CARMEL, Ind. — MISO said Wednesday that a sloped demand curve applied to its recent seasonal auction would have boosted summer clearing prices as much as sixfold, better reflecting the footprint’s tapering supply.

Staff said their internal analyses showed that a seasonal systemwide sloped demand curve would have cleared the Midwest region at $65.50/MW-day in the summer, $25.90/MW-day in the fall, $5/MW-day in the winter and $19.10/MW-day in the spring. MISO South would have cleared at $25.70/MW-day (summer), $25.90/MW-day (fall), $5/MW-day (winter) and $19.10/MW-day (spring).

The subregional transfer constraint between the South and Midwest would have bound and resulted in price separation for the summer season, MISO said.

The RTO is on a mission to design and implement downward-sloping demand curves by its 2025/26 capacity auctions. It’s aiming to have a FERC filing ready sometime in the third quarter. (See MISO Charts Course on Capacity Auction’s Sloped Demand Curve.)

The grid operator said the 2023/24 auction would have cleared 137.7 GW systemwide for the summer with a sloped demand curve, 3.6% beyond its 132.9-GW planning reserve margin requirement. In other seasons, the auction cleared 0.8% above the PRM requirement (spring and fall) and 2% (winter).

The 2023/24 planning resource auction cleared most of its subregions at $10/MW-day (summer), $15/MW-day (fall), $2/MW-day (winter) and $10/MW-day (spring). (See 1st MISO Seasonal Auctions Yield Adequate Supply, Low Prices.)

During a Resource Adequacy Subcommittee meeting Wednesday, MISO’s Mike Robinson said that the nearly 4.7 GW in excess capacity from this year’s auction in MISO Midwest does have incremental value, though the current vertical demand curve has no way to appraise it.

“Prices have crashed because we’re a little long. Prices have gone from the highest price possible last year to $10/MW-day this year,” he told stakeholders.

MISO said its current capacity auction design “does not facilitate the investment and retirement decisions necessary to maintain the resources to meet system reliability.”

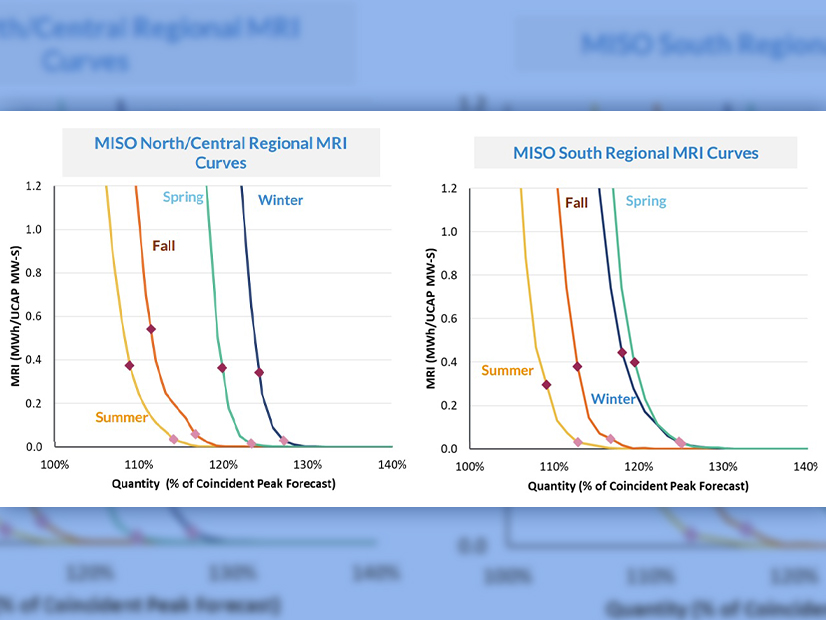

The grid operator intends to base its sloping demand curves on separate seasonal reliability targets for the Midwest and South auctions. Its analyses have only shown an incremental capacity value for capacity procured beyond the season’s reliability target in summer. Robinson said the summer value is a “reflection of assignment of risk.”

To formulate sloped demand curves, MISO will run studies using the net cost of new entry (CONE), or an approximated revenue requirement from capacity payments. To do this, MISO is using three years of historical data to calculate inframarginal rents that cover generators’ fixed costs. Net CONE is calculated by subtracting inframarginal rents from CONE and will be used to influence the curves’ final shape.

MISO said the Midwest’s net CONE averages $73,200/year (about 71% of CONE) and the South averages $58,500/year (about 62% of CONE).

Robinson said staff are hoping to lock in the demand curves’ shape for three to four years at a time, periodically re-evaluating them to reflect the changing resource mix.

“Can we set up an auction design where asset owners can cover their costs?” Robinson asked hypothetically. “But we don’t want to over-procure. We want to do this judiciously.”

Bill Booth, a consultant to the Mississippi Public Service Commission, said the auction has little financial impact on vertically integrated utilities. He said bilateral contracts are a better measure of capacity value.

“Don’t think that these signals are going to stop someone who wants to retire a coal plant from retiring it,” Booth said.

Michelle Bloodworth, CEO of coal trade group America’s Power, argued that increased revenues in MISO’s auction might make a difference to owners of existing thermal plants.

“We do believe that the auction results reflect this year. However, the long-term trend of depleting resources continues to play out,” Durgesh Manjure, MISO’s senior director of resource adequacy, said.

Manjure said that by dividing capacity procurement into seasons this year, MISO spread risky times into separate seasons and lowered PRM requirements. He said this year’s annual requirement was 7.4% on an unforced capacity basis, compared to 8.7% last year.

The RTO is also proposing to include an opt-out provision from the sloped demand curve for market participants.

Robinson said that while MISO is “trying to craft more reasonable” auction outcomes to reflect excess capacity’s incremental value, it also must respect states’ rights to resource adequacy.

MISO plans to require load-serving entities opting out of the curve to meet a capacity requirement that relies on the PRM requirement plus an additional, yet-to-be-determined percentage likely ranging from 1.5 to 3%. The RTO has proposed that LSEs opting out of the curve do so for three years at a time.