Members Shoot down Staff’s Proposal for Integrating High-impact Large Loads

LITTLE ROCK, Ark. — The SPP Markets and Operations Policy Committee resoundingly rejected a proposed tariff change to integrate large loads, pushing back against what some say is a rushed process outside of the normal stakeholder structure.

The committee’s decision during its July 15-16 meeting won’t stop the revision request (RR696) from going before the Board of Directors during its next quarterly meeting Aug. 5. The board in April directed SPP staff to deliver a draft proposal during the meeting that helps integrate large loads, and that includes the “requisite stakeholder engagement.” (See “Cupparo Issues ‘Executive Order,’” SPP Board OKs 1-time Study for LREs’ Gen Needs.)

The measure failed with only 53.7% approval. The Transmission Owner segment voted 11-5 for the measure, while Transmission Users voted 24-38. There were 12 abstentions.

“As SPP members continue to receive or — really, in the case of some members — actually submit large load requests to us, we’ve needed to develop an effective policy that allows our members to be both responsive and competitive in the pursuit of these loads,” COO Antoine Lucas said in setting up the discussion, which ate up much of the meeting’s two days.

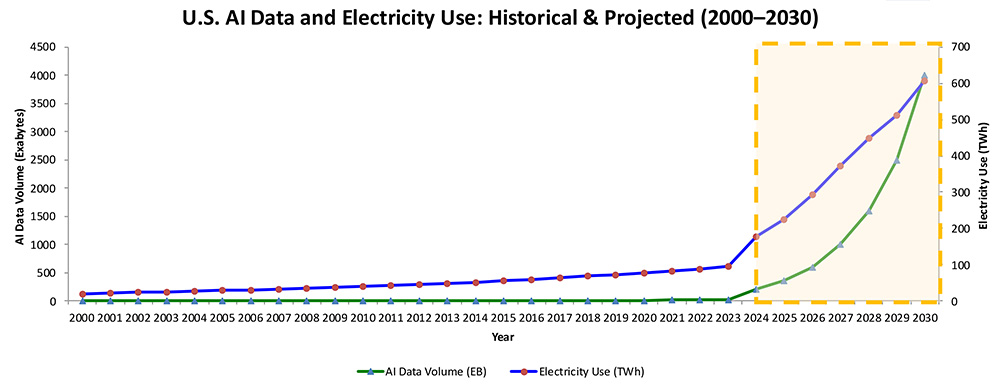

“The large load policy is essential to responsibly allow this new industrial-scale electricity demand such as AI, data centers, advanced manufacturing and even energy-intensive production processes to integrate and operate,” he added.

SPP says its 2025 Integrated Transmission Planning assessment includes about 10 GW of large loads, with an average size of 235 MW. The 2026 ITP includes more than 20 GW of large loads.

The grid operator’s solution addresses gaps in current planning processes that have resulted in long wait times for projects, a lack of flexibility for limited connection or operation of load with system limits and cost uncertainty for transmission upgrades.

The proposal is built around 90-day studies that allow faster load connection with certain reliability-driven conditions. The policy defines several large-load types or services, including:

-

- high-impact large loads (HILLs): any commercial or industrial individual load facility or aggregation of facilities at a single site, connected through one or more shared points of interconnection or points of delivery that can pose reliability risks to the grid. HILLs are nonconforming loads of either 69 kV or below with a peak demand of 10 MW or greater, or greater than 69 kV with a peak demand of 50 MW or more.

- conditional high-impact large load (CHILLs): the portion of a HILL that is receiving conditional high-impact large load service (CHILLS). This is intended for any HILL specifications that cannot reliably be served on a firm basis by existing designated resources or the current transmission system. CHILLs can exist at the same delivery point as firm load.

- CHILLS: a new transmission service available to HILLs to transfer energy to designated points of delivery to serve a transmission or network customer’s CHILL. The service will be available for yearly periods ranging from one to five years.

“HILLs, CHILLs and thrills,” cracked one wag at the table.

“A big principle in this is to have a path to firm service and balanced reliability,” said Casey Cathey, SPP’s vice president of engineering. “Our solution is to be the fastest connection study in the United States. We’ve looked at all of our fellow ISOs and RTOs. We work with them at least quarterly and share best practices. We also looked at Southern Co. We looked at a number of different areas that are challenged with similar challenges. … We want to provide transmission customers all the options necessary in the toolbox.” (See SPP Embraces Need for Speed to Meet Change Head-on.)

