ATLANTIC CITY, N.J. — As the U.S. offshore wind industry prepares to put steel in the water, it is paying increasing attention to how it will deliver its power to load centers.

At the Business Network for Offshore Wind’s 2022 International Partnering Forum last week, much of the discussion focused on the challenges and opportunities of an offshore transmission grid and how New Jersey and New York are approaching the puzzle.

No to ‘Reactive’ Planning

The conference’s theme was “Keep, change, toss.”

“We’re going to talk about keeping policies or practices for mature markets that strengthen the industry and changing or tossing practices that weaken the industry,” explained Liz Burdock, CEO of the Business Network. One practice to toss, she said, is the “outdated grid and transmission planning processes.”

FERC Chairman Richard Glick and New Jersey Board of Public Utilities President Joseph Fiordaliso talked about transmission in a conversation moderated RTO Insider Editor Rich Heidorn Jr. | Business Network for Offshore Wind

“We must move away from an overwhelmingly reactive planning process towards an anticipatory grid and transmission investment model. What does that mean? We need to build an offshore shared grid. If you build it, they will come, and the benefits to ratepayers and more offshore wind will follow.”

FERC signaled its support for more proactive planning on April 21, when it approved a Notice of Proposed Rulemaking that would require transmission providers to conduct regional transmission planning on a 20-year forward-looking basis. (See FERC Issues 1st Proposal out of Transmission Proceeding.)

FERC Chairman Richard Glick, in a conversation at the conference with New Jersey Board of Public Utilities President Joseph Fiordaliso, said he hopes to follow that NOPR “soon” with a rulemaking to expedite processing interconnection queues. “We need to expedite it dramatically, or a lot of your projects will take years to get hooked up to the grid,” Glick said.

“The worst dream I have is … that we’re generating energy out in the ocean, and there’s no place to plug it in,” Fiordaliso said.

‘Balancing Multiple Workstreams’

While there was wide agreement on the need for a networked transmission “backbone” that minimizes shore landings, there were also warnings that long-term transmission plans not slow construction of projects that have already been awarded.

“I think we also need to take a very focused look at costs and timelines,” said Joshua Weinstein, vice president and head of offshore development for Invenergy. “A fully integrated, backbone-style grid is not necessarily directly coincident with meeting targets in the short term.”

Sam Eaton, executive vice president of offshore development in the Americas for RWE, said the current approach is “not sustainable.”

“It’s clear, there’s a lot of planning and thinking that has to go into what is the right solution. … But I think we also have to recognize [that] in the interim, we need to get the first projects in the water. We need to demonstrate we can do this while we’re figuring out in parallel what the longer-term sustainable solution is going to be.”

Doreen Harris, CEO of the New York State Energy Research and Development Authority (NYSERDA), said the state is attempting to balance multiple “workstreams”: implementing its climate law, delivering on five OSW projects under contract and the ports that will support them, and continuing to build the pipeline with a new solicitation this year. “None of these pieces will wait,” she said. “They all need to advance in parallel.”

Weinstein said New Jersey, which has committed to build 7.5 GW of OSW, and New York, which has a 9-GW target, are taking “fundamentally different approaches.” New York is mandating that wind developers include a “mesh-ready” design for a future offshore grid. (See NYPSC Mandates Meshed Offshore Tx Grids.) New Jersey is reviewing responses to a transmission development solicitation issued at its request by PJM. (See NJ Seeks Efficiency, Savings in OSW Transmission Process.)

“But I think that’s also good,” Weinstein said. “We need to look at the book ends; we need to understand the total challenge; the total problem. Different states, different regions of the bulk transmission system, have different problems.”

Interregional Backbone?

In a workshop, John Dalton, president of Power Advisory, touted the value of an interregional offshore grid, noting that Atlantic City’s average wind speed that day was 50% higher than the average for New Bedford, Mass.

“That’s [an indication of] the diversity that you can get when you start to interconnect the PJM system, the NYISO system and the New England system,” he said, predicting such a grid would allow lower operating reserve and capacity requirements.

The U.K., he noted, has five major interconnections with adjacent electricity markets, with more planned.

Dalton said planned transmission means fewer landfalls, “one of the most critical environmental pinch points that projects have when they’re being sited.”

“So when you can effectively reduce environmental pinch points, you can reduce the level of public opposition. … If this transmission infrastructure is in place, there’s going to be less risk that the offshore wind generation developer has to face. And that could result in benefits in terms of lower costs for the energy produced by these projects,” he said. “And then, obviously, once you have a network, it is going to potentially have the benefits of enhanced reliability performance and operability.”

But Dalton said he had no illusions about the challenges to building an interregional offshore grid. “I think that it’s probably easier to demonstrate the benefits [of such a grid] than to sort through the various commercial issues,” he said.

