The early impacts of PJM’s first capacity auction in three years began to emerge Thursday as Exelon reiterated plans to retire two of its nuclear plants, even as cleared nuclear capacity increased by more than 4,000 MW across the RTO.

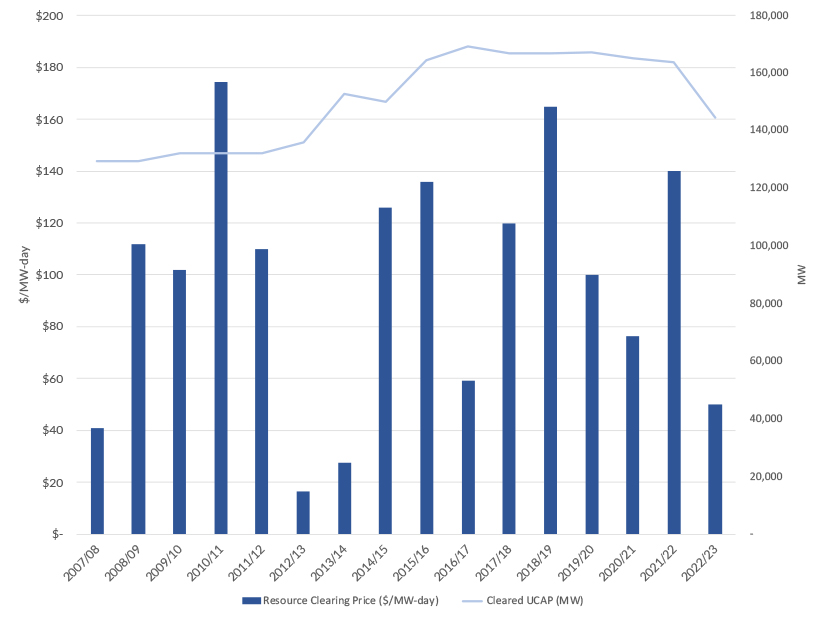

The long-delayed auction was the third in which PJM procured only Capacity Performance resources and the first applying the expanded minimum offer price rule (MOPR) to state-subsidized resources. At $50/MW-day, the RTO resource clearing price for 2022/23 was the lowest since 2013/14, and well below the $90 to $110 range Morgan Stanley had predicted in May. (See Capacity Prices Drop Sharply in PJM Auction.)

With the departure of Dominion Energy Virginia from the auction, fixed resource requirement (FRR) elections were the second-highest ever at 33.3 GW. FRR commitments increased by 19.6 GW, nearly equal to the 20.2 GW reduction in capacity offered. (See Dominion Opts out of PJM Capacity Auction.)

“PJM’s capacity bill will drop from $9.3 [billion] in 2021 to $3.9 [billion] in 2022. $1.1 [billion] of that drop is from Dominion FRRing out,” tweeted Tom Rutigliano of the Natural Resources Defense Council. “Still, saving $4.2 billion in unnecessary payments to fossil plants isn’t bad.”

Changing Fuel Mix

Cleared coal generation dropped by 8,175 MW, adjusted for FRR plans.

Nuclear generators cleared an additional 4,460 MW compared to the last auction, adjusting for FRR elections. But Exelon (NASDAQ:EXC) reported in a Thursday filing with the Securities and Exchange Commission that its three units in the ComEd region — Byron (2,347 MW), Dresden (1,845 MW) and Quad Cities (1,403 MW) — failed to clear the auction.

Exelon already announced in August that it intended to prematurely close the Byron and Dresden plants this fall. (See Exelon to Close Ill. Nukes as Gov. Touts Clean Energy Plan.) Exelon said it will continue operating Quad Cities because of state subsidies provided under the Illinois Future Energy Jobs Act. The company said those same subsidies that subjected it to the MOPR prevented the plant from clearing.

