of capital (ATWACC) from 8.85% to 10% and set the bonus depreciation rate at 0% for the 2027/28 delivery year, rather than the 20% set through the Quadrennial Review. PJM and its consultant Brattle Group argued that the change would reflect higher costs typical PJM market participants face would face to borrow the capital necessary to construct the reference resource, a combined cycle generator.

The Markets and Reliability Committee rejected the increase during its Aug. 21 meeting, with only 57.46% sector-weighted support, short of the two-thirds threshold. End-use customers and electric distributors were each 93% opposed, while transmission and generation owners unanimously supported the proposal. The Other Suppliers sector supported the change with 75% support.

Greg Poulos, executive director of the Consumer Advocates of the PJM States, said each of the parameters feeding into the variable resource requirement (VRR) curve interacts with each other, and that pulling individual pieces out for after-the-fact modifications would undermine the purpose of the holistic Quadrennial Review.

He said consumer advocates would have concerns with the proposal regardless of the direction it shifted the parameters in, but they would be amplified when costs would increase at a time when capacity auction prices are reaching new highs. (See PJM Capacity Prices Spike 10-fold in 2025/26 Auction.)

Carl Johnson, of the PJM Public Power Coalition, said it’s unclear how complete the review that Brattle conducted was and whether its ATWACC values would accurately reflect developer costs given the spike in capacity prices. He also argued there’s a disconnect between the reference resource used in the Quadrennial Review and the resources that have been proposed for construction through the interconnection queue, which is largely composed of renewables and storage.

“It’s pretty clear that the reference resource doesn’t exist in the queue and making a change … that can only drive the price up doesn’t make sense,” he said.

John Rohrbach, of the Southern Maryland Electric Cooperative (SMECO), questioned whether PJM has considered pausing the proposal given how close the entire region came to clearing at point “a” on the VRR curve, which results in the price cap being reached at 1.5 times net CONE. Two regions, BGE and Dominion, hit the price cap in the auction because of insufficient internal generation and transmission constraints.

PJM’s Skyler Marzewski said the RTO’s focus is on ensuring that the parameters accurately reflect the costs to construct the reference resource and that the change would further that aim.

Calpine’s David “Scarp” Scarpignato said price signals should be determined through the balance of supply and demand — a balance that would be disrupted if stakeholders write auction rules with a target price in mind. An accurate CONE value prompts not only new generation development, but also encourages existing generation to remain in the market, potentially by investing in upgrades that bring new supply online, he said.

Stronger Know Your Customer Checks Endorsed

Stakeholders endorsed by acclamation a proposal to expand the data PJM collects when conducting due diligence checks on key leadership among its members through its Know Your Customer (KYC) process. The proposal was also endorsed by the Members Committee as part of its consent agenda. (See “Vote on Enhanced Know Your Customer Deferred,” PJM MRC Briefs: July 24, 2024.)

The proposal would expand the tariff definition of member principals subject to KYC to include beneficial owners, which are a “natural person who, directly or indirectly, alone or together with such person’s family members, owns, controls or holds with power to vote 10% or more of the outstanding securities in the participant.”

Members would be responsible for providing a list of principals meeting the new definition and supplying government-issued identifications. Individuals holding seats on boards of directors would also need to be identified under the changes. The effort is currently focused on PJM members that are not publicly traded, and therefore not required to report ownership information to the U.S. Securities and Exchange Commission.

Since the June 27 first read of the proposal, language was added to specify that ownership split across family members includes spouses, domestic partners, parents, children and siblings. The principal definition was also revised to add the phrase “corporate-level strategy” regarding the control individuals have over the member entity’s operations. The vote on the changes was originally scheduled for July 24, but that was deferred to allow stakeholders to review the changes more thoroughly.

The proposed definition of “principals” also was revised to add the phrase “corporate-level strategy” regarding the control individuals have over the member entity’s operations. PJM Assistant General Counsel Eric Scherling said the change is meant to address feedback that the definition could be too broad and capture staff with day-to-day operational control over assets.

Stakeholders Greenlight 2 New Energy Market Parameters for DR

The MRC endorsed by acclamation a proposal to add two energy market parameters for demand response resources in the day-ahead and real-time markets. The changes are set to go before the MC during its Sept. 25 meeting. (See “New Economic DR Parameters Discussed,” PJM MRC Briefs: July 24, 2024.)

The maximum down time would allow DR providers to define a “maximum number of continuous hours” for resource commitments, while the minimum down time would require a defined number of hours to pass between deployments.

The proposed Manual 11 language states that the new energy market parameters do not override any capacity market obligations on the same resource. Independent Market Monitor Joe Bowring repeatedly voiced concerns throughout the stakeholder process that without such language, it may not be clear to market participants that they would be subject to Capacity Performance penalties if they followed their energy parameters and curtailed instead of remaining online according to a capacity deployment.

