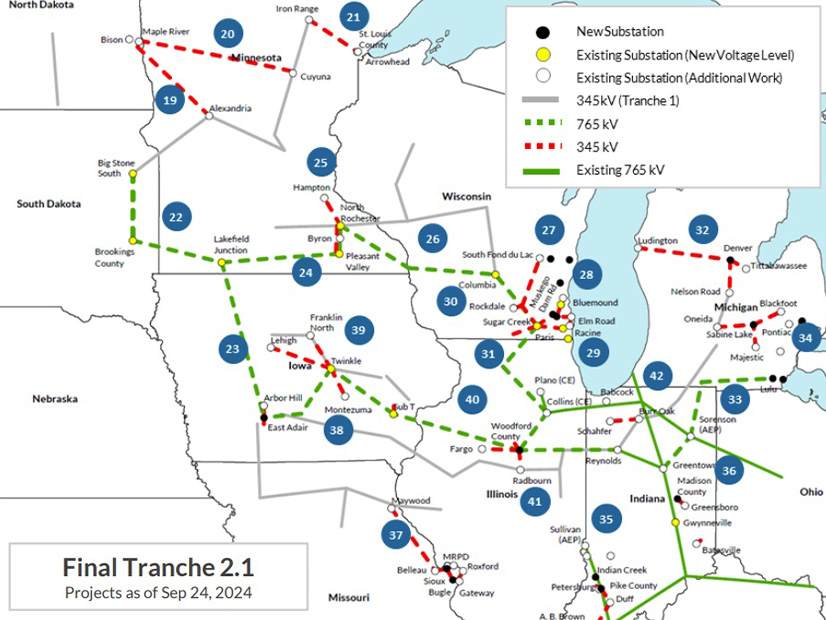

MISO staff are resolute that a collection of 24 proposed, mostly 765-kV projects totaling $21.8 billion is a “least-regrets” avenue to achieving members’ resource plans, despite misgivings from some members.

MISO held a two-day workshop Sept. 24-25 to emphasize the importance of building the second long-range transmission plan (LRTP) portfolio in MISO Midwest. Planning Coordination and Strategy Advisor Ashleigh Moore characterized the workshop as a “two-day finale” for the second LRTP portfolio; MISO will present the portfolio to its Board of Directors in December for consideration.

Director of Cost Allocation and Competitive Transmission Jeremiah Doner said after “fine-tuning” electrical facilities and substation design, the portfolio cost now stands at $21.8 billion, up from last week’s $21 billion estimate. Doner said MISO anticipates the projects would go into service in about 10 years.

With the increase in cost, MISO has slightly scaled back its benefits-to-cost ratios. The RTO now anticipates a benefit-to-cost ratio of between 1.8:1 and 3.5:1 over the first 20 years of the projects’ lives through reliability improvements, production costs, new capacity that won’t have to be built and environmental benefits. (See MISO Says 2nd Long-range Tx Plan to Cost $21B, Deliver Double in Benefits.)

Doner said at a minimum, each cost allocation zone would see a 1.2:1 benefit-to-cost ratio under MISO’s most conservative analysis. Cost allocation zones in Lower Michigan, Illinois and Missouri would experience the most modest benefits, MISO said, at 1.2-1.3 in its conservative estimate. Cost Allocation Zone 2 in Wisconsin and Michigan’s Upper Peninsula would see the most benefit, at a minimum of 2.8:1 and a maximum of 5.5:1 over 20 years.

MISO said the portfolio would free up access to regional resources, reducing the need for almost 28 GW in hypothetical future resource additions and delivering $16.3 billion over 20 years in avoided capacity.

MISO also estimates LRTP II would support almost 116 GW in new resources across MISO Midwest. Local Resource Zone 1 in Minnesota, the Dakotas and Wisconsin and Local Resource Zone 3 in Iowa would see the most resource expansion because of LRTP II, at about 32 GW and 27 GW, respectively.

Lingering Disagreement over Benefits

Bill Booth, consultant to the Mississippi Public Service Commission, asked what would happen if the resources MISO anticipates aren’t built, particularly the 29 GW of undefined but flexible resources MISO identified as necessary and assumed in its modeling.

North Dakota Public Service Commission staffer Adam Renfandt said he wondered if benefits would dim if MISO tried siting resources in its hypothetical future more eastward, nearer load centers where locational marginal prices are higher. He also said he worried MISO might hinder new technologies by assuming a conventional mix of resources 20 years out.

Doner said the second LRTP’s design is flexible enough to support a multitude of directions in resource planning. He said MISO isn’t building specific routes for any prospective facilities. But he said MISO nevertheless will need a fleet that’s spread across the region to support local clearing requirements of MISO’s resource adequacy zones.

