Hybrid power plants, especially projects combining solar and storage, represent a growing amount of new generation online and in interconnection queues across the U.S., signaling a shift in how renewable power can be integrated into electric power markets, according to a new report from the Lawrence Berkeley National Laboratory.

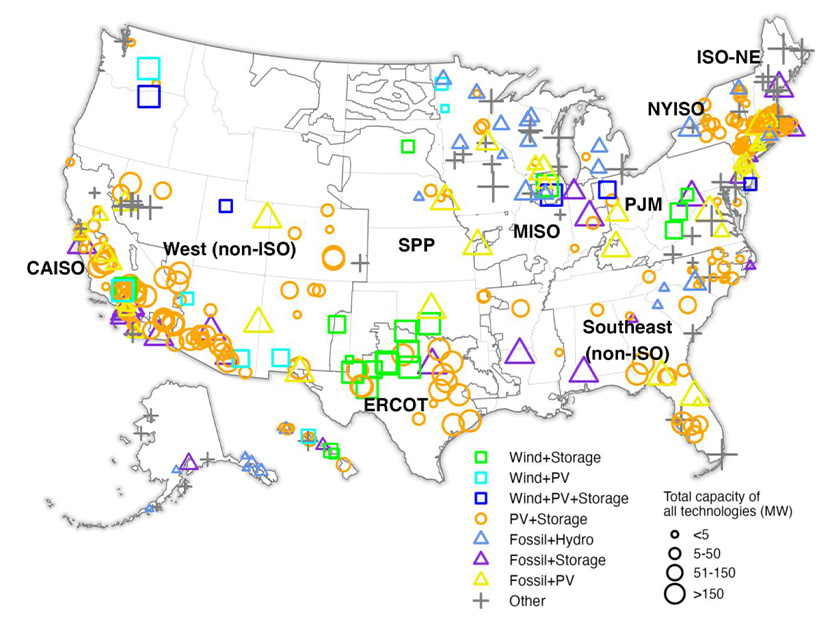

As of the end of 2023, the U.S. had 469 hybrid power plants of 1 MW or greater, with a total of 49 GW of generating capacity and 9.9 GW of storage, the report says, drawing on information from the Energy Information Administration. Solar-and-storage projects made up 288, or more than 60%, of that total, with 14.4 GW of generation and 7.7 GW of storage.

Other topline numbers show that 66 of the 80 new hybrid plants coming online last year were solar-and-storage. Such hybrids also account for 55% of solar generation capacity and 52% of storage capacity actively moving through interconnection queues.

According to LBNL, as of the end of 2023, 2,532 solar-and-storage hybrids with more than 575 GW of power were in U.S. interconnection queues.

Further, the report notes that 46% of all online storage capacity is coming from hybrid plants versus 42% from standalone projects. In terms of energy ― actual megawatt-hours produced ― hybrid storage is outperforming standalone, 52% to 38%.

Will Gorman, a research scientist at LBNL and lead author of the report, said the emergence of hybrid solar-and-storage is a relatively new trend over the past few years, spurred by the increase in solar on the grid, especially in places like California and Texas.

“There is a certain appetite for PV to just come onto the system without any kind of storage getting paired,” Gorman said in an interview with RTO Insider. “But once you get to a certain saturation point, which we certainly have started to see in California … you see that solar in particular is very synergistic with batteries.”

Solar currently generates about 30% of California’s electricity, according to the Solar Energy Industries Association.

Market saturation, along with falling battery prices, has triggered an inflection point, Gorman said, “and it was like, ‘Oh wow, we can basically create a dispatchable generator in a way, by pairing these two resources [at] a fairly competitively priced amount that wasn’t really possible three or four years ago.’”

With solar providing an increasing amount of new generation on the grid ― 54% in 2023, according to the National Renewable Energy Laboratory ― Gorman estimates that solar-and-storage hybrids made up about 25 to 30% of that new solar. California and Texas have the most hybrid capacity, but Massachusetts has the highest number of solar-and-storage hybrids ― 89 ― although they are smaller plants, with a total capacity of less than 7 MW.

