Members of the Organization of MISO States have sent a letter to contradict aspects of NERC’s Long-Term Reliability Assessment, disputing the ERO’s label of MISO as being at “high risk.”

State regulators in MISO said NERC should have counted resources in MISO’s fast-track interconnection queue in assessment totals.

MISO was branded high risk in the near term by NERC in its 2025 LTRA, along with PJM, ERCOT and northern portions of WECC. (See NERC Warns of ‘Worsening’ Resource Adequacy Through 2035.)

Organization of MISO States President Michael Carrigan, of the Illinois Commerce Commission, sent the letter to NERC CEO James Robb on behalf of “several” other OMS member states concerned about MISO’s designation in the LTRA. The letter was not considered a statement from the OMS Board of Directors.

Carrigan wrote that MISO’s generator express lane — “developed collaboratively by state regulators, MISO and stakeholders” — is well underway, “and it is expected to address emerging capacity needs in the near to medium term.”

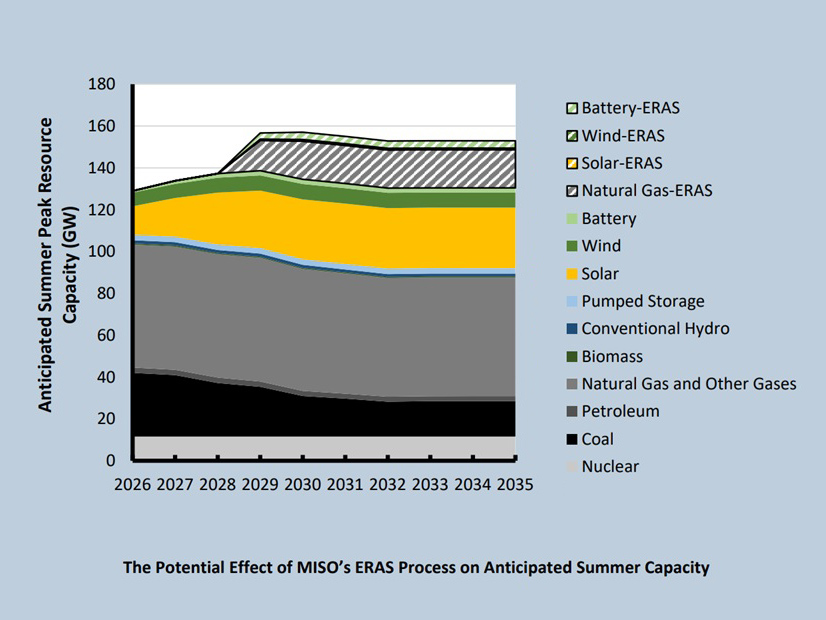

MISO has more than 11 GW of natural gas generation and battery storage proposals in the first two cycles of its expedited interconnection queue that are set to come online by mid-2028. The grid operator will accept more projects throughout 2026. (See MISO Accepts 6 GW of Mostly Gas Gen in 2nd Queue Fast Lane Class.)

At a Feb. 4 MISO Advisory Committee meeting, OMS Executive Director Tricia DeBleeckere said OMS members aired concerns “most importantly because the report did not include” projects in the queue fast lane. She said the expedited generation should neutralize the 7-GW shortfall NERC expects to materialize in winter 2028.

NERC has acknowledged its model didn’t include MISO’s expedited generation proposals. It said if the projects arrive as promised, a projected reserve margin shortfall “would be eliminated.” MISO expects about 8.6 GW more of winter on-peak capacity to reach operation by 2028/29 through the expedited queue.

Per NERC’s assessment, MISO is due to experience a net loss in natural gas units by 2030. MISO’s queue fast lane is comprised mostly of natural gas-fired additions.

‘Red’ Again

OMS continued to voice dissatisfaction with NERC conclusions at a Feb. 6 meeting dedicated to resource adequacy.

“MISO continues to be red. But we think there’s a lot of work in the region … that’s changing the trajectory,” DeBleeckere said.

She said MISO and members “have concerns over the outputs” and that OMS representatives have been in communication with NERC officials since the release of the assessment.

DeBleeckere said there’s a difference between MISO and members carefully crunching reserve margins and “heading toward a stop sign that we’re not going to stop at.”

She said she understands NERC must impose a cutoff on its data to begin working on the assessment.

“But this was such a big piece for us,” she said of MISO’s formation of the interconnection fast lane.

NERC’s inclusion of a sidebar in the report indicates NERC realizes the generator fast lane will mitigate risk, DeBleeckere added. She said MISO’s largely vertically integrated utility model would not allow “massive amounts of load that is un-resourced.”

