More than six months after the proposed August 2024 effective date for ISO-NE’s compliance with FERC Order 2023, generators seeking to interconnect in the region remain in limbo.

More than six months after the proposed August 2024 effective date for ISO-NE’s compliance with FERC Order 2023, generators seeking to interconnect in the region remain in limbo, and some stakeholders are concerned further delays could have detrimental effects on upcoming capacity auctions.

While FERC’s delayed response to the proposal already has affected certain aspects of ISO-NE’s compliance timeline, some stakeholders specifically pointed to an “inflection point” at the end of March and have expressed concern about increased complications if the delay extends beyond this date — especially if the order requires another substantial compliance filing.

FERC Orders 2023 and 2023-A require grid operators to adopt procedures for studying interconnection requests in coordinated cluster studies, instead of ISO-NE’s current process of studying projects sequentially. ISO-NE filed its compliance with the orders in May 2024 with unanimous support from the NEPOOL Participants Committee, after an extensive process of stakeholder feedback and amendments (ER24-2007, ER24-2009).

“Throughout this process and right up to the final vote, there was extremely robust stakeholder engagement in the compliance proceeding,” wrote a coalition of clean energy advocacy groups in comments to FERC supporting the filing. “ISO-NE’s Order No. 2023 reforms will mark an important first step in improving existing processes.”

However, FERC’s delay has compromised ISO-NE’s proposed timelines for the transitional cluster study and transitional Capacity Network Resource (CNR) group study. (See New England Clean Energy Developers Struggle with Order 2023 Uncertainty.)

The cluster study is open to projects with valid interconnection requests, while the CNR study would include projects that have completed system impact studies but need capacity interconnection rights or capacity network resource capability (CNRC).

For the subset of projects that just need CNRC, the delayed response is complicated by ISO-NE’s multiyear delay of its upcoming capacity auction, which is intended to facilitate a series of major reforms to the format and timing of the RTO’s capacity auctions.

Under existing rules, resources achieve CNRC by receiving a capacity supply obligation in the Forward Capacity Auction, or in a reconfiguration auction for a previously held FCA. However, under ISO-NE’s Order 2023 compliance proposal, resources will receive CNRC through the cluster study process instead of the FCA qualification process.

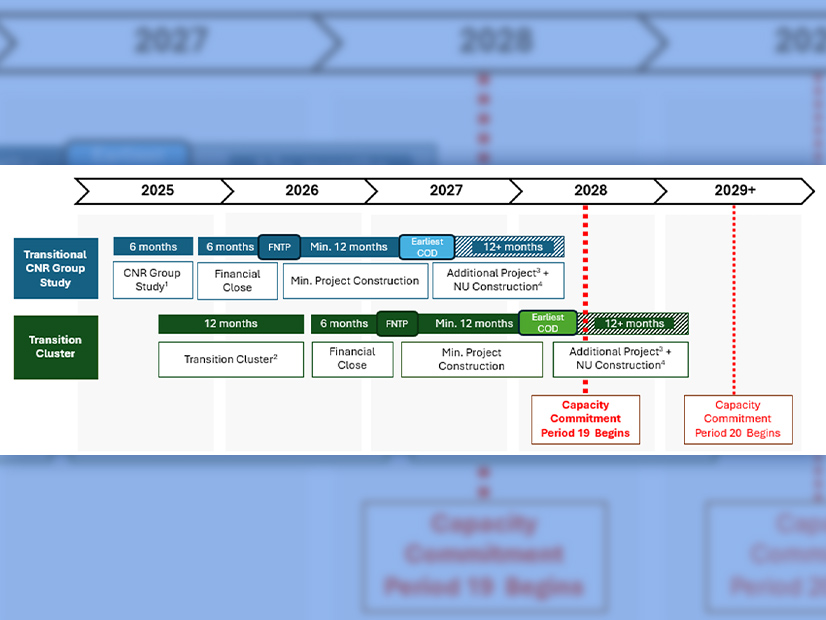

The transitional CNR group study, which would begin before the transitional cluster study and take about six months, would enable eligible projects to receive CNRC without having to go through the full cluster study, which is proposed to last for about a year.

While the delayed response has prevented ISO-NE from aligning the CNR group study with the 2024 reconfiguration auction (RA) qualification process, ISO-NE has expressed interest in aligning the CNR study with the 2025 RA qualification, which is set to begin in April.