During the Aug. 21 meeting, Bowring said the proposal would improve DR flexibility and more accurately reflect its capability in the PJM markets, but he argued it should be one small change in a larger consideration of DR’s role in the market. Bowring noted DR’s inability to be dispatched on a nodal basis, which he argued is critical for it to be an effective resource.

PJM Discusses 2025/26 Auction Results

Changes to planning parameters and a redesign of components of the capacity market drafted through the Critical Issue Fast Path (CIFP) process last year were driving factors in the increase of capacity prices in the 2025/26 BRA, according to an analysis the RTO presented to the MRC. (See PJM Market Participants React to Spike in Capacity Prices.)

PJM’s Tim Horger said the revised planning parameters led to the installed reserve margin (IRM) increasing because of load forecast uncertainty, the price cap being redefined from 1.5 times net CONE to gross CONE, a decrease in net CONE from $293/MW-day to $229, and the peak load forecast increasing by 3,243 MW.

PJM’s Patricio Rocha Garrido said part of the impetus behind the planning changes was to identify and incorporate potential correlated outage into risk modeling. Following the December 2022 winter storm (“Elliott”), PJM also abandoned its practice of excluding the 2014 polar vortex data from risk modeling.

Dominion Energy participating in the Reliability Pricing Model, rather than using the fixed resource requirement (FRR) alternative, also pushed supply and demand closer together, Horger said.

The most significant CIFP changes were a requirement that generation owners planning to complete projects ahead of the start of the 2025/26 delivery year submit a binding notice of intent in order to offer into the auction; reliability risk modeling that captured more extreme weather, particularly winter storms; and marginal effective load-carrying capability (ELCC) for resource accreditation.

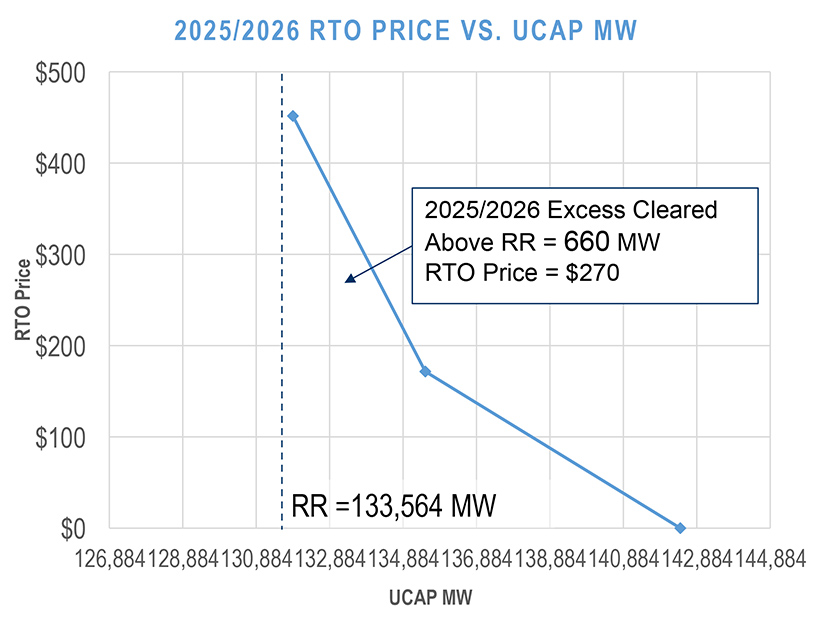

The results of the changes were lower accreditation for many resources, meaning they could offer less supply, and more capacity being required to meet reserve margins. Horger said only 43 MW of capacity did not clear in the rest-of-RTO region, and the auction cleared 660 MW over the reliability requirement, compared to 7,754 MW in the prior auction.

“Pretty much everyone who offered in the auction cleared,” he said.

PJM Vice President of Market Design and Economics Adam Keech said most of the factors tightening supply and demand would have occurred regardless of the CIFP changes. About 16 GW of excess unforced capacity (UCAP) was available in the 2024/25 auction, of which 12 GW were lost because of generation deactivations, higher expected peak loads and the increased IRM. The CIFP changes are credited with reducing available UCAP by a further 2.7 GW.

“There’s a lot of moving parts before we even get there that have an impact on the supply and demand balance on the system,” he said.

Keech defined excess capacity as the total supply offered into the auction minus the reliability requirement. The UCAP values in the analysis were measured according to the rules for the 2024/25 auction.

He said some of those dynamics are on track to continue in the 2026/27 BRA, for which the load forecast and reserve requirement are set to increase. That auction will be the first to use a combined cycle unit as the reference resource, which carries a gross CONE 55% higher than the combustion turbine used in past auctions. A higher CONE value could lead to the price cap also being higher.

“We’ve got a tight system and one where the demand for capacity is going up,” he said.