SPP said the rules for large load’s cost allocation are consistent with the existing tariff and aim to minimize cost shifts from HILLs and CHILLs to other customers, aligning costs with those causing the upgrades. Those costs are directly assigned to the large-load customer until it secures firm service and is potentially eligible for base plan funding.

CHILLS is billed on reserved capacity megawatts. If curtailed, charges adjust to the curtailed megawatts.

In opening the second day of discussion on large loads, CEO Lanny Nickell expressed the need for speed and stakeholder input. To bolster his case, he said a person could draw circles around any 14 contiguous states in the country — as he did — and they would find more data centers in that region than in SPP’s 14-state service territory.

Quoting ChatGPT, Nickell said the lost opportunity of a more-than-$1 billion capital investment for a 100-MW load amounts to more than the $1 billion: It also results in $200 million to $500 million lost construction and ongoing jobs, $50 million to $150 million of lost tax revenue over 10 years and $25 million to $75 million of lost grid and system value.

“That’s the pure evidence. That’s the pure data,” he said. “That’s not something I really want to go to the governor and say, ‘You know what? Because we couldn’t get this done in a timely fashion, you just lost another 100 MW.’

“It was made clear to me several months ago [by members’ leadership] that this is an opportunity that we have to take advantage of, and if we don’t, it’s not only hundreds of millions to billions of dollars of lost opportunity if we don’t take advantage of this. It turns into a threat to our long-term existence. So that’s why we’re doing this, and that’s why this is urgent, and that’s why we’re doing it as fast as we can, but we still are trying to do it in a way that considers as much input as we can possibly get. We want every piece of input that we can get.”

Over two days, including a half-day education session on large loads, SPP got that input.

“My background has always been in operations, and I have extreme concerns about the reliability impacts of large loads. I don’t think we’ve thought of all the potential issues that can come from bringing these large loads on,” NextEra Energy’s Jeff Wells said, calling for more time. “I’m not saying we need three months. I’m not saying we need six months, but we need time to go to our experts in SPP that aren’t SPP employees. … We need to get their feedback, and we need to make sure that we’ve addressed all those concerns.”

The Advanced Power Alliance’s Steve Gaw said SPP has not followed its stakeholder process. Members, some constrained by a lack of internal resources, have struggled to keep up as the policy and revision requests are developed at the same time.

“There’s a reason why we need to prioritize things,” he said. “There are lots of investment dollars that have been lost because of road blocks to getting generation interconnected over the last several years. We would not have the same kinds of problems in having resources to match this load if we had done some additional work to prioritize things in that fashion as well.”

Gaw also complained about the little time stakeholders have had to comment on the proposal’s “500-plus pages that were dropped on us” in late June.

Noting that additional comments to the board on the tariff change are limited to two pages, Western Farmers Electric Cooperative’s Matt Caves asked whether the directive could be reciprocal.

“Can SPP reduce this RR to, say, 100 pages?” he asked, drawing chuckles from staff and stakeholders.

Olivia Hough, a regulatory strategist with City Utilities of Springfield in Missouri and MOPC’s vice chair, said the utility has formed a task force to go over the “voluminous” document.

“It’s a lot to go through, and I understand that everyone maybe can’t read every single line item of it,” she said. “In whole, we want to see this move forward. We don’t want to miss out on the opportunity, and we think that the economic development potential and the challenge is worth it. I appreciate SPP’s commitment to putting this together at the same time that all the utilities are trying to develop their own frameworks.”

“This is what SPS has been asking for: help to serve loads,” Southwestern Public Service’s Jarred Cooley said. “We really see that this is something that needs to be done. … We get the opportunity to get in front of FERC, get that feedback, figure out maybe what changes we need to make in the next iteration, and continue to push forward.”

SPP’s Market Monitoring Unit also weighed in, saying that despite a “high level” of engagement with the RTO, it still has concerns that the proposal introduces risk to the market and other participants. It recommended risks be mitigated before any implementation and said it may identify additional risks and make further recommendations in the future.

MOPC passed a motion to hold a special workshop and further consider RR696 no later than the end of September. The motion passed with 69.9% approval.

