NYISO’s Management Committee on Wednesday saw graphic evidence of how the COVID-19 pandemic response is impacting power demand and heard how the ISO’s operations team continues to be sequestered at the two control centers, alternating shifts.

“Even though they were sequestered on-site, we didn’t take for granted that they weren’t infected, so after a 14-day period we allowed them more liberty to move around the site,” NYISO CEO Rich Dewey said.

“We’re almost exclusively working from home, except for the operators,” he said. “We still have to run operations and issue invoices, so from a business process viewpoint, I’m happy to report that’s all going very well. I’m happy to report that we have not experienced any operational issues yet.”

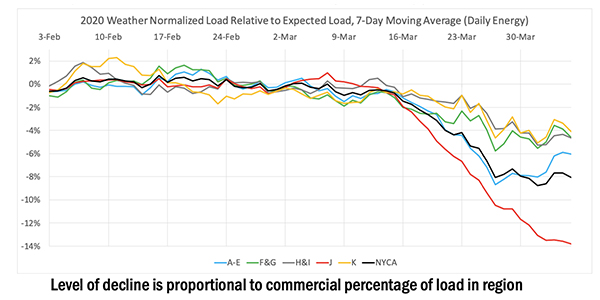

Demand Forecasting Manager Charles Alonge presented estimated impacts of the pandemic on NYISO demand.

“We saw approximately a 4% drop in daily energy across the New York Control Area for that first week,” Alonge said. “Moving into the second week of the shutdowns, we saw the decline grow to about 8% during the week beginning March 22, and then the last week, March 29 through April 4, stayed the same at about an 8% decline.”

The week ending April 11 saw a further 1% decline in load, to 9% below the expected levels, he said.

The same energy information plotted on daily, regional and NYCA bases showed varied regional impacts.

“The biggest impact on load was seen in Zone J, New York City, and Zone J also has the largest commercial percentage of load in the New York Control Area,” Alonge said. “The biggest signal that we have observed with respect to demand impact is the morning ramp, which is lagged against where we expect it to be, and also the morning peak for this time of year is delayed.”

Budget Precautions

The committee approved a staff proposal for the ISO to retain $6.4 million remaining from the 2019 budget cycle to potentially offset a shortfall in 2020 Rate Schedule 1 (RS1) recoveries and unplanned expenditures resulting from the pandemic.

The NYISO Board of Directors will vote on the budget proposal at its meeting this week.

“If we do find that these funds are not needed for the estimated budget shortfall, we still will have the opportunity to pay down principal on outstanding debt in the fourth quarter of 2020,” CFO Cheryl Hussey said.

The recommendation was discussed with market participants at the Budget and Priorities Working Group meeting March 31 following completion of NYISO’s 2019 financial statement audit.

The 2019 $6.4 million budget surplus stems from a RS1 overcollection of $700,000 combined with a spending underrun of $5.7 million.

ESR Scheduling Performance Proposal

The MC approved a proposal to resolve scheduling performance issues related to energy storage resources (ESRs).

Michael DeSocio, NYISO’s director of market design, presented a proposed Tariff revision that would allow the ISO to provide stakeholders advanced notice of performance concerns no later than 4 p.m. on the day before day-ahead bids must be submitted for a day-ahead market (DAM) day.

The Tariff provision also would suspend the use of ISO-managed energy levels with DAM offers until the performance concerns have been addressed.

The Tariff change will be bundled with other ESR revisions and voted on by the board this week ahead of filing with FERC later this month.

Enhancing Mitigation Rules

The MC also approved a fast-track approach for the ISO’s proposal to revise its buyer-side mitigation (BSM) Part A exemption test based on the Market Monitoring Unit’s two-pronged recommendation as part of the 2020 Comprehensive Mitigation Review (CMR) project. It recommended that the board approve measures for filing with FERC so that the changes could be used for the current class year.

ICAP Mitigation Engineer Christina Duong presented the CMR project overview, saying the goal is to complete a market design this year, and that revisions to the Part A test are part of BSM enhancements.

NYISO’s BSM rules provide that, unless exempt from mitigation, new installed capacity (ICAP) suppliers in mitigated capacity zones may only participate in the ICAP spot market auctions at a price at or above the applicable offer floor until their capacity clears 12 months (not necessarily consecutively).

FERC in February narrowed the resources exempt from NYISO’s BSM offer floor determinations in southeastern New York, ordering the ISO to subject storage and special case resources to a minimum offer floor in its capacity market (EL16-92). (See FERC Narrows NYISO Mitigation Exemptions.)

Prong 1 of the CMR involves changes to the parts A and B exemption tests such that public policy resource (PPR) examined facilities would be placed in the supply stack before non-PPR ones. Projects currently go in the supply stack from lowest to highest net cost of new entry.

“This change will allow legitimate PPR supply resources to be awarded a Part A exemption before non-PPR resources that may be less expensive but do not further the state’s policy objectives,” Duong said. “This is an incremental improvement as part of that larger goal, but we still may revisit the Part B mitigation study period as well.”

“Among the stated goals in doing this [CMR] was to help enable the state’s achievement of the recently enacted climate act,” said Howard Fromer, director of market policy for PSEG Power New York. “In a related vein, earlier this week there was a petition filed at FERC seeking a technical conference on carbon pricing and pointing to all the extensive work that NYISO has done.” (See related story, IPPs, Renewable Groups Seek FERC Carbon Pricing Conference.)

Addressing Dewey, Fromer said, “If you haven’t seen the petition, I encourage you to do so, and I hope the New York ISO would be supportive of that request. It’s not asking for a rulemaking; it’s asking for just a technical conference to discuss these issues … and hopefully put in a filing at FERC indicating you would support this technical conference and participate in one.”

“I read [the petition] earlier this morning, and I absolutely would support any open discussion that supports the advancement of carbon pricing,” Dewey said. “The New York ISO continues to be very supportive of New York state’s goals. … The pandemic aside, we do recognize that the clock is still ticking on the achievement of these goals and the timeline it’s going to take.”

Fromer said he hoped that Dewey would share his support with FERC.

“Yes, I have personally told that to each of the FERC commissioners, and at the next opportunity I’ll reiterate it,” Dewey said. “We still think [carbon pricing] is the most effective, efficient means for the state to achieve its goals.”

The Climate Leadership and Community Protection Act (A8429), signed into law last July, calls for 70% of New York’s electricity to come from renewable resources by 2030 and for electricity generation to be 100% carbon-free by 2040.

— Michael Kuser