Markets and Reliability Committee

Dead Bus Replacement Logic Changes Endorsed

PJM stakeholders unanimously endorsed changes to the dead bus replacement logic for assigning prices to de-energized pricing nodes (pnodes) at last week’s Markets and Reliability Committee meeting.

Vijay Shah, lead engineer in PJM’s real-time market operations department, reviewed revisions to Manual 11: Energy and Ancillary Services Market Operations designed to incorporate the changes that were introduced as part of a problem statement on five-minute dispatch and pricing in July 2020. (See PJM Stakeholders OK 5-Minute Dispatch Proposal.)

Vijay Shah, PJM | © RTO Insider LLC

Vijay Shah, PJM | © RTO Insider LLCPJM said the revisions are intended to provide increased transparency in the logic and how it performs replacements for de-energized buses. The RTO is required to produce LMPs for all pnodes in the RTO’s network model for all intervals, including those that are de-energized.

The new logic is based on Dijkstra’s algorithm, an industry standard, to find a suitable replacement for de-energized pnodes. The manual changes include updated language to reflect the new logic.

Shah highlighted a change to section 9.1.1: Intraday Offers Optionality that was not included in the first read at the December MRC, which clarifies language to state that a generation resource’s fuel-cost policy only needs to be updated when opting into intraday updates for the cost-based schedule.

“We already had an ongoing effort to update the language in Manual 11, and we thought it would be good to include these changes as part of that,” Shah said.

The new dead bus replacement logic and manual revisions will take effect March 1.

Fuel-cost Policy Standard Clarifications Endorsed

Members unanimously endorsed a joint PJM/Independent Market Monitor proposal regarding fuel-cost policy standards and penalty language.

Melissa Pilong, senior analyst in PJM’s performance compliance department, reviewed the proposal clarifying fuel-cost policy standards in Manual 15 and Schedule 2 penalty language of the Operating Agreement. The proposal was endorsed at the December Market Implementation Committee meeting. (See “Fuel-cost Policy Standards Proposal Endorsed,” PJM MIC Briefs: Dec. 1, 2021.)

The changes would require that generation unit market sellers verify that all intraday offer triggers are specified in the unit’s fuel-cost policy. The Manual 15 updates include changes to the intraday update triggers. Pilong said market sellers would need to have a one-time trigger to update the maximum allowable cost offer to opt into intraday offers. Another clarification to Manual 15 includes language that PJM or the Monitor can work with market sellers to extend their fuel-cost policies prior to their expiration.

OA updates include standards of review that must be systematic and verifiable. Fuel-cost policies would be required to provide a fuel price that can be calculated by the Monitor or PJM “after the fact with the same data available to the generation owner at the time the decision was made and documentation for that data from a public or a private source.”

The changes now go to the Members Committee for a vote this month and would take effect upon approval by the PJM Board of Managers and FERC.

Virtual CC Proposal Endorsed

Stakeholders unanimously endorsed a proposal from Vistra addressing regulation for virtual combined cycles.

Michael Olaleye, senior engineer with PJM’s real-time market operations, reviewed the proposal to revise Manual 12: Balancing Operations. The issue charge was originally endorsed at the May MIC meeting and worked on during committee meetings. (See “Virtual Combined Cycle Regulation Issue Charge Endorsed,” PJM MIC Briefs: May 13, 2021.)

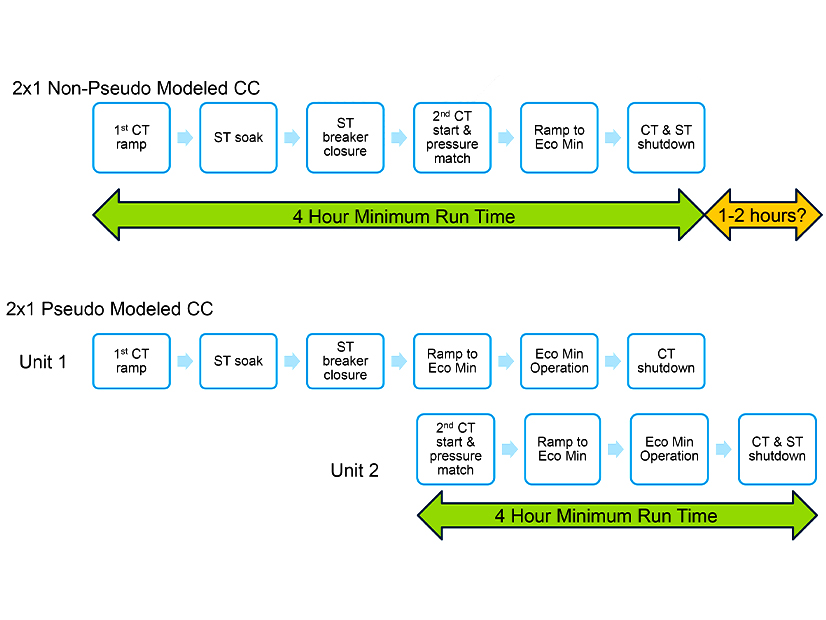

Units that are modeled virtually by PJM can sometimes receive varying regulation awards from the market clearing engine, Olaleye said, which Vistra has experienced with some of its units, calling it “operationally challenging.” When a combined cycle unit is modeled as multiple virtual units, there is a possibility for unbalanced or unequal regulation awards to each unit by the engine.

