A new WECC report forecasts “staggering” growth in electricity demand in the Western Interconnection over the next decade — a trend that is even more concerning as entities struggle to complete resource additions on schedule.

Those trends are detailed in WECC’s 2024 Western Assessment of Resource Adequacy (WARA), released Dec. 3.

The report predicts that annual demand in the Western Interconnection will grow from 942 TWh in 2025 to 1,134 TWh in 2034. That 20.4% increase is more than four times the 4.5% growth rate from 2013 to 2022, and twice the 9.6% growth forecast in 2022 resource plans.

WECC said large loads are a major factor in the rapid demand growth, including data centers, factories and cryptocurrency mining. Electrification also plays a role.

If the 172 GW in new generating capacity planned over the next decade comes online as scheduled, the Western Interconnection will be largely resource adequate through 2034, WECC said.

But plans for resource development have been falling behind. From 2018 to 2023, only 76% of planned resource additions came online in the year scheduled. In 2023, that share was even lower, at 53%.

“If demand grows as expected and industry experiences delays and cancellations in building new resources over the next decade, the West will face potentially severe resource adequacy challenges,” the WARA said.

Factors contributing to the delays are supply chain disruptions, lengthy interconnection queues and rising material costs. Siting struggles are another issue, WECC said, as local opposition to wind, solar and battery projects is “widespread and growing.”

The WARA looked at how delays in bringing planned resources online might increase the number of demand-at-risk hours each year. Demand-at-risk hours — a measure of resource adequacy risk — are times when there is a risk for potential load loss.

If all planned additions are completed on time, there are 89 demand-at-risk hours over the next decade, the report estimated. If 85% of resources are built on time, 36 hours are at risk in 2029, increasing to 129 hours in 2034.

If only 55% of resources are finished on time, eight hours are at risk in 2025 and 952 hours are at risk by 2034.

‘Positive Sign’

The WARA was discussed during a Dec. 5 monthly meeting of the Western Interconnection Regional Advisory Body (WIRAB), where some attendees were complimentary of the report.

“It is going to be very helpful as we try to grasp the scale of what the region faces,” Wyoming Public Utility Commission member Mary Throne said during the meeting.

The California Energy Commission’s Grace Anderson said WECC continued to improve the WARA every year.

Anderson pointed out that it was WIRAB that first asked WECC to produce the WARA and asked that the report track the rate of proposed resources actually coming online.

“So, seeing that that number is as high as it is at the moment is a positive sign,” she said.

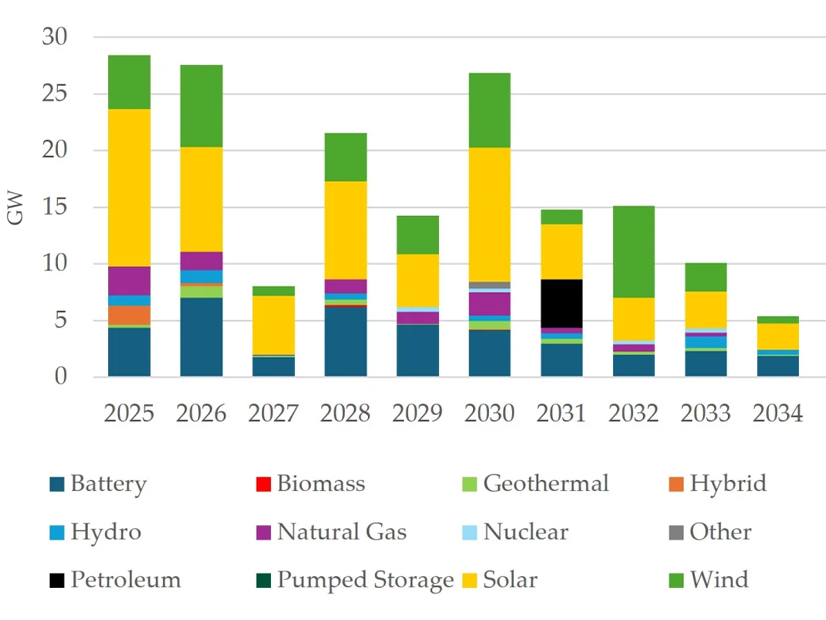

Anderson said the finding that 85% of proposed additions are inverter-based resources signals an “important challenge to reliability.” Of the 172 GW of new generating capacity planned by 2034, solar, wind and battery storage account for almost 145 GW.

Variable Resources

In addition to growing demand, the Western Interconnection is also facing resource retirements over the next decade that are increasing the need for new resources, the WARA noted.

Over the next decade, 25.85 GW of generation is slated for retirement, including more than 24 GW of baseload generation such as coal, natural gas and nuclear.

More than 4.4 GW of coal and more than 3.6 GW of gas are scheduled for retirement in 2025 and 2026, respectively. In California, retirement of the 2.2-GW Diablo Canyon nuclear power plant was postponed for five years and is now set for 2030.

The baseload resources set for retirement are largely being replaced by variable resources such as solar and wind.

“These changes increase risk and create challenges in system planning and operation,” the WARA said.

Robert Mullin contributed to this article.