Bruce Campbell, of Campbell Energy Advisors, said the CIFP changes led to an administrative degradation of DR capability through the implementation of marginal ELCC accreditation, the effect of which remains unclear to many stakeholders a year after an endorsement vote on the approach. In the future, he said the Board of Managers should hold PJM accountable for providing more transparency regarding capacity market changes to reverse a history of DR being treated as an afterthought in market design.

PJM CEO Manu Asthana said DR played a critical role in ensuring that the RTO met its reliability requirement in the 2025/26 auction.

Susan Bruce, of the PJM Industrial Customer Coalition, said there is little time for new generation to come online ahead of the 2026/27 auction, which is scheduled to be conducted in December. Given that short timeline, she said DR could play an especially large role if market rules recognize its full value, especially for industrial loads in the winter that are less sensitive to weather than residential load.

Bowring argued DR ELCC values are overstated because of assumptions about performance that are not supported by the data. He said DR is playing an increasingly pivotal role in the capacity auction — meaning that the auction would not have cleared reliably without DR — and argued that the exercise of market power by DR is correspondingly becoming a growing concern that will need addressing.

He said the Monitor is planning to publish its own analysis on the 2025/26 auction as it does not agree with all the conclusions PJM has drawn, including the assertion that the prices primarily reflected changes in supply/demand fundamentals.

Bruce said one of the goals underlying the CIFP changes was to create a market signal that would slow thermal deactivations, but one of the major causes of the high prices in the 2025/26 auction was coal, gas and oil deactivations.

Keech said some resources were already planning to retire, while others are in a stage of their deactivation that they still have an ability to re-enter the market.

PJM Proposes Sunsetting Electric Gas Coordination Senior Task Force

PJM brought a proposal to close the Electric Gas Coordination Senior Task Force (EGCSTF) and continue efforts to harmonize how PJM’s markets interact with gas supply through existing working groups, such as the Reserve Certainty Senior Task Force (RCSTF) and a possible new subcommittee with more flexibility in its scope.

Susan McGill, PJM senior manager of strategic initiatives and chair of the task force, said the group’s working areas were completed when stakeholders endorsed a proposal to align day-ahead energy commitment cycles with the daily gas nomination deadlines in order to give gas generators more certainty on when they should procure fuel. (See “Stakeholders Endorse Revised Proposal to Align Energy, Gas Schedules,” PJM MRC/MC Briefs: June 27, 2024.)

The task force was envisioned to spend a year working toward proposals, a timeline that was extended after Elliott.

Hourly Notification Times

PJM’s Joe Ciabattoni presented proposed revisions to the tariff, Operating Agreement and Manual 11 to use hourly notification times when considering unit commitment in the day-ahead market.

Hourly notification times can only be used in the real-time market, leading to discrepancies in reserve eligibility and capability when resources are offline, Ciabattoni said.

The RTO intends to bring the proposal for endorsement votes during the Sept. 25 MRC and MC meetings, with a targeted implementation date on Dec. 1.

First Reads on Several Manual Revision Packages

PJM presented first reads on three sets of revisions to Manual 6: Financial Transmission Rights, Manual 14B: PJM Region Transmission Planning Process and Manual 15: Cost Development Guidelines.

The Manual 6 revisions would add a deadline for auction revenue right (ARR) trades on noon ET of the business day before the relevant auction opening and a deadline for relinquish requests on noon of the business day prior to the opening of stage 2 of the annual ARR allocation.

The revisions also would disqualify transmission customers with firm services to charge energy storage or hybrid resources from receiving an allocation of ARRs to conform with FERC orders (ER19-469 and ER22-1420). (See RTOs Move Closer to Full Order 841 Implementation.)

The changes to Manual 14B would revise the inputs to the light-load case that the RTO uses in its Regional Transmission Expansion Plan load forecast. (See “Manual 14B Revisions Include Change to Light Load Model,” PJM PC/TEAC Briefs: Aug. 6, 2024.)

The case is meant to reflect load growth with flat profiles unaffected by weather and season by scaling load down to 50% of the summer forecast peak using bus-level data provided by transmission owners. PJM’s Stan Sliwa said the growth of non-scaling load, such as data centers, is changing how load shifts over the course of the year. The revisions would remove non-scalable load from the light-load case.

The Manual 14B changes would also expand the NERC Transmission Planning standards examined during generator deliverability analysis to match current practice, updating the system operating limit definition and adding new standards created by the ERO.

The Manual 15 revisions are aimed at correcting formulas throughout the manual and would remove a table displaying variable operations and maintenance (VOM) costs. Pulling the table from the manual is intended to avoid giving the impression that the values are fixed; the manual would instead point to the PJM website, where the VOM costs are updated annually to account for inflation. (See “Several Corrections to Formulas Included in Proposed Manual 15 Revisions,” PJM MIC Briefs: Aug. 7, 2024.)