FERC on Thursday defended its April ruling approving bidding results in ISO-NE’s 2013/14 Winter Reliability Program as just and reasonable, expanding on its reasoning in response to a rehearing request (ER13-2266-005).

TransCanada Power Marketing’s request was automatically rejected when the commission failed to act on it within 30 days. FERC’s April order was prompted by a D.C. Circuit Court of Appeals ruling in December 2015 that directed the commission to provide additional justification for approving the rates. (See FERC Reaffirms ISO-NE Winter Program Cost.)

TransCanada had argued that ISO-NE’s pay-as-bid auction resulted in excessive costs because resources were incented to raise their bid prices knowing they would probably be accepted, but the commission ruled that the RTO’s Internal Market Monitor’s cost-based supply curve and a 25% adder used in the analysis were reasonable.

ISO-NE’s program procured reliability service from resources providing demand response and generators able to run on oil — a response to limited natural gas supplies that can leave gas-fired generators without fuel during peak winter heating demand.

In requesting rehearing, TransCanada claimed that the “only support” for the 25% upward adjustment was that the suppliers were “likely to adjust their bid prices upward to compensate” for their lack of knowledge regarding how other suppliers would bid in the market.

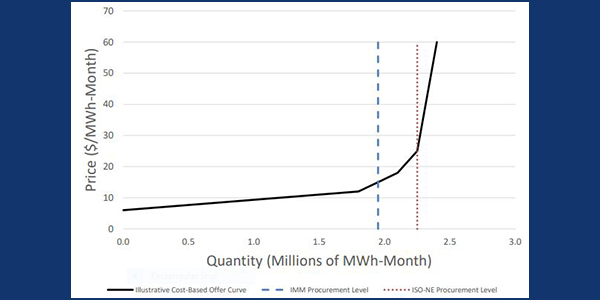

“This is incorrect,” the commission responded, saying it also considered analysis submitted by ISO-NE and its Monitor that included a cost-based offer curve (i.e., supply curve) that intersected with an expected procurement of 2.25 million MWh at a price of $24.86/MWh-month. “This adjustment revealed an expected clearing price of $31.08/MWh per month. Given that no accepted bids from the auction exceeded that price, the commission concluded that the accepted bids were reasonable.”

TransCanada also asserted that ISO-NE did not seek commission approval to administer the program as a competitive “oil inventory services” market, and that the commission failed to make an ex ante finding of the absence of market power.

“TransCanada’s attempt to invoke the commission’s market-based rate regulations in the instant proceeding is unavailing because the Winter Reliability Program does not fall within the rubric of the commission’s market-based rate program, and, contrary to TransCanada’s arguments, our use of a market-based paradigm to review the bids did not convert the bids and awards into transactions under our market-based rate program,” FERC said.

This case instead involved FERC’s analysis of the RTO’s bid and auction results from a one-time process created for the purpose of maintaining reliability during the 2013-2014 winter season, the commission said.

“Finally, we continue to find that a market-based analysis of the auction results is appropriate and is not indicative of any ‘post hoc rationalization,’ as TransCanada alleges,” the commission said.