By Michael Kuser

FERC on Thursday approved ISO-NE’s November 2019 filing of information related to qualification of resources to participate in Forward Capacity Auction 14, which together with a substitution auction was held the first week of February (ER20-308).

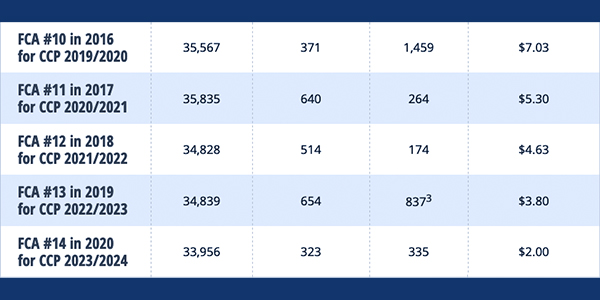

FCA 14 cleared 33,956 MW of capacity for 2023/24 after five rounds of bidding. Prices came in at a record low of $2/kW-month, a nearly 50% drop from $3.80/kW-month in 2019. (See ISO-NE Capacity Prices Hit Record Low.)

In accepting the filing, including offer floor prices proposed by the RTO’s Internal Market Monitor, the commission said it was not persuaded by “arguments that the qualification results reflect faulty mitigation.”

“When the offer floor prices submitted by resources are below the relevant offer review trigger price [ORTP], the Tariff requires the Internal Market Monitor to estimate its own offer floor prices with which to make comparisons with the submitted prices,” the commission said.

Intervenors included Able Grid Infrastructure Holding, which contested the mitigation of its two qualifying battery storage projects, and Potomac Economics, acting as ISO-NE’s External Market Monitor.

The commission rejected the EMM’s request that the IMM should have been required to revise its calculation of offer floor prices for energy storage resources in preparation for FCA 14, finding the IMM’s method reasonable because it’s “based on a careful study of submitted models and associated assumptions, conducted in the proper time frame.”

“We agree with the Internal Market Monitor, however, that, even if the External Market Monitor method is potentially more accurate, that alone does not indicate that the Internal Market Monitor abused its discretion or that the model it used is inconsistent with the Tariff,” the commission said.

With regard to Able Grid’s Ballston and Cahoon projects, the commission said it was unpersuaded by the developer’s argument that the IMM acted improperly by not collaborating with it during the qualification process to ensure that it provided sufficient supporting information for its submitted values.

Able Grid acknowledged that “the Tariff does not impose a strict obligation,” and the commission noted that the Tariff, in fact, states that “sufficient documentation and information must be included in the resource’s qualification package” to enable the IMM to review the resource’s proposed offer floor price, and that if a resource sponsor’s supporting information is deficient, the IMM, “at its sole discretion,” may consult with the resource sponsor to gather further information.

The commission also said it was unpersuaded by Able Grid’s claim that the IMM does not properly support its own data inputs, and disagreed with the developer’s argument that the IMM acted inconsistently with Order 841 by not implementing an ORTP model for energy storage resources.

“Order No. 841 is silent on the topic of this proceeding: mitigation in the FCM,” the commission said.