California’s 72 hybrids include 30 projects with more than 100 MW of solar; for example, the Slate solar-and-storage project, which came online in Kings County in 2022, has 390 MW of solar and 140 MW of storage with four hours of duration.

Arizona led the nation for new solar-and-storage hybrids in 2023, with 16 plants coming online.

In addition to solar and storage, the LBNL report includes a long list of other types of hybrid plants in operation, including wind and storage (19 projects), fossil fuels and storage (28), nuclear and fossil (four), and geothermal and solar (seven). Hydropower paired with biomass, fossil fuels or storage also is on the list, as are triple combinations such as wind, solar and storage, and geothermal, PV and concentrated solar power.

Hybrid Synergies

As noted by Gorman, the emergence of hybrid plants has paralleled the growth of renewables on the grid and the need for new carbon-free resources that can provide the grid services, flexibility and dispatchability of traditional generation, such as natural gas peaker plants.

Federal tax credits — or rather, the lack of them — were another early driver. Prior to the passage of the Inflation Reduction Act in 2022, a tax credit for standalone storage did not exist. To cash in on the 30% federal investment tax credit (ITC) for solar, storage had to be connected to a solar project where it could charge off the PV panels at least 75% of the time.

The IRA provided a 30% ITC for standalone storage, similar to the solar tax credit. But, Gorman said, the ongoing growth of PV-and-storage projects could indicate the hybrid trend is not “just some type of tax-driven construct. There are real synergies behind the things that are getting paired and extracting value from the markets we’ve set up.”

The report tracks key data points that reflect evolving market dynamics.

Solar-and-storage projects generally have a higher ratio of storage to generation than other hybrids. Gorman defines a project’s “storage-to-generation ratio” as the amount of storage per 1 MW of generation capacity. In the LBNL report, the storage ratio for PV-and-storage projects averages out to 54%, versus 18% for wind-and-storage hybrids and 21% for fossil fuels and storage.

The higher ratio means these projects can store more of the excess solar energy produced at off-peak times to meet demand during peak load times, Gorman said. “You need more storage capacity to be able to absorb more of that solar energy,” he said.

The higher storage capacity of these projects also is leveraged in how they are used. While many solar-and-storage plants are designed to take advantage of multiple uses and revenue streams, the report notes that in 2023, EIA started asking hybrid plant operators to provide information on their projects’ primary use.