Vistra’s proposal calls for calculating the “hourly” score and extending it to each market resource with an assigned regulation for the given hour. It also called for PJM to calculate the “historic” performance score and extend it to each market resource in the performance group.

Olaleye said the changes would ensure that all resources of the performance group have the same historic performance score, which should fix the regulation clearing calculation problem in the software.

“The proposal is not changing the process of regulation clearing, pricing or settlement,” Olaleye said.

PJM plans on implementing the changes beginning March 1.

Consent Agenda

In the MRC consent agenda, members unanimously endorsed revisions to Manual 38: Operations Planning resulting from a periodic review. The revisions were originally endorsed at the Jan. 13 Operating Committee meeting and included minor changes. (See “Manual 38 Revisions Endorsed,” PJM Operating Committee Briefs: Jan. 13, 2022.)

Members Committee

Sector Selection Challenge Proposal Fails

Stakeholders rejected a proposal at last week’s Members Committee meeting seeking to change the way challenges can be made to sector selections in PJM.

The proposal, brought forward by Exelon and Public Service Enterprise Group from the Stakeholder Process Forum, received 45 votes in favor for a sector-weighted vote of 2.2, failing to meet the 3.33 threshold.

Sharon Midgley, Exelon’s director of wholesale market development, reviewed the proposed OA revisions. Several stakeholders questioned the proposal at the December MC meeting. (See “Sector Selection Challenge Process,” PJM MRC/MC Briefs: Dec. 15, 2021.)

The issue of sector challenges has been a source of discussion at the Stakeholder Process Forum for the last 18 months. In 2020, Exelon and FirstEnergy requested that PJM more actively police stakeholder selections after the disclosure that an LS Power affiliate was improperly voting in the RTO’s senior committees. (See Exelon, FE Ask PJM to Tighten Sector Selection Process.)

Under current rules, Midgley said, “questionable” sector selections of an existing member may only be challenged one time per year, coming within 30 days of the Annual Meeting. Challenges to a new member’s sector selection must be made within 30 days of the member joining PJM.

In the last three years, Midgley said, PJM required changes to the sector selections of 14 members, determining that a sector modification was warranted for 88% of challenges.

“Our goal is to make sure going forward that we ensure the integrity of sector-weighted voting at PJM,” Midgley said.

The proposed solution called for revising section 8.1.3 of the OA to say that any member may request that PJM review the qualification of another member to participate in a sector “if the basis for such challenged member’s qualifications have not been subject to a sector challenge review in the prior 24 months, unless there is a good faith assertion of a material change in the challenged member’s active and significant business interests with PJM.”

The revised language also called for removing the 30-day requirement from the Annual Meeting. Midgley said the requirement can be “challenging” for stakeholders to do “proper investigative work” on a sector challenge.

Susan Bruce, counsel to the PJM Industrial Customer Coalition, said the ICC was “not in a position to support” the proposal. She noted that it takes “significant time” to go through the sector selection process. “I think there’s value in having the orderly progression of having it be done once per year,” she said.

Greg Poulos, executive director of the Consumer Advocates of the PJM States, said he could see the arguments in expanding the sector challenge process to any time, but he said he had “broader concerns” after talking to his members about the proposal. Poulos said he is concerned that there could be “cherry picking” in what PJM members are selected for a sector challenge.

“It’s too limited and too narrow in the approach,” Poulos said.

After the vote failed, Midgley said Exelon and PSEG were “disappointed by the outcome.” A lack of a framework to allow stakeholders to appeal a sector selection on a “timely basis” can result in “inaccurate sector-weighted voting outcomes,” she said.

Consent Agenda

Stakeholders endorsed two different items on the MC consent agenda. They included:

- tariff and OA revisions addressing several aspects of market participation by solar-battery hybrid resources. The revisions were unanimously endorsed at the Dec. 15 MRC meeting. (See “Solar-battery Hybrid Resources Endorsed,” PJM MRC/MC Briefs: Dec. 15, 2021.)

- tariff and OA revisions addressing synchronous reserve deployment. The proposal, which was developed from discussions in the Synchronized Reserve Deployment Task Force (SRDTF), is meant to improve the deployment of synchronized reserves during a spin event. (See “Synchronous Reserve Endorsed,” PJM MRC/MC Briefs: Dec. 15, 2021.) The proposal was endorsed with 18 objections.