PJM’s Market Implementation Committee on Wednesday resumed its discussion on potential changes to how the RTO curtails generating output when needed to maintain stability during maintenance outages. Generating units must sometimes be reduced below their normal economic max limit if a planned or unplanned transmission outage presents stability problems that could result in damage to the units.

Current rules require the RTO to implement a thermal surrogate to reflect the stability constraint in the day-ahead and real-time markets and to bind the constraint, affecting the unit’s dispatch.

The MIC agreed in August to consider alternative approaches in response to a problem statement and issue charge by Panda Power Funds’ Bob O’Connell, who said PJM’s decision to remove supply from the market to address stability constraints will result in some units committing at price-based offers, rather than cost. Under the RTO’s rules, only the affected generator would know of the constraint, O’Connell said, gaining a competitive advantage over other units and possibly incorporating greater mark-ups into their offers.

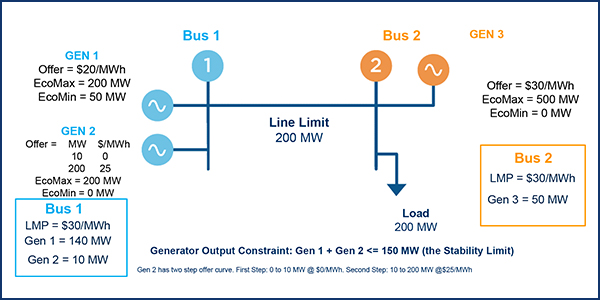

PJM’s Keyur Patel gave a revised presentation Wednesday showing examples of how the RTO’s proposed approach would work. At the MIC’s March meeting, Paul Sotkiewicz, PJM’s former chief economist, said the examples in the RTO’s presentation contained errors in its LMP calculations. (See “PJM Developing Alternative on Stability-limited Generators,” PJM MIC Briefs: March 11, 2020.)

PJM’s proposed new approach for clearing stability-restricted generating units | PJM

PJM’s proposal is to model stability limits on generating units as a “capacity constraint” that doesn’t directly affect the LMP.

Sotkiewicz, now with E-Cubed Policy Associates, thanked PJM for correcting the examples but pressed the RTO on the need for the change.

PJM’s Joe Ciabattoni said the problem is when day-ahead commitments differ from those in real time.

“You could have a feasible solution in the day-ahead that’s infeasible in real time,” requiring operators to decommit one of the two units in PJM’s example and causing make-whole payments.

“We would prefer to have a solution that is feasible in both the day-ahead and real-time,” he said.

The discussion of alternatives to PJM’s proposal was cut short because the MIC meeting was running behind schedule.

ARR/FTR Market Task Force

PJM’s Dave Anders said the ARR FTR Market Task Force has completed three of its five key work activities (KWAs) in the issue charge approved by the MIC in October: reviewing the evolution of PJM’s auction revenue rights and financial transmission rights market design; reviewing congestion rights market designs of other regions; and discussing how PJM’s current design accomplishes its objectives.

The task force is currently discussing the “value proposition” of the market, the fourth KWA, and will soon begin the final one, proposal development, which it expects to run through August.

The initiative grew out of a recommendation in PJM’s independent consultant report on the GreenHat Energy FTR default that the RTO “conduct a general review of the FTR market … to evaluate the risks and rewards of potential structural reforms.”

The task force’s next meeting is April 29.

nGEM Project Update

PJM has decided to expedite the implementation of network applications for day-ahead and real-time markets under its Next Generation Markets (nGEM) project, a multiyear partnership among PJM, MISO, ISO-NE and General Electric that began in April 2017.

PJM’s Todd Keech said the day-ahead market clearing engine released by GE in March met all performance improvement criteria specified in the development contract.

GE and PJM last month completed factory acceptance testing for capacity and FTR data transfer improvements and network applications; a final GE release for those functions is expected in the second quarter.

Schedule for PJM’s Next Generation Market (nGEM) project | PJM

Keech said PJM is seeking to implement network applications for day-ahead and real-time markets in the fourth quarter to address findings from its “Markets Process Review.”

The Phase 2 nGEM agreement is under negotiation, he said.

The partnership with GE allowed the grid operators to share in development and maintenance costs and reduce time-to-market. PJM said the project will improve system security and quality.

Performance Assessment Interval Report

PJM is considering changes to its manuals and Tariff to address “a lack of clarity and detail” and improve the transparency of its performance assessment interval (PAI) settlements process, PJM’s Danielle Croop told the MIC.

Croop said the RTO will bring a problem statement and issue charge to an upcoming MIC meeting to address issues including ancillary service accounting and the determination of scheduled megawatts. It will also include provisions to make the language for energy-only and demand response resources parallel with that of generation resources, where applicable.

The initiative will seek to identify where more transparency or clarification is needed. “This effort is not intended to redefine any previously defined practices surrounding the calculation of performance assessment interval nonperformance assessments,” PJM said.

The average initial shortfall across the October 2019 performance assessment event was 10,457 MW, prior to excusals. | PJM

In March, PJM released a report on PAI settlements as an addendum to its review of the Oct. 1-2, 2019, performance assessment event, when an abnormal October heat wave led to emergency procedures and the first call on DR resources in more than five years.

The incident resulted in $8.2 million in nonperformance charges. Bonus payments averaged $32.89/MW-interval with the average bonus 9,706 MW/interval.

Independent Market Monitor Joe Bowring noted that the 2019 State of the Market report also includes an analysis of the October event. “We’re also working on a confidential report that we will share with PJM,” he said.

‘Quick Fix’ on PMA Credit Requirements

PJM’s Bridgid Cummings presented the MIC with a problem statement and issue charge for a proposed “quick fix” Tariff revision to address a regulatory change in Ohio concerning the billing of network integration transmission service (NITS).

The RTO requires load-serving entities to sign NITS agreements and post collateral based on their peak market activity (PMA).

In 2015, the Public Utilities Commission of Ohio moved NITS and other related charges to a non-bypassable rider that is the responsibility of the electric distribution company. The change means competitive retail electric suppliers serving load in Ohio are no longer allowed to collect NITS or any other transmission-related charges from end-use customers.

As a result, PJM’s credit requirements “do not reflect or consider the appropriate exposure for the responsible party” in Ohio, the problem statement says. “It is possible that other states may have similar laws in place or may enact similar laws in the future. This situation puts LSEs in those jurisdictions at a disadvantage with respect to having the responsibility for the applicable credit requirements in PJM although they have no responsibility for the underlying transmission service charges in the states in which they operate.”

As a result, PJM is proposing to amend Tariff Attachment Q to allow the RTO to adjust PMA requirements “where state law requires the transfer of charges or credits from a participant to another party.”

The committee will be asked to approve the issue charge and endorse the Tariff revisions at the May MIC meeting under the quick-fix process detailed in section 8.6.1 of Manual 34.

Regulation Market Settlement Agreement

PJM’s Eric Hsia gave a briefing on PJM’s compliance filing in response to FERC’s March 26 order approving settlements of two complaints over PJM’s regulation market design (ER19-1651-001).

The settlements resolved complaints filed in 2017 by the Energy Storage Association (EL17-64), and Invenergy and Renewable Energy Systems Americas (EL17-65), which alleged PJM’s January 2017 regulation market redesign violated commission precedent and discriminates against faster, dynamic “RegD” resources such as battery storage. (See FERC OKs PJM Regulation Deal over Monitor’s Opposition.)

– Rich Heidorn Jr.