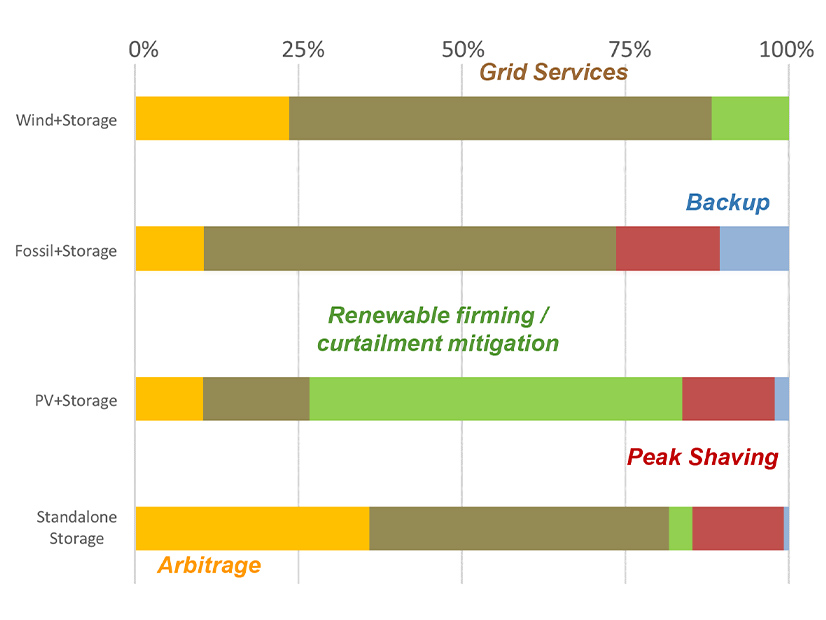

Grid services ― an umbrella term covering frequency regulation, ramping, load following and voltage support ― were the top primary use for most hybrids, except solar-and-storage projects, the report says. The primary use there has been system firming for renewable power and minimizing curtailment, while standalone storage projects increasingly are being used for arbitrage.

Gorman again sees the difference as a result of market evolution: Being able to time-shift power from off-peak to peak demand hours is increasingly valuable. “In the past, batteries were mostly providing these kind of reserve values, providing grid services available on demand,” he said. “Now that [developers] have started to see some price differentials in the markets that are beneficial to arbitrage, they’ve added daily cycling on top of that.”

At the same time, prices on power purchase agreements for solar-and-storage hybrids are going up in line with their increased value on the grid, as well as the impacts of inflation and supply chain constraints that have affected solar and storage in general. From 2018 through 2021, PPA prices were relatively flat, coming in around $40/MWh, Gorman said. But prices have edged up since 2022, moving toward $60 to $80/MWh.

But Gorman cautioned that PPA prices “don’t reflect costs. PPA prices are a mixture of supply and demand.” If demand for battery storage goes up, he said, hybrid solar-and-storage projects may be perceived as more valuable.

Capacity Markets and Queues

In addition to the IRA, expansion of the hybrid market also could be affected by FERC Order 2023, issued in July 2023, the report says. The order allows more than one form of generation or storage to co-locate on a single site with a single point of interconnection and be treated as a single project in a grid operator’s interconnection queue. (See FERC Updates Interconnection Queue Process with Order 2023.)

Projects in the queue also can add a resource in certain circumstances without losing their place in the queue; for example, a solar project adding storage that does not materially change its interconnection application.

Hybrids’ impact on grid flexibility and reliability also may depend on their participation in RTO and ISO capacity markets, which in turn could depend on how individual grid operators value them. According to the report, valuation methods are in transition across the country.

In 2023, CAISO valuation was based on a method combining effective load-carrying capacity (ELCC) and sum of parts. ELCC quantifies how much additional load a resource can support on the grid while maintaining reliability, while sum-of-parts valuation quantifies individual components of a hybrid and then combines them to determine an overall capacity value.

CAISO plans for a 2025 transition to a “slice of day” method that will value plants according to their performance in every hour during the highest peak-load day of each month.

Similarly, the trend among other RTOs and ISOs is toward more targeted valuation methods. MISO has gone from a yearly valuation of a plant’s output during the top eight peak demand hours to a seasonal framework in which capacity value is based on peak output in each season.

LBNL has research underway looking at which valuation methods might best reflect and optimize the different capabilities of hybrids and benefit the grid, Gorman said.

Whether Order 2023 will help get more solar-and-storage hybrids interconnected remains an open question. The rule is aimed, at least in part, at shortening queues by limiting the number of “speculative” projects seeking interconnection.

Gorman recognizes that, like other projects, not all hybrids will make it through the queues. But, he said, “I think the ‘speculative’ term is charged. At LBNL, we try to maintain neutrality. If you talk to transmission providers, they will use ‘speculative.’ If you talk to the developers, they will tell you that the inherent uncertainty of the process requires them to discover how expensive it is to connect to the system, and since it takes so long to make it through the queues, they have to submit multiple requests.”

Still, hybrids may have an edge. “There is an interconnection strategy to hybridizing,” Gorman said. “Since these queues are so backlogged, instead of submitting two applications, FERC has now allowed that these hybridizing plants can go in as one … not skipping the queue per se, but sometimes avoiding some of the pain of the queue.”