MISO said even a 109-GW peak this winter shouldn’t prove problematic, though the RTO said a more probable scenario would deliver a 103-GW peak in January.

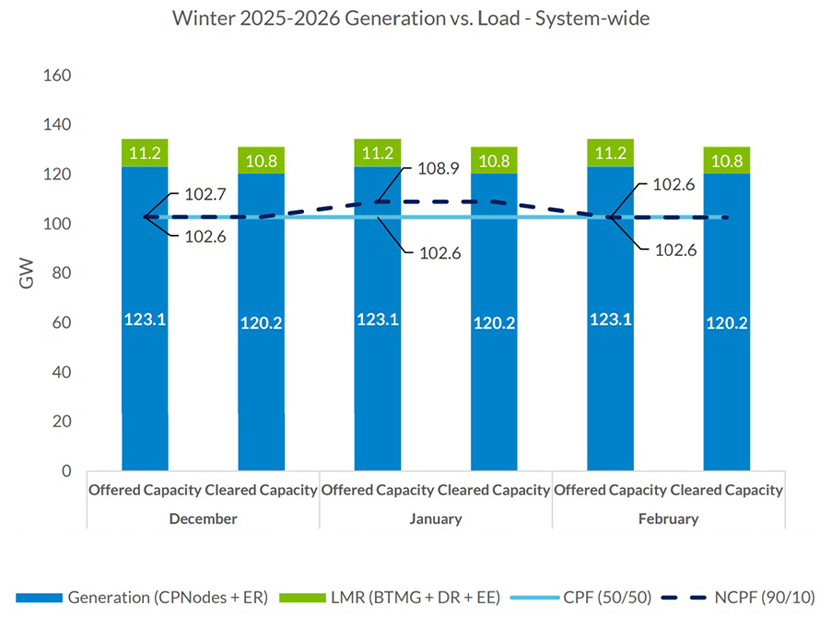

MISO’s coincident peak forecast from members estimates a 102.6-GW winter peak in January. However, MISO said there’s potential for a 108.9-GW peak using a non-coincident peak forecast.

MISO attracted 123.1 GW worth of offers in its winter capacity auction, with 120.2 GW ultimately clearing. The grid operator also has about 11 GW in load-modifying resources that can assist in an emergency during the season.

At an Oct. 29 Winter Readiness Workshop, MISO Senior Resource Adequacy Engineer Gurman Kaur said MISO believes it has more than enough supply to get through the winter.

However, MISO Director of Operations Risk Management Jason Howard said ongoing fleet change coupled with increasing demand and extreme weather could make for thorny operations.

“The combination of load growth, resource flexibility needs during the riskiest times of the day and the ever-present possibility of larger winter storms is our new reality,” Howard said in a press release. “In response to this complex risk environment, MISO is enhancing our forecasting capabilities, dynamic reserves and outage coordination processes to ensure MISO maintains reliability for the 45 million people we serve.”

Howard said MISO would rely on its Forward Reliability Assessment and Commitment system tool, which looks six days ahead to make unit commitments, and would issue grid notices and warnings days in advance when it notices reserves are poised to shrink.

MISO reminded stakeholders that it and its members “reliably and efficiently navigated several significant weather events last winter,” including an arctic 6.5-degree Fahrenheit average footprint-wide temperature Jan. 20-22 that sent systemwide peak demand shooting to 108 GW, with a record-high 33 GW of that from MISO South. (See MISO South Hit Record, 33-GW Winter Peak in Jan. Storm.)

MISO Manager of Operations Risk Assessment Matthew Campbell said during last winter’s trio of storms, MISO maintained consistent communications with members, conducted daily risk assessments and produced net uncertainty forecasts to guide unit commitments.

Campbell noted that the U.S. Energy Information Administration expects coal inventories at power plants to be lower than last winter and “on the lower end of the five-year average.” He likewise said natural gas storage is projected to be lower than a five-year average every month of winter.

MISO said winter 2024/25 — which was colder than usual due to periods of “durable” cold air — is the top comparison to draw on to predict winter 2025/26.

Ella Dankanics, a senior at Purdue University and a meteorological risk analyst for MISO, said the National Oceanic and Atmospheric Administration expects equal chances for MISO Midwest to have a colder- or warmer-than-normal winter. MISO interprets the equal opportunity could mean temperature swings.

Dankanics said warm and cold air could “battle” throughout the season, bringing a greater risk of equipment icing.

NOAA, meanwhile, anticipates above normal temperatures in MISO South. The agency also predicts active storm patterns and higher-than-average precipitation in the Great Lakes region with a drier season near the Gulf of Mexico.

Dankanics said there’s potential for a weaker La Niña weather pattern this winter that creates more opportunities for deep freezes, reinforced by weaker stratospheric winds.

Dankanics said in historical winters with a weak La Niña trend, MISO’s systemwide peak load consistently reached the 95th percentile, or about 97 GW.