OMS is meeting with MISO and NERC representatives to understand “the math that goes into the models that produce these results,” DeBleeckere said. She said NERC’s perceived risk of a shortfall by winter 2028/29 clashes with MISO’s summer-peaking conclusions from loss of load studies and that NERC’s interpretation might be one of an array that could be drawn.

DeBleeckere said there may be a “translation issue” between the way utilities plan their resources and how NERC draws its conclusions.

OMS believes there could be issues with the reference margin levels NERC uses in the LTRA, which assume risk only in summertime. NERC’s winter reference margin levels use a one-event-in-100-years assumption.

MISO uses varying seasonal requirements to account for risks. For the 2026/27 planning year, MISO found a slight loss of load risk in all winter months, leading it to use a 0.014 days/year risk — roughly equivalent to one day in more than 70 years — in its loss of load expectation study.

Interestingly, NERC determined MISO would maintain resource sufficiency in summers through 2029, even with an added 10 GW of load growth and a peak demand drifting upward to 138 GW.

Wisconsin Public Service Commissioner Marcus Hawkins said he wanted MISO, members and regulators to focus on the anticipated summertime performance.

“That is wildly impressive in this assessment, so I don’t want this to get lost among the concerns,” Hawkins said.

Bill Booth, a consultant to the Mississippi Public Service Commission, asked how results would be used and which outcomes they could influence.

DeBleeckere said beyond the report “hitting hard” in the press, the U.S. Department of Energy has used NERC assessments to justify keeping generation online in emergency 202(c) orders.

“It also can certainly work its way into state dockets,” Hawkins added.

Booth predicted reacting to the report would involve “damage control.”

‘Already Proactively Addressed’

Meanwhile, Carrigan noted in his letter that most utilities in MISO and state commissions coordinate to anticipate demand growth, retire generation and plan new generation through integrated planning approvals. He said reliability is handled “holistically” in MISO.

“[S]tate regulators, regulated utilities and MISO are actively engaged in identifying and mitigating evolving risks and have well-established tools to do so, as we have been doing for decades. Many risks highlighted in the assessment have already been proactively addressed in the MISO region, for example, by establishment of winter planning requirements,” Carrigan wrote.

Carrigan added that NERC treats planned retirements and load additions as certainties, while replacement generation is branded uncertain until the projects traverse regulatory, interconnection or market prerequisites.

“Utilities and regulators are aware of evolving system needs and have been, and will continue to be, actively engaged in taking corrective planning and regulatory actions to maintain reliability,” Carrigan wrote.

Carrigan said OMS’ well-established resource adequacy survey in conjunction with MISO often predicts shortfalls years down the road, similar to the LTRA. But he said the OMS-MISO survey’s “out-year uncertainty is a structural feature of planning-based jurisdictions and is routinely managed through coordinated utility planning, regulatory oversight and market and policy actions, well before reliability could be affected.”

Carrigan recommended NERC incorporate MISO’s longstanding planning processes and work from its collection of jurisdictions to moderate LTRA results. He said more balanced results could help dodge “disproportionate economic or policy consequences driven by out-year risk signals.”

“In MISO, the balance of state regulatory oversight, utility obligations and market mechanisms is intentionally designed to moderate risk and ensure timely corrective action,” Carrigan wrote.

Southern Renewable Energy Association Executive Director Simon Mahan said NERC’s “maps of doom” aren’t helpful and that MISO’s results in the assessment are “head-scratching.” Mahan said NERC’s inputs are outdated by the time it publishes the report, evidenced by the missing expedited resource additions.

“These maps are already being teed up in legislative hearings, regulatory filings and media articles as justification for: bypassing competitive procurement; fast-tracking utility self-build projects; locking in long-lived fossil investments; and sidelining lower-cost clean energy resources,” Mahan wrote in a reaction piece, adding that knock-on effects include rising gas prices and less-thought-out reliability.

“People make decisions based on NERC reports, even if NERC attempts to dissuade just that,” Mahan said.

In 2025, the MISO community similarly found itself at odds over NERC’s risk interpretation in its LTRA. In that case, MISO’s Independent Market Monitor criticized NERC’s conclusion and pointed out an error.

NERC had used unforced capacity values for MISO when calculating a margin that it ultimately compared to an installed capacity requirement. After a back and forth between MISO and NERC, the reliability corporation ultimately downgraded MISO from “high risk” to “elevated risk.” (See IMM: NERC Reliability Assessment Still Overstating MISO Risk.)