“The result is that customers in Northern Illinois and throughout PJM will pay for more capacity from polluting generation instead of securing carbon-free megawatts from Quad Cities, at what would have been a lower cost absent the MOPR,” Exelon said.

Exelon’s Braidwood and LaSalle nuclear plants were able to clear the capacity auction, the company said, but also face premature retirement “due to unfavorable market rules that favor emitting generation.” The company said a commitment to operate the two plants through May 2023 will provide a window for the logistical and technical planning necessary “to ensure a safe and orderly retirement in the event policy changes are not enacted.”

Exelon has been lobbying the Illinois legislature for years to provide support to its nuclear plants in the state. Media reports indicate Gov. J.B. Pritzker struck a deal late last month to charge ComEd customers more to support the Dresden, Byron and Braidwood nuclear plants, but details of the deal have yet to be officially made public.

Vistra (NYSE:VST) said in a press release it had cleared 7,218 MW at a weighted average price of $66.89/MW-day for a total of $176 million. “Including Vistra’s incremental revenue of $55-$60 million from existing retail bilateral sales above the capacity auction clearing price, Vistra’s total revenues for the period as of June 2, 2021 are approximately $231-$236 million,” it said.

Renewables had their biggest incremental increases ever in 2022/23, with wind adding 355 MW of new capacity and uprates and solar adding 1,491 MW. But they were still dwarfed by natural gas, which represents about three-quarters of all additions. Combined cycle plants added 5,943 MW and combustion turbines added 688 MW.

Generation’s success in clearing the capacity auctions has dropped from near 100% to below 90% as demand response and energy efficiency have played larger roles. But generation still represents 91% of capacity resources.

The auction showed a continuation of energy efficiency’s steady growth since 2014/15. Demand response was down, continuing its ping ponging between increases and decreases year-to-year.

Market Power

Another constant in the auction was the presence of market power. PJM said the RTO as a whole failed the three-pivotal supplier test, triggering market power mitigation for all existing generation resources. That limited offers by existing generation resources to their approved market seller offer cap (MSOC).

In March, FERC ordered PJM to revise the MSOC, siding with the arguments made in separate complaints filed in 2019 by the Independent Market Monitor and several consumer advocate groups (EL19-47). The Monitor said the MSOC has been inflated by the “unreasonable and unsupported” expectation of 30 performance assessment hours (PAHs) annually. (See FERC Backs PJM IMM on Market Power Claim.)

Market Monitor Joe Bowring said in an interview that he believes the MSOC issue allowed market power to be exercised in the latest auction, and plans on referring “a number of participants” to FERC as the commission requested in the March order.

Bowring said many dynamics influenced the clearing price, including a reduction in demand because of PJM’s reduced load forecast and an increase in transmission into key areas like ComEd and PSEG. He said Dominion Energy Virginia’s choice of the FRR option also had a “downward effect on prices” for the rest of PJM.

Bowring said he expects to release a report on the auction results within a month.

‘No Urgency’ on MOPR Changes

Other PJM stakeholders urged the RTO and FERC to reconsider any hasty action on MOPR reforms, saying the auction results showed the competitiveness of renewable resources in the market.

Todd Snitchler, CEO of the Electric Power Supply Association (EPSA), said the results of the capacity auction provided several key takeaways, including “no urgency to rush additional reform” of the MOPR. Snitchler said EPSA has advocated that PJM run auctions under the current MOPR rules to see the results before making dramatic changes.

Snitchler said the results of the latest capacity auction demonstrate PJM’s current path to eliminate the MOPR doesn’t have to be rushed and that stakeholders have time to “holistically address market reforms.” He said a well-designed approach to reforms can ensure that reliability is maintained while costs are affordable and carbon emissions goals are accomplished.

“The application of the MOPR did not raise prices for PJM consumers,” Snitchler said. “Nor did the application of the MOPR provide a financial windfall to fossil generators. Today’s results can, at long last, put an end to speculation — from all sides — about market outcomes.”