FERC on Tuesday approved PJM’s revised schedule for the upcoming Base Residual Auctions (BRAs), incremental auctions and associated pre-auction deadlines through the 2026/27 delivery year (EL19-58).

PJM’s updated schedule proposed conducting the 2022/23 third incremental auction (IA) beginning on Monday, as scheduled, and continuing to use the forward-looking energy and ancillary services (E&AS) offset, as it was used in the 2022/23 BRA.

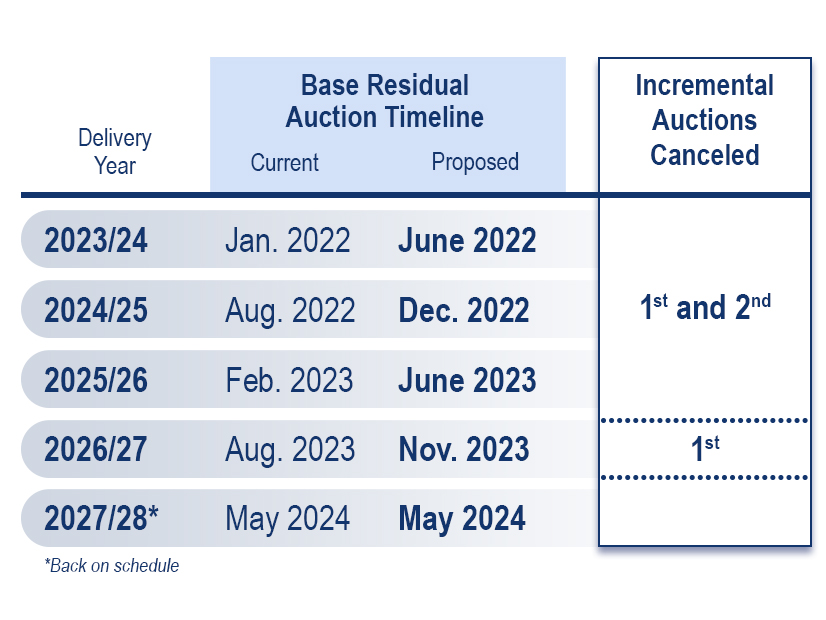

The 2022/23 BRA, originally scheduled for January, will now take place on June 8; the 2024/25 BRA moves from August to December; the 2025/26 auction moves from February 2023 to June 2023; and the 2026/27 auction moves from August 2023 to November 2023. The 2027/28 BRA will be back on schedule in May 2024.

The first and second IAs are canceled for the 2023/24, 2024/25 and 2025/26 BRAs, and the first IA is canceled for the 2026/27 BRA.

In a remand order issued Dec. 22, FERC reversed its approval of PJM’s forward-looking E&AS offset. The commission said PJM must now revert to the previous, backward-looking offset. (See FERC Reverses Itself on PJM Reserve Market Changes.) The commission said it recognized PJM would need to delay the BRA to implement a revised E&AS offset, a key variable in calculating the net cost of new entry for resources in capacity auctions.

In the remand order, the commission directed PJM to submit a compliance filing proposing a new schedule for the 2023/24 delivery year and subsequent BRAs. PJM updated the schedule in the middle of January and made an official filing on Jan. 21. (See PJM Reveals Preliminary Capacity Auction Timeline.)

On Tuesday, FERC said it found that PJM complied with its directive by filing an appropriate revised schedule and that it included “sufficient justification” for the schedule.

“PJM reasonably minimizes the delay of the 2023/24 BRA by proposing to revise only pre-auction deadlines impacted by the E&AS offset revision and the general delay of the auction, which necessitated the use of an updated load forecast,” FERC said in its order. “PJM also reasonably proposes to allow capacity market sellers to update only the E&AS offset portion of their unit-specific requests. We agree with PJM that this approach will allow for administrative efficiencies by not requiring duplicative information to be resubmitted, potentially allowing PJM to avoid unnecessary delay.”

The commission agreed with PJM’s proposal to eliminate some of the IAs. It also said it found it “reasonable” for the RTO’s proposal to retain limited discretion of up to 10 business days to set the specific deadlines associated with any pre-auction activities.

“We agree with PJM that it would be cumbersome and administratively inefficient to seek further amendments to the auction timelines for minor adjustments to the deadlines,” FERC said in its opinion. “However, we recognize PJM’s commitment to post the specific dates of pre-auction activities no later than eight months prior to the commencement of any associated BRA in order to ensure that all market participants are aware of the relevant deadlines.”

Danly Concurrence

In a separate concurrence, Commissioner James Danly said he agreed with the updated schedule, stating that PJM’s capacity auctions “have been delayed for far too long.” Auctions that have historically been looking three years ahead “have had their periodicity reduced to a year or less,” he said

Danly said the commission in its role as regulator “bears most of the blame for the sorry state of PJM’s auction schedule,” but he also faulted the RTO for the auction delays. He said PJM’s filing made to “eviscerate its minimum offer price rule” in the summer and another auction delay it requested in September contributed to the limited timing of the auctions.

“This last delay is particularly galling,” Danly wrote. “Given its role in causing and requesting auction delays, PJM’s call for the commission to ‘expeditiously’ and ‘promptly issue an order and provide much needed market certainty’ is … brazen.”