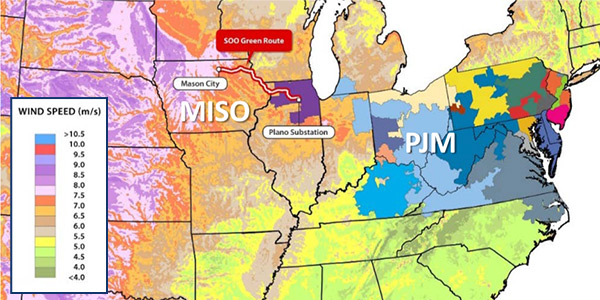

FERC on Thursday approved SOO Green HVDC Link’s request to charge negotiated rates on its proposed 350-mile, 2,100-MW transmission line, which the developers hope to use to deliver renewable energy from upper MISO to Illinois and the PJM grid (ER20-1665).

In June, PJM stakeholders agreed to consider integrating HVDC converters as a new type of capacity resource in the RTO at SOO Green’s request. (See HVDC Initiative Endorsed by PJM Stakeholders.)

The SOO Green line is planned to run underground, primarily along existing rail rights of way from Mason City, Iowa, to Plano, Ill. Construction is expected to begin in early 2022 and be completed by 2024.

SOO Green is owned 80% by Copenhagen Infrastructure III, 10% by Jingoli Power Transmission and 10% by Siemens Energy. None of the owners or their affiliates owns any other transmission facilities, except for generation interconnection facilities, the developers said. (A Jingoli affiliate owns less than 10% of a small cogeneration facility in Michigan, and Siemens holds a minority interest in a combined cycle generation facility near Cleveland.)

The developer has hired London Economics International to design an open solicitation process and serve as its independent evaluator.

SOO Green hopes to attract generators, marketers, load-serving entities and end-users to obtaining transmission capacity rights, either as “anchor shippers” or later through an auction. The “registered participants” can seek commercial arrangements on their own or ask to be matched with others by the independent evaluator.

FERC evaluates negotiated rate applications based on four factors: the justness and reasonableness of the rates; the potential for undue discrimination; the potential for undue preference, including affiliate preference; and regional reliability and operational efficiency requirements. The commission said its review takes into account its open-access requirements, the Federal Power Act and the “financing realities faced by merchant transmission developers.”

No one filed interventions or protests in response to SOO Green’s application.

The commission concluded that the developers will bear the full market risk of the project and have no ability to erect barriers to entry or incentive to withhold capacity because they will turn over operational control of the line to either MISO or PJM, which will operate it under its Tariff.

“SOO Green states that while it is currently in discussions with both MISO and PJM about the many operational issues involving the project, it is unclear at this juncture which RTO will ultimately have operational control of the project,” FERC said.

The commission conditioned its approval on SOO Green’s submission of a compliance filing after the open solicitation demonstrating that the allocation process was fair and transparent and consistent with the commission’s 2013 policy statement on allocation of capacity on new merchant transmission projects (AD12-9, AD11-11).