This would mean that “the entire transition schedule in the compliance proposal would need to shift by roughly one year,” ISO-NE noted in December.

In a FERC filing submitted Feb. 5, Flatiron Energy Development urged the commission to rule on ISO-NE’s compliance proposal “in no event later than March 2025,” arguing that a ruling after this date “greatly complicates the path to aligning the transitional CNR group study with the 2025 interim reconfiguration auction qualification process.”

Flatiron, which develops energy storage resources, expressed concern that delaying the CNR group study past the qualification for the 2025 RA could jeopardize the ability of participating resources to come online in time for the 2028/29 capacity commitment period (CCP 19). Delays to the transitional cluster study would mean an even tighter window for projects that are waiting on the results of this study to reach financial close and begin construction.

The company wrote that its storage projects in ISO-NE take about 18-30 months to come online after receiving final interconnection approval. Under this timeline, starting the transitional CNR study in April would enable resources to come online between 2027 and early 2028, just in time for CCP 19, which starts in June 2028.

“Each additional month of delay adds risk for projects planning to participate in ISO-NE’s proposed transition processes and decreases the likelihood that they will be able to offer capacity into [CCP 19],” Flatiron wrote. “Q1 of 2025 is an inflection point, where if a decision is not issued by then, the risk that many projects will not be able to complete the necessary processes in time to deliver their capacity through this auction substantially increases.”

The company estimated that up to 3 GW of capacity is eligible to participate in the CNR group study. It stressed that preventing a substantial amount of capacity in the interconnection queue from participating in CCP 19 could lead to more expensive capacity prices, reliability risks, and higher emissions.

Alex Lawton of Advanced Energy United agreed the region appears to be “approaching a juncture” for its Order 2023 timeline.

“It seems pretty clear now that the [transitional cluster study] and CNR group study are linked to the interim RA [qualification] process, which begins with a SOI [show of interest] window mid-April, so I think it’s a legitimate concern about whether the one-year implementation delay approach will still work if FERC misses the SOI,” Lawton noted.

ISO-NE spokesperson Randall Burlingame said the RTO’s ability to align the CNR group study with RA qualification “would be difficult if we don’t receive an order this quarter,” adding that the substance of the order, and the extent to which additional compliance word will be needed, also will affect the RTO’s ability to align its compliance with external processes.

Delays to the interconnection process in New England would almost entirely affect renewable and storage resources; of the more than 39 GW of potential new generation tracked by ISO-NE, wind and battery storage each make up about 43% and solar accounts for about 13%. Natural gas, oil, and fuel cell generation account for less than 1%.

The states also have expressed concern about an extended delay to Order 2023 implementation. In a letter to FERC in late November, the New England States Committee on Electricity (NESCOE) wrote that the delay “has resulted in ambiguity for generators as to when and by which process their projects will be interconnected and has left ISO-NE unsure as to how best to posture ISO-NE staffing and other internal resources.”

NESCOE noted that the uncertainty also affects distribution-level affected system operator studies, which will need to coordinate with ISO-NE cluster studies.

“This uncertainty undermines one of the principal tenets of Order 2023 around which there is general agreement — the efficient and timely interconnection of new resources,” NESCOE added.

In a filing submitted Feb. 19, the New Hampshire Office of the Consumer Advocate wrote that it agrees with Flatiron’s concern that a delay beyond the first quarter of 2025 could lead to a “very significant difference” in capacity prices for upcoming auctions.

“Should cost-competitive capacity not be able to efficiently interconnect, there will likely be both cost and reliability impacts to the region, including to the residential utility customers of New Hampshire,” the office wrote.

In the meantime, ISO-NE continues to process interconnection requests under the existing sequential rules, which may help some projects in the late stages of their interconnection studies avoid needing to participate in the transitional cluster study.

The RTO’s interconnection queue remains closed to new interconnection requests and would not reopen to new requests until fall 2026 if the entire process is simply pushed back by one year.

“Depending on the content of an order on the Compliance Proposal, the ISO is open to evaluating whether it is possible to shift the Order No. 2023 established eligibility date to allow for a limited reopening of the ISO Interconnection Queue,” ISO-NE said in December.