COO Lucas emailed MOPC’s membership on July 18, laying out the several channels open to stakeholders who want to continue shaping the proposal before it goes to the board. SPP followed the email with a survey that members can use to share their concerns and recommended solutions.

Members can also provide “high-level, strategic feedback” directly to the board. The feedback, using a template to ensure consistency and focus, is due July 28, the same date the grid operator is keeping the comment period open for RR696. Several working groups will each review the proposal during their scheduled meetings before Aug. 5.

“Your continued participation in this process is valued and vital,” Lucas wrote. “You have our continued commitment to incorporate our stakeholders’ diverse perspectives as thoughtfully and equitably as possible. With your help, we aim to bring a proposal to the board that reflects both the urgency of this issue and the collective wisdom of our stakeholders.”

Seams Cost Allocation Rejected

MOPC also rejected a proposed tariff change RR681 that would provide a cost-allocation mechanism for projects that don’t qualify as interregional projects and where SPP shares cost with one or more neighbors. The measure received only 54.9% approval.

Aaron Shipley, the RTO’s senior interregional coordinator, said the proposal would make the process of building future jointly funded projects more efficient. He said it would be helpful to have the tariff change in place as SPP moves forward with the RTO’s Western expansion.

“We would expect to receive efficiency in our processes by having this cost-allocation tariff mechanism already approved and thus eliminating individual at-the end-of-the-process cost-allocation debates that we have all been through before and provide significant risk at the end of a project and process,” he said. “This is something we’ve heard support from both stakeholders and regulators all the way from the beginning of this effort.”

SPP’s membership first raised the issue in 2014, and it was later readdressed and confirmed through the Strategic and Creative Re-engineering of Integrated Planning Team’s (SCRIPT) work in 2020-2021. The RTO’s state regulators in October 2024 endorsed a seams policy white paper and directed staff to move forward with a recommendation to seek FERC approval.

Stakeholders pushed back against RR681 over concerns the seams projects would be subject to the grid operator’s competitive process screening. They wondered whether staff would be able to take on the number of new planning processes feeding into the process.

“I’m not opposed to following this kind of process in general,” American Electric Power’s Richard Ross said. “I’m opposed to just automating it so that it’s just there all the time. I think there may be some serious instances where we do things in one area that really don’t have greater benefits across the region, and so they ought to be allocated more. I do hope you will share with me that we ought to take a closer look at these on an individual basis.”

Three RRs Endorsed

Members endorsed three other revision requests with varying levels of approval.

RR693 received 76.5% approval, with SPS the only transmission owner of 17 to vote against it. The first phase of Surplus Plus and its suite of initiatives designed to accelerate the addition of new generation, the measure would quickly add shovel-ready incremental capacity at existing generating sites. The process would end when the Consolidated Planning Process begins in 2026. (See SPP ‘Blazes Trail’ with Consolidated Planning Process.)

Under the proposal, priority requests would be queued higher than study clusters that haven’t started. The process would be conducted on an accelerated time frame, not subject to waiting for open seasons or processing as part of a cluster or from needs driven by other requests.

Assuming FERC approval in October, the first requests would be submitted for a 90-day system impact study, with the first GI agreements issued by April 1.

RR693 was an outgrowth of discussions at the Resource and Energy Adequacy Leadership (REAL) Team, said Steve Purdy, SPP’s technical director of engineering policy.

“It is another tool in the toolkit for customers to be able to add new generation to the system, in addition to all of the existing processes that customers have available to them,” he said. “It’s a new process that will allow a customer to make a request and submit that outside of the DISIS [definitive interconnection system impact study] window.”

RR689, which passed with 95.8% approval, was opposed only by four members of the Transmission Users segment. The proposal would reject market participant bids in the transmission congestion rights (TCR) market when sourcing from an electrically equivalent settlement location (EESL) to another settlement location on the system, or when the participant adds another bid from a settlement location back into the original EESL group that sinks at a different settlement location than the source.

“We saw some concerning TCR bidding strategies in the TCR market,” said Micha Bailey, SPP’s manager of congestion hedging. “[EESLs] don’t have to be co-located, but electrically equivalent settlement locations basically have what we like to call unconstrained flow between them. So, you can basically get an infinite amount of TCR awards.”

The MMU’s Raleigh Mohr said the Monitor was supportive of the measure.

