ICF International forecasts that demand could increase by 9% by 2028, while peak demand could increase by 5% over the same period, according to a report it published Sept. 12.

The consulting firm expects that growth to continue, as overall demand will increase by 18% by 2033 and peak demand by 10.7%. The shift to demand growth comes after decades of relatively flat levels in the U.S.

A robust economy, electrification, growth in manufacturing, data centers and cryptomining are all contributing to the rising demand for electricity. Growth will vary by region, with ICF seeing the largest increase overall in the Mid-Atlantic region because of vehicle electrification and data centers, where demand is expected to grow by 68% by 2050, compared to the national average of 57%.

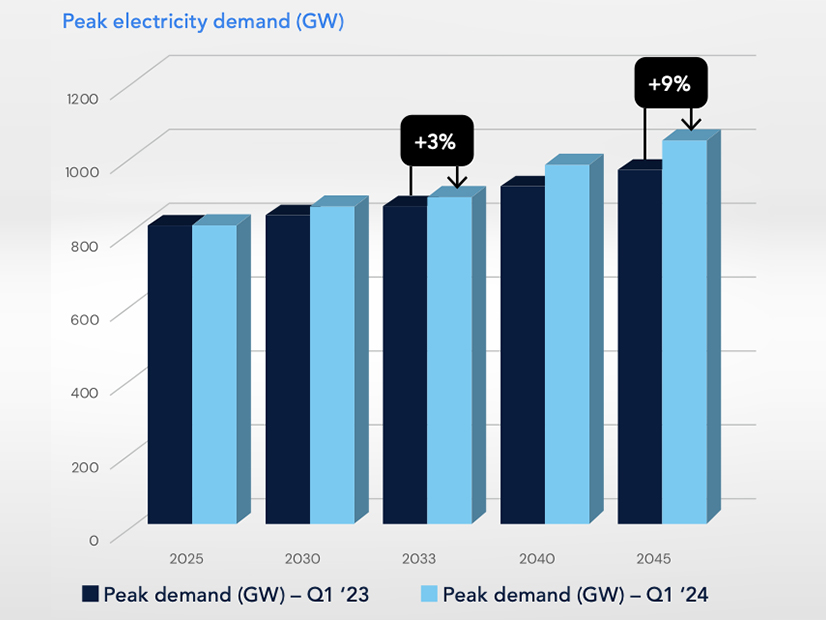

“What makes this stark increase in energy demand, particularly peak demand, so challenging is that it simply wasn’t [forecast] in most projections until very recently,” the report says. “The latest demand projections are significantly higher than projections made as recently as 2023. The divergence between last year’s projections and current projections is broad by 2033 and only continues to grow in the coming decades.”

New supply, including utility-scale solar and wind, could help meet the rising demand, but ICF notes that it faces hurdles for that to happen, including the need to upgrade the grid, cutting the time frame of the permitting process and finding suitable locations to build.

The grid is not designed to accommodate major amounts of new generation immediately, with ICF noting that on average, it can handle just 189 MW at once, with upgrades needed to handle additional supply. The Mid-Atlantic, northern New England, parts of the Southeast and the Upper Midwest are particularly constrained in that way, the report says.

And the industry needs to worry about getting that down to the distribution level, with the average amount of such “withdrawal capacity” being 153 MW before upgrades are required, with the biggest challenges in areas with high peak demand growth such as Northern Virginia and parts of Texas.

The growing demand could slow progress in the transition to clean energy, as it might force utilities to keep fossil-fueled power plants running longer than otherwise, the report says.

“With enough investment, the U.S. can make major upgrades to the grid and install vast amounts of renewable energy, meeting demand growth while decarbonizing the grid. Americans will likely pay higher utility rates, taxes to pay for federal and state subsidies, or both.”

The wholesale prices that many utilities pay for electricity could go up by an average of 19% by 2028, and “much of” that would be passed onto customers, the report says. ERCOT could see even higher price increases of 22% by that year.

The report suggests utilities start engaging in more sophisticated planning that considers the entire system from generators to end-use customers.

“This requires an integrated approach across all asset classes, including generation, transmission, distribution, distributed energy resources, conservation and load management,” the report says. “This holistic approach equips utilities to consider long-term investment strategies that enhance grid reliability, resilience and operational efficiency by adding greater flexibility and responsiveness to traditional generation and transmission solutions, like virtual power plants.”

Other suggestions include identifying areas with plenty of renewable resources that can be connected to the grid, enhancing the distribution grid, expanding load-management programs, using artificial intelligence to improve planning and grid management, and staying engaged with regulators on the issues.