MISO resource adequacy staff are considering multiple options in the RTO’s effort to implement a sub-annual capacity mechanism and define new reliability criteria.

MISO has said it could define unique seasonal system reliability requirements as a bulwark against its increasing emergency events outside summer months. The RTO’s analyses indicate an emerging wintertime loss-of-load risk. MISO said it could be in the position of facing a winter peaking situation when electrification picks up in 2035 and beyond.

The shift could prompt MISO to issue a sub-annual reserves requirement based on a seasonal resource adequacy construct.

Stakeholders attending a virtual Resource Adequacy Subcommittee meeting Oct. 7 asked if MISO would run a Planning Resource Auction (PRA) four times per year.

MISO Director of Research and Development Jessica Harrison said several options are under consideration, including an annual construct that reflects sub-annual needs, one annual auction with seasonal or monthly segments, multiple seasonal auctions or monthly auctions across the planning year.

MISO is also exploring the use of additional risk assessments beyond loss of load, including the expected unserved energy calculation, where MISO calculates the expected amount of energy when load is set to exceed generation.

Senior Manager of Resource Adequacy Coordination Lynn Hecker said there could be additional “administrative burden” on MISO and its members if it develops separate planning reserve requirements and resource accreditations for each season.

“That’s really on the MISO to-do list, to get a better idea of what — if any — administrative burden … the proposed construct options might create,” she said.

If MISO moves to a sub-annual version of the capacity auction, Hecker said it would reduce its focus on summer peak modeling and forecasting in favor of pinpointing multiple loss of load risk hours throughout the year, called resource adequacy hours. RA hours would likely occur in summer and winter.

Harrison said MISO must decide if it should rely more on forward-looking projections or historical data to establish accreditation and reserve requirements using resource adequacy hours.

“In a time of slower-paced change, that’s reasonable; in a time of fast-paced change, that’s less reasonable,” she said of historical data being a predictor of system conditions.

Seasonal capacity auctions might give way to more seasonal economic outages, MISO and members said.

Harrison said MISO will be mindful of a seasonal auction’s possible effect of corralling too many generation outages into shoulder seasons. The RTO might consider must-offer obligations on capacity resources for each sub-annual period.

“The more granular we go, the more complex it will be to implement,” Hecker said.

The State Authority Quandary

The possibility of new reliability requirements has MISO and members probing the complicated relationship between MISO and state authority.

Some stakeholders have said that a move toward additional reliability criteria could infringe on state jurisdiction over resource adequacy and that MISO’s existing annual local clearing requirements and planning reserve margin are sufficient for reliability needs. (See MISO Closer to Seasonal Capacity, Reliability Reqs.)

To date, no states have ever requested that MISO increase or decrease a planning reserve margin, said MISO Managing Assistant General Counsel Michael Kessler.

The MISO Tariff stipulates that states have the authority to supersede the RTO and set their own planning reserve margins, but they cannot change MISO’s local reliability requirements or local clearing requirements. MISO would have to incorporate a state-set planning reserve margin into its planning resource margin requirements if it received a special state margin figure for a set of jurisdictional utilities. The Tariff also prohibits MISO from developing a resource adequacy requirement that conflicts with “state reliability or safety standards.”

Kessler said there’s “no other entity … than a state authority” that can alter MISO’s planning reserve margin requirement.

Some stakeholders questioned why states wouldn’t also have at least some authority over local reliability requirements or local clearing requirements if resource adequacy is ultimately the states’ prerogative.

Six of MISO’s ten local resource zones include territory from two or more states.

“Our interpretation of the Tariff — our literal reading of it — is that states do not have the authority to create a different local reliability requirement other than the one established by MISO,” Kessler said.

If a state chooses to set a lower planning reserve margin, the local clearing requirement of a local resource zone would still apply, Kessler said, with MISO still responsible for procuring capacity up to the requirement. Costs of the extra capacity procurement would be uplifted to the entire MISO footprint.

WEC Energy Group’s Chris Plante asked whether states could use a different loss of load risk than MISO’s one-day-in-10-years standard. A state’s decision to rely on a two-days-in-10-years risk would seem to affect zonal clearing and reliability requirements, he said.

“We haven’t had to work through a scenario where some of these mechanics would apply,” Kessler said, adding that MISO could pursue a deeper legal analysis of interaction between the Tariff and state law.

Plante has noted that states already largely rely on MISO’s recommended margins to set their resource adequacy plans.

“I think states increasingly look to MISO to establish their reserve margins,” he said during a special Aug. 21 MISO teleconference to discuss resource availability.

Zone 7 Reliability Requirements Questioned

Stakeholders are expressing consternation over draft 2021/22 PRA reserve requirements. This year, MISO began factoring unavailable generation due to planned outages into its loss of load expectation (LOLE) modeling, resulting in higher local reliability requirements for almost all local resource zones.

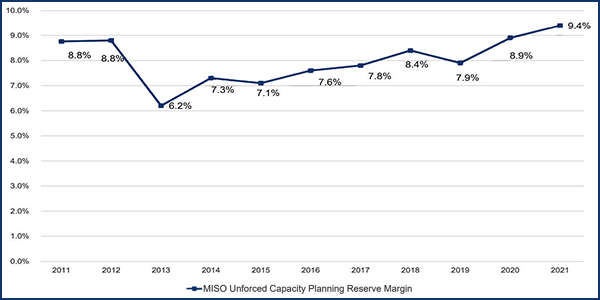

MISO is estimating it needs a 9.4% unforced capacity (UCAP) planning reserve margin, up from last year’s 8.9% figure. Translated into an installed capacity basis, MISO needs an 18.3% reserve margin requirement in 2021, compared with 18% last year. (See MISO Planning Reserve Margin to Climb in 2020.)

The need for more padding is the most dramatic in Lower Michigan’s Zone 7. Some stakeholders said it was unfair that a few individuals in MISO’s modeling group could have such an outsized impact on capacity requirements.

Customized Energy Solutions’ Ted Kuhn asked for “guardrails” in the LOLE modeling inputs process so members could expect more stability in the results.

MISO said its LOLE analysis showed that Lower Michigan runs the risk of more peak demand days in September than other local resource zones.

MISO plans to publish final LOLE results by Nov. 1.

For the 2020/21 planning year, Zone 7 cleared at a cost of new entry price of $257.53/MW-day, due in part to a new MISO rule banning capacity resources from taking extended outages. (See MISO: New Outage Rules Boosted Mich. Capacity Prices.)

MISO Independent Market Monitor David Patton said two resources in Zone 7 raked in a combined $154 million in the 2020/21 Planning Resource Auction despite being on outages over the entire summer.

“Those resources are effectively unavailable even though we pay them the same,” Patton said during an Oct. 8 Market Subcommittee conference call.

Patton said he has long calculated leaner capacity margins than MISO projects because of the RTO’s failure to incorporate outages into its capacity picture.

Meanwhile, Planning Adviser Davey Lopez said MISO’s short-term resource availability and need fixes were successful in freeing up an additional 5-10 GW in capacity over the past year, as planned.

MISO launched new Tariff rules early last year to introduce demand response capability testing, seasonal documentation of the availability of load-modifying resources and a 120-day notice period for planned generation outages. (See “Near-term Filings,” MISO to Continue Resource Adequacy Talks in 2019.) The rules were meant as a stopgap measure to buy the RTO more time to flesh out bigger ideas.

“We are striving to come up with longer term solutions. The first phase was intended to buy time,” Lopez said, adding that MISO must continue working on the longer-term PRA changes. “Capacity margins continue to erode.”