“Essentially, the message is this behavior is bad. FERC has ruled in other markets and in our market that this behavior is manipulative. We wanted to make sure that at this full representation body, that everyone heard that message,” he said.

A motion to include comments from The Energy Authority (TEA), speaking for six market participants, failed with only 35.8% approval. TEA recommended restricting implementation to auction revenue rights (ARRs) submitted for self-conversion to TCRs and not applying the restrictions to settling ARRs.

“Our general principle is if a gaming opportunity exists and it can be closed, then it should be closed,” Mohr said, arguing against TEA’s comments.

RR676 came within a percentage point of unanimous approval, receiving its only opposing vote from NG Renewables Energy Marketing. The measure creates a process for studying electric storage resource loads subject to SPP’s generator interconnection process and ensure compliance with FERC Orders 845 and 2023 and NERC reliability standard FAC-002-2.

“Today, our studies assess them for injection as a resource,” Evergy’s Derek Brown said. “One of the reasons for the enhancement is to better assess the impacts of these electric storage resources.”

The RTO currently has 179 active storage projects, totaling 31 GW, in the queue.

“We just think this is a crucial step forward for ensuring reliability and compliance of ESRs within the SPP transmission system,” Eolian’s Kyle Martinez said. “This is generation that can come online [and] provide ancillary service products off of the market.”

DR Policy Endorsed

MOPC endorsed SPP’s demand response and load-responsible entity peak-demand assessment policy proposals, designed to help ensure realistic forecasts that reflect the effect of flexible load.

Members amended the original motion to direct staff to prepare an RR based on the DR policy framework and conduct stakeholder reviews in conjunction with the LRE peak-demand assessment’s policy and RR.

Assuming their eventual approval, SPP plans to file both tariff changes together at FERC in early 2026 because of the “interdependency” between the two. A joint filing would provide a single, transparent foundation for resource adequacy and tariff evolution, staff said.

The DR framework includes various metrics, criteria and thresholds for both reliability and market-registered DR to reduce consumption during tight grid conditions.

The REAL Team approved the policy earlier in July during a special meeting. (See SPP REAL Team Endorses Demand Response Framework.)

Consent Agenda Passes

MOPC endorsed RR692 by more than 91% approval after it was pulled from the consent agenda over timing concerns.

The change allows multiple Phase 1 restudy iterations within the DISIS process in the face of growing interconnection clusters. The 2024-001 cluster has 380 requests totaling more than 100 GW of capacity, almost double the size of the previous largest cluster.

“We’re seeing large amounts of dropouts between phases. Customers are being asked to make decisions about moving to the GIA portion of the DISIS analysis before we really have an understanding of what customers are going to remain when we’re through the entire process,” SPP’s Natasha Henderson said. “What’s proposed here is that we add additional Phase 1 studies. For instance, if 30% of the projects drop out in Phase 1, we would repeat Phase 1 again if we’re going to Phase 2, which adds stability to the mix.”

The measure received 91% approval from members.

The consent agenda included eight other revision requests that, if approved by the board, would:

-

- RR675: modify the local market power test for resources in a nonbinding frequently constrained area.

- RR677: add language that was inadvertently omitted from the settlement calculations changes approved in RR628 (Price Formation) that checks whether a resource is below its day-ahead market position.

- RR678: remove outdated references to quick-start resources, which have been replaced by fast-start resources, from the protocols because of updates in registration parameters.

- RR679: revise the ITP manual to remove conflicting language and references to the Model Development Procedure Manual’s new process. The new method allows for more data points to be included in calculating the number used for renewable resource dispatch, resulting in increased accuracy and confidence in the base reliability model.

- RR680: establish the incremental market efficiency use (IMEU) mechanism to provide revenue that offsets the increased operational costs of the West DC ties because of more frequent market-directed dispatches under the five-minute market.

- RR683: clarify and align governing document language with actual operational practices for notifying market participants during emergency conditions, including cleanup edits and new language allowing operations to issue notifications as soon as practical when emergencies are anticipated.

- RR685: update the Integrated Marketplace rules to allow SPP’s Western balancing authority area to join the Western Power Pool’s Reserve Sharing Group, lowering ancillary service costs and strengthening system reliability.

- RR691: revert tariff language back to its correct verbiage regarding changes for the RTO’s Western expansion.