In a March 14 filing, FERC ruled that the Southeast Energy Exchange Market (SEEM) is compliant with the commission’s orders and reaffirmed its acceptance of the SEEM Agreement in 2021 (ER21-1111, et al.).

However, commissioners also ordered SEEM’s member utilities to update the market’s manual to account for changing a key requirement and submit a compliance filing within 30 days confirming they have done so.

FERC’s filing came after the commission requested briefings in June 2024 from SEEM’s members and its opponents, in response to a 2023 order from the D.C. Circuit Court of Appeals remanding FERC’s approval of the market. (See FERC Requests Briefings on SEEM After DC Circuit Order.) The commission wanted to hear arguments on:

-

- Whether SEEM is a loose power pool.

-

- If so, whether and how SEEM “is consistent with or superior to the open-access requirements for loose power pools” in Order 888.

-

- If SEEM is not a loose power pool, whether and how it is superior to or consistent with the pro forma open access transmission tariff.

-

- Whether the market’s non-firm energy exchange transmission service (NFEETS) should be considered a non-pancaked rate.

-

- Whether NFEETS is “comparable to traditional transmission arrangements in bilateral markets.”

-

- Whether entities with a source or sink outside of SEEM’s territory could conform with the technical requirements of the market’s matching platform.

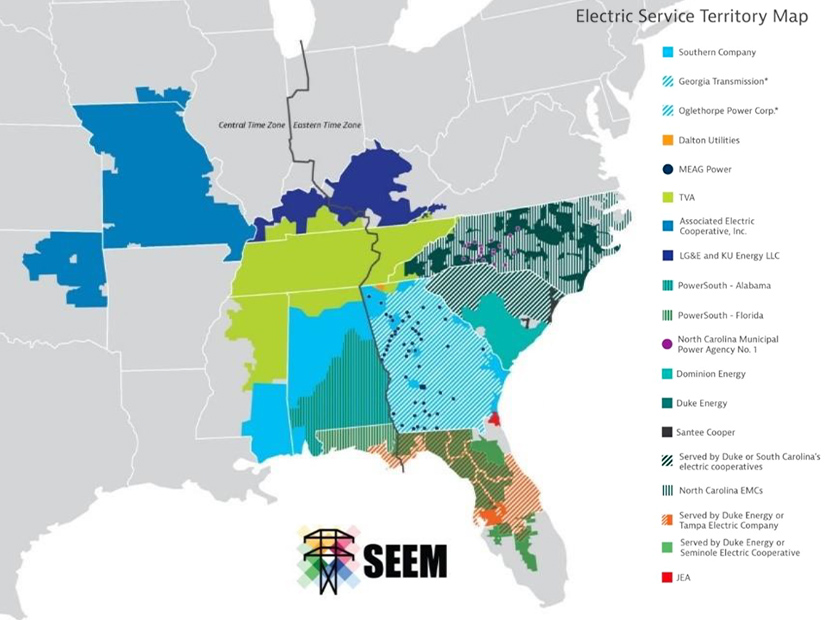

Southern Co., Dominion Energy, Duke Energy and Louisville Gas & Electric, all members of SEEM, answered the commission’s request in an August 2024 briefing that argued the market is not a loose power pool because NFEETS is not a discount or a special rate, as FERC previously determined. They further claimed that NFEETS is pancaked and that owning a source or sink connected to a SEEM transmission provider is necessary for SEEM to be technically feasible.

SEEM’s opponents, a group of environmental organizations and renewable energy trade organizations, countered the following month with a filing arguing that the market’s supporters focused on technical issues while ignoring the fact that SEEM “has walked and quacked like an exclusive power pool” since its conception. The opponents said SEEM violated Order 888 by systematically excluding independent power producers, while energy sales have been dominated by just a few utilities. (See SEEM Opponents Push Back on Supporters’ Claims.)

In its March 14 filing, FERC agreed with SEEM’s members that the market is not a loose power pool. Commissioners said that, based on information provided in the reply comments, NFEETS “cannot neatly be described as either pancaked or non-pancaked,” but that the service “is best characterized as a pancaked rate because each SEEM transaction relies on the acquisition of NFEETS from each participating transmission provider.”

The commission added that even if NFEETS did not disqualify SEEM as a loose power pool, the market still would comply with Order 888. FERC said though the order “prohibits participation requirements that are exclusionary based on geographic location or entity type, the commission does not read [Order 888] as prohibiting reasonable technical requirements for participation.”

These “reasonable technical requirements” include the source/sink requirement, FERC said, because it ensures that participants are close enough for NFEETS to function properly.

“These are not optional characteristics that constitute artificial barriers to participation,” FERC said. “Rather, they are technically integral to the goal of SEEM — to efficiently match buyers and sellers of energy with transmission capability that is unused through any existing transmission services.”

FERC did note SEEM members’ statement that they have amended the market’s business practices manual to allow utilities to use pseudo-ties to satisfy the source/sink requirement. Pseudo-ties are used to represent interconnections between two balancing authorities where no physical connection exists between the load or generation and the power system network.

The commission said the pseudo-tie option “significantly affects rates and services because it is the only option for such resources to participate in SEEM and use NFEETS.” FERC said the terms of service for using pseudo-ties, and the process for evaluating such mechanisms, therefore must be included in the SEEM Agreement, and gave members 30 days to submit a compliance filing verifying the agreement has been updated with the option.