The American Clean Power Association on April 8 released a report produced by The Brattle Group laying out how organized markets can replicate the success CAISO and ERCOT have had in deploying energy storage resources.

The “Energy Storage Market Reform Roadmap” includes detailed changes for the energy, capacity and ancillary services markets, with individual “road maps” for MISO, NYISO and PJM guiding how to grow storage in their territories.

The report and road maps focus on those grid operators because they have “opportunities for market reform,” their states are pursuing decarbonization, and they have a mix of central planning and market-based investment.

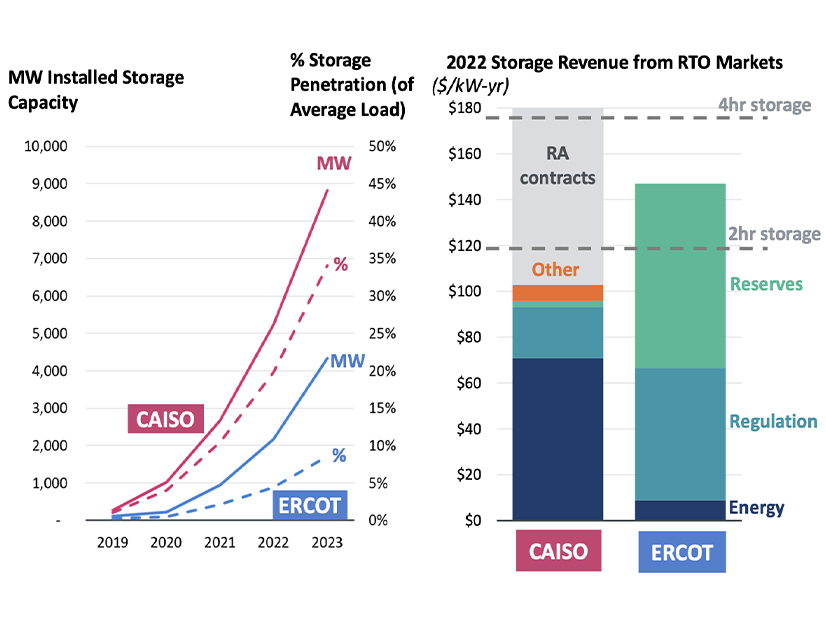

CAISO and ERCOT have shown that with updated market rules, energy storage delivers substantial value and complements both thermal and renewable generation to help meet reliability needs.

“Energy storage technologies add a new dimension of flexibility and efficiency to our electric grid,” ACP Vice President of Energy Storage Noah Roberts said in a statement. “Energy storage has proven to boost reliability and lower energy costs. In Texas, the state added 5 GW of energy storage in one year, eliminating calls for customers to reduce electricity use during historic summer heat, stabilizing the grid through volatile winter storms, all the while delivering more than a billion dollars in energy cost savings. This road map outlines actionable steps to better utilize energy storage to deliver reliable and affordable power across the United States.”

Before FERC issued Order 841 in December 2020 to open up the RTOs to energy storage, the resource faced barriers to participation in the markets, which were designed around the attributes of other generators. Where the organized markets have encouraged deployment and removed barriers, storage has helped prevent blackouts and reduced pressure on customers during tight operating conditions on the grid, while delivering cost savings, ACP said.

One of the areas the report and road maps focus on is the need to replace retiring generation while maintaining reliability and meeting growing demand in many parts of the country. Storage can help replace the reliability services retiring generation provided while keeping a lid on high capacity prices, ACP said.

Many generators were planned to support local transmission needs, especially when they were built in load pockets. Retirements will continue to trigger transmission violations, and some of those are too localized for capacity markets to solve.

The industry’s historic answer for those situations is to build transmission, and sometimes to keep power plants running with out-of-market, reliability-must-run contracts while that is built. But storage, or non-wires alternatives, can contribute to solving those issues at lower costs to consumers, the paper says. “RTOs should identify solution(s) that lead to the lowest costs for ratepayers when procuring reliability solutions out of market.”

Some RTOs, including PJM, do not consider non-wires alternatives for retiring generators. Others do, but they are rarely picked because of a lack of comprehensive benefit-cost analysis, which is exacerbated by the short notice period between the solicitation date and required online date, the report says.

On average in PJM, RMRs have cost $300/MW-day, which is well above the market clearing prices in the long term of $100/MW-day, according to the paper. Studies have shown the benefits of competitive solicitations both in transmission infrastructure procurement and generator procurement, it says.

Energy storage — especially long-duration and multiday — may be able to resolve both transmission security constraints and provide flexibility value to the grid, the report argues.

The report highlights how CAISO oversaw a process to replace the 165-MW Oakland gas plant that announced its retirement in 2016. The ISO picked Pacific Gas and Electric’s Oakland Clean Energy Initiative, which included some transmission upgrades, storage and demand response that met the need at a lower cost than transmission or generation solutions alone.

It also pointed to NYISO’s efforts to replace the dual-fuel Narrows and Gowanus plants that were slated for retirement this year. The plants are to be replaced by the Champlain Hudson Express Line to bring hydropower down from Quebec. That line is on track for an operation date of May 2026 but potentially could be delayed until 2027.

NYISO identified a short-term reliability need and issued a competitive solicitation for a solution, but none of the responses could solve it in time. Recently, NYISO said the peaker plants will still be needed for the next couple of years. (See related story, NYISO Reaffirms Need for NYC Peakers in Summer.)

“As electricity grids struggle to keep pace with the feverish growth in energy demand across the country, every electron of power counts,” Eolian COO Stephanie Smith said in a statement. “Battery energy storage helps both thermal and renewable energy technologies optimize their participation and increase reliability and resilience by providing power when and where it is needed quickly. By updating existing rules to account for new technologies, regional electricity markets can enhance grid performance and lower costs for consumers.”