“We’re trying to have a regional backbone plan to support energy transfers. What resources are built is ultimately up to members,” Director of Economic and Policy Planning Christina Drake said.

Executive Director of Transmission Planning Laura Rauch said MISO isn’t trying to send signals on where to build resources. She stressed that MISO needs regional transmission expansion, and generation will continue to interconnect to an expanded system via individual network upgrades.

“Resource adequacy and transmission planning in aggregate are in the same house. … We aren’t building for specific units as much as we are regional needs,” Rauch said. She added that the LRTP is planned intentionally on a long-term horizon and allows for resource planning to “continue to evolve and change.”

WPPI Energy’s Steve Leovy said he continued to have concerns that MISO’s reliability benefit assumptions are overstated. He said absent the portfolio, MISO members would tender reliability projects incrementally under annual transmission expansion plans to maintain NERC standards.

Stakeholder doubts over the realistic chances of MISO’s assumed future fleet and MISO’s reliability value projections mirror those made by MISO’s Independent Market Monitor. (See MISO, Monitor at Stalemate over Need for $21B Long-range Tx Plan.)

“We’re not assuming that these issues would go unaddressed and that we would experience future load shed,” Doner said. However, he said MISO cannot ignore the fact that the LRTP portfolio would resolve “hundreds” of reliability issues and subdue substantial risks.

“There is a value in proactively planning to mitigate these risks … rather than chasing what’s happening year after year,” MISO planner Joe Reddoch said. “There’s obviously value, or we wouldn’t be doing it.”

WEC Energy Group’s Chris Plante said MISO shouldn’t measure reliability benefits of the LRTP through expected unserved energy, but through the annual reliability projects MISO would avoid. MISO planners have said it would be extremely difficult to predict the multiple reliability projects that might be avoided.

“It seems like this metric is destined for a lot of time on the witness stand,” Plante said, hinting that the metric will be contested.

Doner countered that the RTO is using a “very dated” $3,500/MWh value of lost load to gauge reliability impacts, making for a conservative view of reliability benefits.

Support for LRTP II

American Transmission Co.’s Bob McKee said he “really wanted to push back” on the notion that transmission owners should continue to address reliability risks individually. He said MISO’s purpose is to examine its system and prescribe regional plans.

“If you step back and look back at [the directives of [FERC’s] Order 1920 and even Order 890 and Order 1000, this is exactly what MISO is doing. We’ve been litigating these benefit metrics for a year now. MISO’s metrics are pretty much in lockstep in what FERC is directing other RTOs to do,” McKee argued.

ITC’s Brian Drumm also said it’s appropriate for MISO to gauge reliability value, especially considering the “wave” of generation retirements and extreme weather conditions bearing down on the footprint.

Drumm said the $14.8 billion reliability value MISO has placed on LRTP II is “incredibly conservative.”

“I mean, that number could be $100 billion, $200 billion. And when you’re talking about human lives, I don’t even want to place a number on that,” he said.

Great River Energy’s Jared Alholinna said his utility believes MISO has done a “remarkable” job analyzing its portfolio. He added that the portfolio most likely will demonstrate the most value in the times that are the hardest to predict, like punishing winter storms.

Alholinna said MISO’s overall, minimum 1.8:1 ratio probably is understated because the footprint’s fleet transition is occurring faster than the RTO’s 20-year scenario predicts.

Xcel Energy’s Madeleine Balchan said while it’s possible for Xcel’s Northern States Power to build to meet needs on its own, that’s not why the utility joined MISO.

Kavita Maini, a consultant representing MISO industrial customers, said she wasn’t suggesting MISO shouldn’t engage in regional planning; however, she said stakeholders are disturbed by some “problematic” and “overexaggerated” benefits MISO is crediting to the portfolio.

Rauch said the second LRTP portfolio is a culmination of more than 40,000 hours of labor from MISO staff, expertise from outside consultants, about 300 meetings and numerous discussions with stakeholders.

Rauch said generally, members reacted to the draft LRTP II map released months ago with, “You all need to go bigger,” which was a “shock” to MISO planners. She said the RTO evaluated 97 stakeholder submissions for additional projects, eventually landing on seven and creating an even “stronger portfolio at the end of the day.”

Rauch said the final LRTP II is an exceptionally valuable portfolio that creates a reliable, “765-kV transmission backbone to support high system transfers under a new resource plan” that members have charted.

“We’ve come to the end of a very, very long journey,” Vice President of System Planning Aubrey Johnson summed up. “I think we’re better off because of the dialogue. … We’ve often said, ‘this is hard,’ and this should be hard.”

Johnson said at the end of the day, MISO has heard stakeholder objections over the value of LRTP II, investigated them and disagreed with them.