Potential energy suppliers in IESO’s second long-term energy and capacity procurement (LT2) sparred with ISO officials July 10, saying its proposed auction rules favor natural gas generators by insulating them from most of the cost of gas transmission upgrades.

In a webinar, the ISO said it would reimburse gas generators 75% of upgrade costs “to address natural gas transmission cost uncertainty.” The auction rules also provide cost protections for all generators facing increased tariffs and allow gas generators to extend their commercial operation dates because of delays in obtaining gas turbines.

Mike Marcolongo, associate director of Environmental Defence, said the 75% reimbursement was “quite generous.”

“I think that we have done quite a lot for all of the technologies that are that are eligible to participate in our [requests for proposals] over time,” responded Dave Barreca, IESO’s supervisor of resource acquisition. He cited the materials cost index adjustment the ISO has used in previous solicitations to address the fluctuating costs of lithium for battery providers.

Attorney Jake Sadikman — co-chair of Osler, Hoskin & Harcourt’s national energy group, which is working with IESO on the procurement — also cited the “regulatory charge credit,” which reimbursed battery storage for regulatory energy charges, including global adjustment.

Barreca said the ISO decided a 75% reimbursement was “an appropriate value … that would mitigate the risk sufficiently for a gas generator to be able to participate in the RFP while maintaining the incentive for them to mitigate — or, in fact, avoid — the costs.”

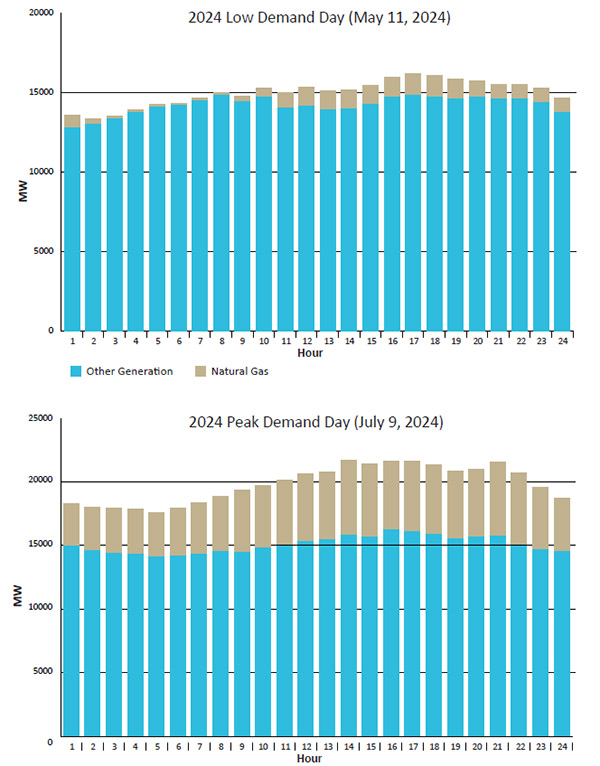

Need for New Gas Generation

Brandon Kelly, director of regulatory and market affairs for Northland Power, said the ISO’s approach could result in “inefficient outcomes” if the added cost makes a gas generator more costly than rejected bids.

“This is an imperfect outcome,” Barreca acknowledged. “It’s not what we would have necessarily wanted. But this is what we need to ensure that all resources are able to participate.

“We wouldn’t be doing this if we didn’t think that we need some amount of … new natural gas on the system to get us through the transition period over the next few decades,” he added. (See Ontario Integrated Energy Plan Boosts Gas, Nukes.)

“I can recognize that none of this will be perfectly efficient, but that is true for the rest of the RFP. There are a lot of constraints other than cost: on where sites are selected and what ultimately gets chosen. So we are, I think here, doing the best, given the constraints that we have.”

Kelly was unpersuaded. “What you’ve done here is not to … allow these resources to participate; it’s to advantage them, and that’s materially different from the approach you guys have taken elsewhere,” he said. He suggested gas generators instead incorporate a risk premium in their offers.

IESO’s Ben Weir said if the actual gas transmission connection costs ultimately approved by the Ontario Energy Board are less than the risk premium, “ratepayers end up covering that risk-adjusted premium for really no reason.”

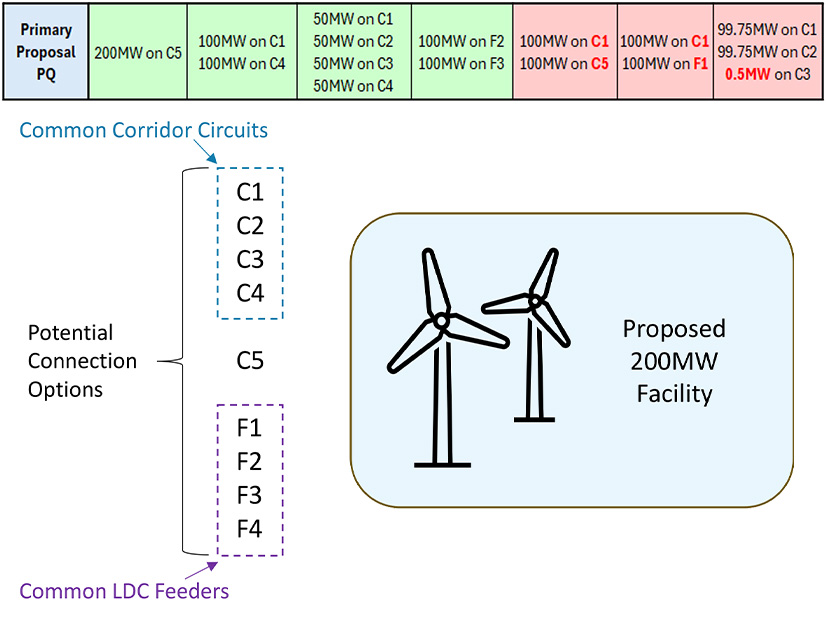

Uncertainty over Grid Interconnection Costs

Eric Muller, Ontario director of the Canadian Renewable Energy Association, said there also is great uncertainty on the costs of interconnections with the electricity transmission system. He said the ISO should provide a cost-sharing or true-up mechanism to address those risks.

