A new report examines CAISO, MISO, PJM and SPP efforts to accelerate interconnection queues and concludes that while some may succeed in speeding generation additions, some sacrifice fairness, transparency and open-access principles.

Early evidence suggests these emergency mechanisms produce portfolios heavily weighted toward thermal resources that potentially face high network upgrade costs, according to the analysis performed by Grid Strategies for the American Council on Renewable Energy.

The ACORE report warns that these programs are labeled as one-time measures but could be extended or repeated. Instead of that, the authors urge a long-term strategy that upholds open access and competition, and they propose two paths to this goal:

-

- An Enhanced Readiness Fast Lane — a narrowly tailored, transparent pathway for projects that address verified near-term reliability needs, activated only under specific conditions and governed by transparent, objective and nondiscriminatory criteria.

- Proactive Integration with Transmission Planning — a restructured baseline queue that aligns project intake with available and planned transmission capacity, using scoring systems to prioritize commercially ready and policy-aligned resources.

ACORE released “Interconnection Queue Rationing Reforms” on Nov. 25. The authors acknowledge that while priority interconnection processing can be designed to uphold the open-access principles that are the cornerstone of competitive wholesale energy markets, many such efforts fail to meet this ideal.

“Discriminatory queue processing undermines fair competition among technologies and interconnection customers,” they write, “introducing regulatory uncertainty that ultimately harms consumers.”

The report drills down on four efforts:

-

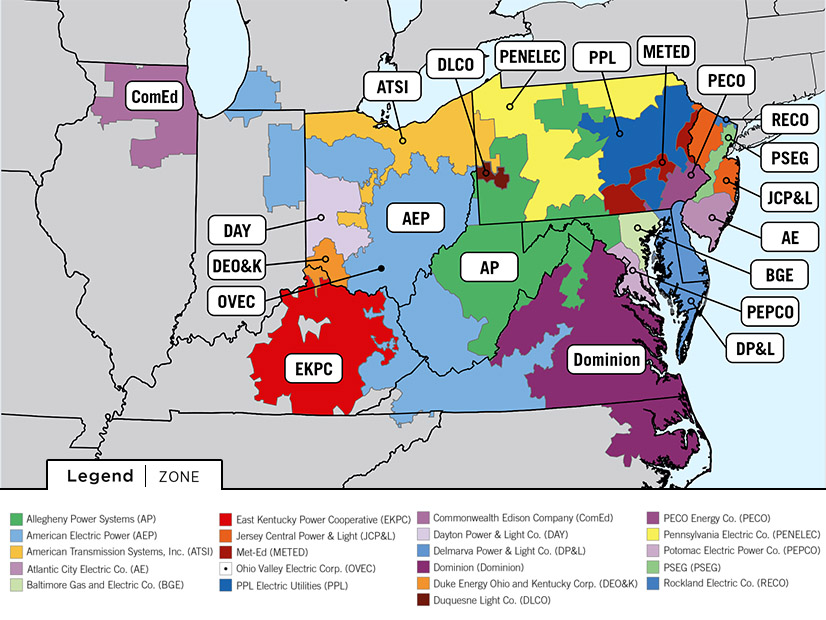

- CAISO’s Interconnection Process Enhancements;

- MISO’s Expedited Resource Addition Study;

- PJM’s Reliability Resource Initiative; and

- SPP’s Expedited Resource Adequacy Study.

All were implemented after FERC Order 2023 directed a shift from the first-come, first-served approach to queue management to first-ready, first-served.

The driving factors for the changes are well known: The U.S. interconnection queue has grown to more than 2.3 TW of potential capacity, interconnection timelines have grown to more than five years on average and fewer than 20% of queued projects reach commercial operation. Meanwhile, power demand is expected to grow significantly, costs are increasing and the supply chain to build all this capacity is bottlenecked in places.

The authors say Order 2023 produced only modest changes, but early evidence suggests grid operators’ reforms beyond the order have begun to streamline and speed queue processing, and show great promise.

The authors take a critical view of the emergency rationing mechanisms being implemented and say the RTOs and ISOs should give their reforms enough time to work before resorting to emergency measures.

“Queue rationing mechanisms like these should not become the default operating model or a substitute for comprehensive reforms,” the report states. “As a guiding principle, grid operators should exhaust all other alternatives that make the standard interconnection queue more effective before invoking new emergency rationings.”

Rationing measures are drawing legal challenges, with environmental groups recently filing suits against the MISO and SPP processes in the D.C. Circuit Court of Appeals, arguing the programs are unjustly preferential by allowing primarily fossil fuel generation to jump queues while ratepayers are billed for the upgrades needed to accommodate it. (See Enviros Challenge MISO, SPP Queue Express Lanes.)

The authors draw a distinction between the temporary fast-track programs MISO, PJM and SPP adopted and the permanent restructuring CAISO undertook.

CAISO’s changes were not without controversy, they write, but “on balance, CAISO’s IPE represents one of the most comprehensive queue reforms among system operators to date.”

Nonetheless, timelines remain extended, the percentage of projects advancing remains low and transmission constraints continue to strand low-cost energy potential.

“The upcoming refinements under IPE 5.0, particularly around energy-only conversion, long lead-time upgrades and equitable scoring oversight, will determine whether CAISO can transform this framework into a sustainable, scalable model for integrating the volumes of clean energy required to meet California’s 2030 and 2045 goals,” the authors write.