By Steve Huntoon

By now we’ve all been told that FERC’s recent order on PJM’s minimum offer price rule is the death knell for renewables and a big hit to consumers.

This is the spin from renewable advocates who didn’t actually read the order before firing off press releases.[efn_note]The order was posted at 5:51 p.m. ET on Dec. 19, 2019, after press releases were issued. Other groups also didn’t read the order before firing, but their shots in the dark weren’t so far off the mark.[/efn_note]

Let me explain four elements of the order that are positive for renewables, and then discuss the consumer rate hike that isn’t.

The Death Knell for Renewables that isn’t

Existing Renewables are Grandfathered, Fossil and Nuclear Aren’t

This is a big preference for renewables. It also means that to the extent uneconomic subsidized fossil and nuclear units retire, energy prices for renewables increase.

Renewables Depend Much less on Capacity Revenues for Project Viability

Renewables’ nameplate capacity is heavily discounted for Reliability Pricing Model purposes because of their intermittency. As a consequence, renewable projects are much less dependent on RPM revenue for project viability.

By the way, those complaining that renewables will lose project-critical RPM revenues are some of the same wanting to get rid of RPM altogether. Which is it?

The Unit-specific Exemption Favors Renewables

There is an exemption for projects that can show financial viability even without a state subsidy. And it would seem many renewable projects will be able to satisfy the test because of the generic nature of their subsidies.

State subsidies for fossil and nuclear units are tailored to providing just enough money to keep specific units around. So by definition — or at least by representations to state legislators — they have to have the subsidies to be financially viable, which in turn would mean no unit-specific exemption for them.

Federal Subsidies are Excluded

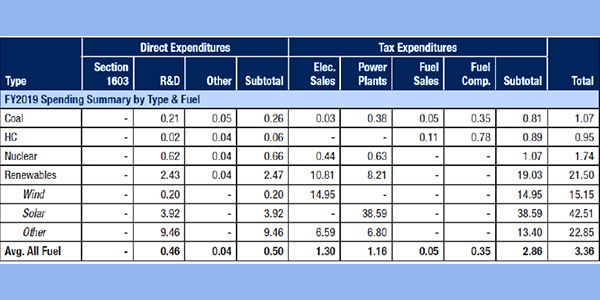

This is a big preference for renewables because their federal subsidies per megawatt-hour are enormous, averaging $21.50, with fossil and nuclear subsidies less than 1/10 of that. Here’s a chart with the data:[efn_note]https://live-energy-institute.pantheonsite.io/sites/default/files/UTAustin_FCe_Subsidies_2017_June.pdf, page 23, Table 7, FY 2019 (“HC” stands for hydrocarbons oil and natural gas). By the way, historical subsidies that no longer exist, and aggregate dollar amounts of subsidies, are irrelevant to relative subsidy value among resources. What is relevant is amount of subsidy per unit of generation.[/efn_note]

Yet, renewable advocates complained about federal subsidies for fossil being excluded. OMG.

The Consumer Rate Hike that isn’t

At some point, we’ll have some rigorous modeling of the consumer impact. There are a lot of moving parts, including how significant the unit-specific exemption turns out to be.

One thing we know now is that the consumer rate hike claimed by some advocates is a fantasy. They rely on a study that claimed an increase in RPM consumer costs of $5.7 billion compared to the last RPM auction.[efn_note]https://www.sierraclub.org/press-releases/2019/12/ferc-costs-consumers-billions-hobbles-clean-energy-economy-help-coal-and; https://www.eenews.net/stories/1061856193; https://www.vox.com/energy-and-environment/2019/12/23/21031112/trump-coal-ferc-energy-subsidy-mopr. The study relied upon is here: https://gridprogress.files.wordpress.com/2019/08/consumer-impacts-of-ferc-interference-with-state-policies-an-analysis-of-the-pjm-region.pdf.[/efn_note] This estimate was based on 24,000 MW being subject to the MOPR.

There are fatal flaws in that study. First is that at least 16,416 MW of the 24,000 MW didn’t clear in the last RPM auction.[efn_note]The 16,416 MW is composed of 14,300 MW of future renewable resources and 2,116 MW of Ohio nuclear units that did not clear in the last RPM auction. https://www.prnewswire.com/news-releases/firstenergy-solutions-comments-on-results-of-pjm-capacity-auction-300654549.html.[/efn_note] So the study is estimating a price increase by subtracting capacity resources that weren’t there to subtract in the first place.

Now let’s look at what’s left after subtracting the nonexistent 16,416 MW from the 24,000 MW. The roughly 7,600 MW that’s left is made up of three nuclear plants (Hope Creek and Salem in New Jersey, and Quad Cities in Illinois) and one coal plant (Ohio Valley Electric Corp.). The FERC order requires that offer prices be adjusted to the net avoidable cost rate, which is the gross going-forward cost net of estimated energy, capacity and ancillary services market revenues. Independent Market Monitor data show that none of the nuclear plants in question needs revenues in excess of estimated total energy and capacity revenue in order to remain financially viable.[efn_note]http://www.monitoringanalytics.com/reports/PJM_State_of_the_Market/2019/2019q3-som-pjm-sec7.pdf, Tables 7-20 and 7-21 (The MMU didn’t include ancillary services, which would add to revenue.)[/efn_note] The necessary implication of this is that their minimum offer price will be below the locational deliverability area clearing price for the respective units.

As for the coal plant, generic PJM data show a gross going-forward cost of $171/MW-day and very conservative energy and ancillary services revenue of $45/MW-day.[efn_note]Initial Submission of PJM Interconnection, LLC, Docket No. EL16-49-000, https://elibrary.ferc.gov/idmws/common/opennat.asp?fileID=15059002, pdf pages 118 and 120.[/efn_note] Netting the $45/MW-day from the $171/MW-day gives a MOPR replacement rate of $126/MW-day, which is below the $140/MW-day RTO clearing price in the last auction. Thus, the coal plant clears without affecting the RTO clearing price.

Although not part of the study reviewed above, let me add a note on Commissioner Richard Glick’s estimate that 25% of demand resources that cleared in the last auction won’t clear in the next one allegedly because a curtailment service provider (effectively an aggregator) will need to know its specific end-use customers three years in advance. This does not consider that the FERC order exempted all demand response resources that cleared in a prior auction, i.e., all the DR resources that Glick says are subject to the MOPR. Moreover, CSPs already live with some uncertainty about their ultimate end-use customers; no state subsidy for DR has been identified; and DR resources could alleviate uncertainty for CSPs by certifying to current and future nonreceipt of state subsidies (which, as noted, don’t even seem to exist).

To sum up: No effect on the last RPM auction results.

Yes, you read that right. No increase in RPM consumer costs relative to the last auction.

Speaking of reading, might I recommend the order?

Columnist Steve Huntoon, principal of Energy Counsel LLP, and a former president of the Energy Bar Association, has been practicing energy law for more than 30 years.