The buildout of new resources in the Western Interconnection over the next 20 years is “remarkably similar” across a variety of scenarios tested in the Northwest Power and Conservation Council’s market availability study.

Staff members presented the study results at a council meeting Nov. 18. The study will inform the upcoming Ninth Power Plan, which the council is required to develop under the Northwest Power Act “to ensure an adequate, efficient, economical and reliable power supply for the region.” NWPCC publishes a plan every five years, according to the council’s website. (See NWPCC’s Initial Demand Forecast Sees Sharp Growth for NW.)

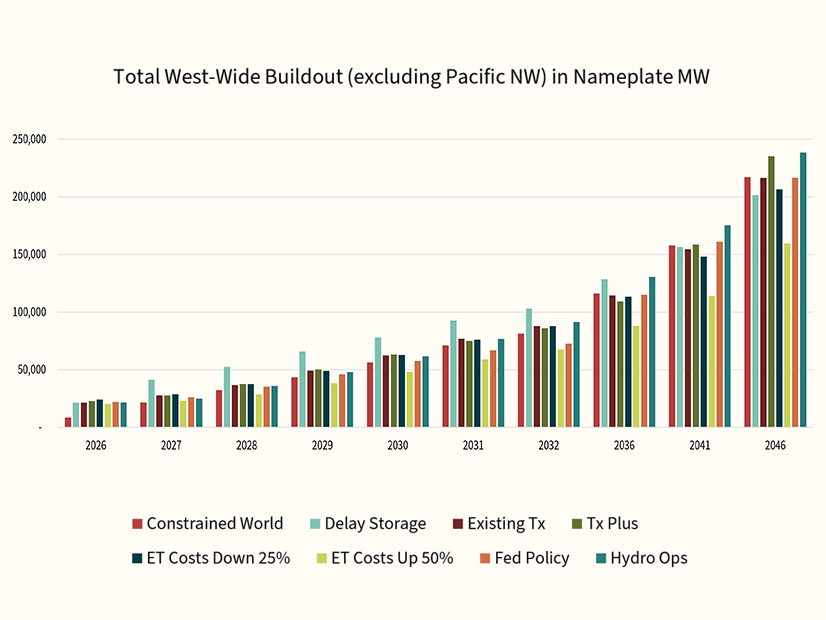

The market study evaluates out-of-region load growth and resource buildouts in the West over the next 20 years under different scenarios, including constrained buildout, delayed storage availability, existing transmission, increased transmission, emerging technology cost uncertainty, federal policies and hydro operations.

The study found that “market availability does not change significantly across the various sensitivities,” according to council presentation slides.

Though near-term buildouts of resources shift slightly, primarily where there are limitations in resource availability, the 20-year buildouts are “remarkably similar.”

“In other words, there isn’t something so disruptive in one of the sensitivities that we’re seeing a major change in trajectory,” said John Ollis, manager of planning and analysis.

Ollis noted some variation among the scenarios in the pace of uptake of certain types of resources. For example, delays in short-duration storage increase variable energy resource (VER) build by more than 20% and gas build by 25% by 2032, but they decrease VER by 25% by 2046, according to the presentation.

The study found expansion of gas resources under scenarios in which transmission builds are limited, resource acquisition is delayed or emerging tech costs are high.

The majority of resources built across all sensitivities are a mix of renewables, storage and gas. Demand growth and carbon pricing policies in California, Washington and Canada are key drivers for buildout, according to the study.

The market study helps power planners better understand the economics and resource adequacy issues underlying the power plan, Peter Jensen, a spokesperson for the council, told RTO Insider.

On the economics issue, Jensen said, “Even though we only plan for the region, the economics of every regional resource decision depends not just on the regional market fundamentals and policies, but on the market fundamentals and policies throughout the WECC.”

Similarly, “even though resource adequacy depends primarily on regional resources, understanding what resources might be available outside the region during stressful times is also important for informing adequacy and keeping rates down,” Jensen added.

On Nov. 5, the council’s System Analysis Advisory Committee — which includes regional utilities, Bonneville Power Administration staff, regulators and technical experts — reviewed the market study’s results.

“We had an opportunity to gut-check the size of the build, size of investments, risks and other key findings, and the committee members were broadly comfortable with the results,” Jensen said. “We appreciate the opportunity to collaborate and check the assumptions and results of our analysis with these experts as we continue to develop the Ninth Plan.”

The council aims to have a draft of the Ninth Plan ready for public comment by July 2026, and a final version by the end of 2026.