Barreca said the risks of electric interconnection costs are “materially different” than that for gas because of a new process that will allow Hydro One, the province’s largest transmission operator, to give generators “perhaps not perfect [certainty] but at least enough certainty on those costs that they’ll be able to confidently submit their bids.

“We continue to work hard with our colleagues at Hydro One on this issue and hope to be able to share something with you all in the very near future,” Barreca said.

Officials said IESO will hold an engagement session with Hydro One on July 30 to provide an overview of the process for making new or modified connections to the grid.

Barreca said the ISO was unable to reach such certainty regarding gas distribution costs. “That ultimately just was not possible. And that is a kind of regulatory thing,” he said.

Tremor Temchin, senior vice president of development for Convergent Energy and Power, said the ISO’s requirement that generators provide continuous power for at least eight hours; its “open ended” commercial operation date for delayed turbine deliveries; and the cost sharing on gas distribution all look “like the ISO picking and choosing winners in a procurement that is supposed to be technology agnostic.”

He suggested the ISO run a separate, gas-specific procurement, saying “it’s the only way to keep this fair for other technology types.”

“This is not the ISO trying to tip the scales in favor of one technology or the other merely to enable participation,” Barreca responded. He said the move to an eight-hour minimum duration is “reflective of system needs and evolving system conditions.”

He noted that the ISO has added nearly 3,000 MW of battery storage “in a very short period of time.”

“The capacity value of that four-hour storage diminishes the more that you add without adding more … energy-producing resources,” he said. Nevertheless, he said, the ISO has not sought to derate storage capacity.

“So, I really do not think that we are here trying to tip the scales in one direction or the other. We want to have as balanced and fair a procurement as possible. We very strongly believe in the value of a diverse supply mix, and that includes some of everything.”

14 TWh, 1,600 MW Sought

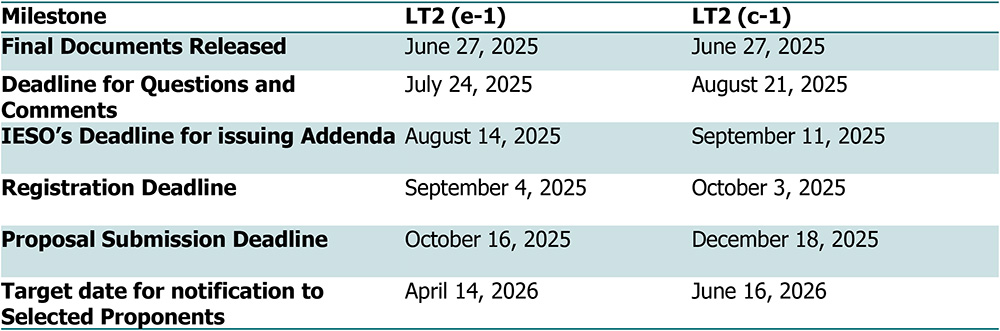

IESO announced in December that it was seeking up to 14 TWh of annual generation and up to 1,600 MW of capacity resources in its second long-term procurement. The first window seeks 3 TWh of energy and 600 MW of capacity.

The ISO released final documents June 27 for the first window of LT2 energy and capacity procurements. Energy proposals will be due Oct. 16 and capacity proposals due Dec. 18, with notifications of winners set for April 14, 2026, and June 16, 2026, respectively.

The LT2 documents include updates to some terms to reflect IESO’s May 1 introduction of a financially binding day-ahead market and the elimination of the State of Charge Reduction Factor, a transitional mechanism used to address storage facilities’ need to withdraw real-time market (RTM) offers after depleting energy during RTM obligations. With its new forward market, the day-ahead market no longer includes RTM, eliminating the dual obligation. (See Ontario Introducing Nodal Market May 1.)

The new procurement also gives bidders based in Canada a 2% reduction to their “evaluated proposal price.”

IESO Senior Adviser Nick Topfer said the home-field advantage was added in response to a June 26 directive from the Ministry of Energy and Mines and will be additive — not diluting existing bonuses such as for Indigenous participation.

The new solicitation also will allow bidders to seek price increases if import tariffs imposed after the proposals are submitted “directly” increase capital costs by more than 10%.

The ISO will have 50 days to respond to a “tariff adjustment notice” — down from 100 days, as originally proposed. If it rejects the revised price, the contract will be terminated, and the bidder’s completion and performance security will be returned.

IESO has eliminated from the capacity solicitation a proposal to limit capacity check tests to a maximum of 15 degrees Celsius.

“This decision … was a bit premature and was made hastily by us,” IESO’s Sanjiv Sohal said. “It didn’t wholly consider other articles contained in the contract. So as a result, we’re walking this decision back, and the maximum temperature limit for the winter months in section 15.6 of the contract has not been removed.”

The contract requires the tests be conducted when temperatures do not exceed 35 C in the summer or fall below ‑20 C in the winter.