Laila El-Ashmawy, a project manager with NYSERDA’s OSW team, said New York officials have had some very preliminary conversations with ISO-NE and PJM about offshore interconnections. “We have the benefit of New York state [being] a one-state ISO, and that’s challenging enough. … Integrating in the region is something we all dream about. But I’d say [interregional connections are] part of that long-term planning, ongoing discussion process. As far as anything material, you have the mesh-ready [approach].” (See related story, New York Seeks to Protect Tx Options with Mesh-Ready OSW.)

In the near term, Dalton said he was encouraged by news that Massachusetts (5.6 GW) and Connecticut (2 GW) officials are considering collaboration on their transmission. “Unlike New York, which has such an ambitious offshore wind goal … Massachusetts has a more modest, residual offshore procurement target. So to really make this investment effective, it makes sense to increase the volume that you’re planning this transmission for,” he said. “So that’s [the driver for] Massachusetts [and] Connecticut, as well as conceivably Rhode Island, to work together.”

Another factor: “Building [onshore] transmission in New England on new rights of way is, I think, a nonstarter.”

New Jersey Transmission Procurement

The BPU’s 2019 award to Ørsted’s Ocean Wind project (1,100 MW) and its June 2021 awards to Ørsted (1,148 MW) and EDF/Shell’s Atlantic Shores (1,510 MW) makes those projects responsible for their own transmission.

To make sure that it can plug in its additional offshore wind farms, New Jersey contracted with PJM to use the State Agreement Approach (SAA) to solicit transmission proposals. (See FERC Approves PJM-NJ Transmission Agreement.)

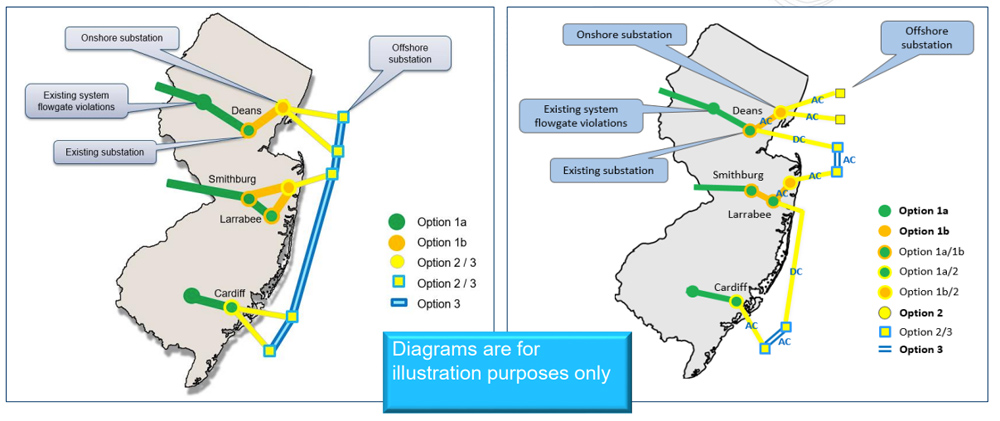

PJM is reviewing 80 proposals from 13 transmission developers. It has broken up the proposals into four categories: onshore upgrades on existing facilities (option 1a); new onshore transmission connection facilities (option 1b); new offshore transmission connection facilities (option 2); and an offshore network (option 3).

The RTO said it is performing reliability studies for about 20 potential points of interconnection. The winners of the 2021 OSW projects could seek to buy into the SAA transmission if it provides a cheaper alternative than siting their own lines.

Some of the proposals include cost-containment pledges. Under the SAA, New Jersey would be obligated to fund all of the transmission itself.

Asked whether New Jersey would consider a transmission proposal that didn’t include a cost cap, Fiordaliso said “it depends on the proposal.”

“We are prudent in our approach. We just don’t throw mud up against the wall and hope something sticks. We have to be prudent in the approach; always keep in mind — and this is a direct instruction from [Gov. Phil Murphy] — the impact on the ratepayer.”

Clarke Bruno, CEO of Anbaric Development Partners, said he supports the approach behind FERC’s NOPR. “The notion of planning in a comprehensive way for two decades and more is, I think, critical to the development of an offshore grid,” he said.

But he said he was dismayed by FERC’s proposal to reinstate the federal right of first refusal (ROFR). (See ANALYSIS: FERC Giving up on Transmission Competition?)

“Candidly, I was disappointed in the treatment of competition,” he said. “The Murphy administration has demonstrated, I think, the benefits of an RTO working closely with the state to identify goals, to identify how to get there, and to ask the best of the private sector to come in, and design and price what can work for PJM and New Jersey. And I think that’s a proof point that the current approach is working.”