In a two-day meeting last week, the New England Power Pool Markets Committee continued work on ISO-NE’s proposed Energy Security Improvements (ESI) proposal, with discussions on LNG supplies, market mitigation and a second demand curve.

The RTO has five months to file a long-term fuel security mechanism under FERC’s second extension since its original order last July (EL18-182). The new deadline is April 15, 2020.

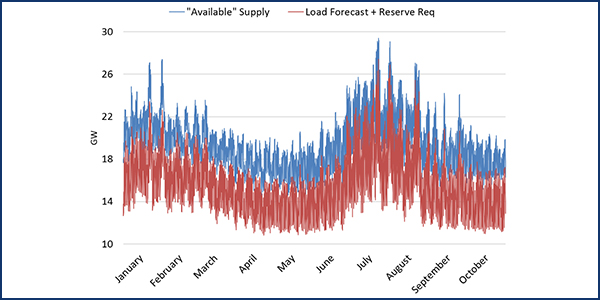

The RTO’s lead analyst for market development, Ben Ewing, started the two-day meeting by presenting on the forecast energy requirement (FER) and clearing energy imbalance reserve (EIR) awards to clear the constraint.

The FER constraint ensures that the RTO can meet forecast load throughout the next operating day. It currently is applied after the clearing of the day-ahead market through the reserve adequacy assessment (RAA) process, an “out-of-market” approach, Ewing said.

Under ESI, the FER will be applied in the clearing of the day-ahead market — satisfied by physical generation, net scheduled interchange and EIR awards.

NEPOOL rules prohibit RTO Insider from quoting stakeholders’ comments during the meeting. However, after the meeting, ISO-NE and other speakers approved the quotes attributed to them to amplify their written presentations.

“Including the FER in the day-ahead will provide a clear market solution to ensuring we’re able to meet the forecast load in real time and will better signal the cost of having a reliable operating plan, and provide compensation and incentives for those resources we’re relying on for meeting that reliability requirement,” Ewing said.

The day-ahead clearing typically results in excess supply to meet the FER and operating reserve requirements, making supplemental commitments in the RAA process rare — with zero in 2019 to date, he said.

The RTO is proposing to begin compensating that excess “online” capacity — the capability, or headroom, of scheduled generators above what they cleared in the day-ahead market.

The FER would create a second demand curve in addition to the existing one for bid-in energy demand of market participants. Similarly, it would result in a second constraint, simultaneously clearing physical energy supply offers and energy options to satisfy the FER.

The day-ahead LMP would remain the incremental cost to satisfy another unit of bid-in energy demand. The FER price is the incremental cost to satisfy another unit of forecast demand.

“An online EIR approach is reasonable and practicable, and we will be glad to consider refining it further as technology permits,” Ewing said.

“I think this is a big step toward resolving some of our issues,” Brett Kruse, vice president of market design at Calpine, told RTO Insider after the meeting.

Interchangeability between the different products has been an issue for Calpine all along the design process, he said.

“I’m not sure that some product bifurcation isn’t necessary, but I’m finally getting an appreciation of why [ISO-NE planners] are doing things without regard to which option they get paid for, and why they currently think that they should all get one price,” Kruse said.

The schedule calls for further discussion by the MC over the next few months and a vote on Tariff language and submitted stakeholder amendments at its March 2020 meeting ahead of a vote in April by the Participants Committee.

Enhancing ESI Impacts Analysis

ISO-NE economist Chris Geissler and Todd Schatzki of Analysis Group presented enhancements to the modeling used in the impact assessment of ESI, with Schatzki taking the lead for a “look under the hood” at the specifics of three key changes to the modeling: evaluation of non-winter months independent of winter months; enhancements to the model’s fuel inputs and logic; and adding price-responsive demand (PRD) to EIR.

The RTO is responding to stakeholder concerns and will evaluate non-winter months independent of winter months but will not aggregate the studies into a single annual case, he said.

“Separate analysis of winter months will allow continued focus on the energy security outcomes that are of greatest concern during the winter months and will enhance the information given to the committee as it deliberates the proposed rule changes,” Schatzki said.

Modeling of fuel supply accounts for storage and delivery limitations, while modeling EIR ensures that there is enough energy available to meet the forecast energy level in each hour, he said.

The planners are analyzing resource-level fuel inventory based on multiple parameters:

-

-

- Initial, beginning of winter, inventory levels;

- Trigger levels for replenishment: balancing costs of refilling too frequently (holding costs) and costs of refilling too infrequently (lost revenues);

- The replenishment lag: one day for trucks, four for barges; and

- Replenishment rate: Different replenishment rate for resources relying on trucks and barges. The rate is projected to be 33% higher with ESI.

-

“Re-evaluation of fuel parameters will allow the model to better represent potential market and reliability impacts associated with ESI,” Schatzki said.

The New England States Committee of Electricity (NESCOE) submitted a memo expressing its concern that a market power analysis “might not show a problem if it fails to evaluate the conditions that could create vulnerability to exercise of market power (such as a tighter supply/demand balance), or if it fails to model ‘real world’ conditions.”

Schatzki said changes in global LNG prices could affect the LNG supply at the terminal.

“In principle, if LNG prices went way down or way up, that might affect the LNG storage decision and the eventual in-winter supply, given the resulting risk of forward committing to LNG supplies,” Schatzki said. “A lot of that procurement happens in advance of the winter.”

Schatzki said his company’s analysis was “very conservative.”

“We assume every day that the terminal, in this case Repsol, is full every day,” Schatzki said. “And whether that’s a reasonable assumption or not … we made the conservative assumption that there is fuel available.”

On EIR, Schatzki said that properly accounting for day-ahead energy and EIR interactions requires modeling PRD.

“Without price-responsive demand, the model cannot substitute between energy and EIR, but including price-responsive demand allows the model to endogenously solve for energy and EIR quantities,” he said.

Market Power Analysis and Mitigation

Concurrent with discussions regarding conceptual mitigation approaches, ISO-NE will conduct a market power assessment (MPA), according to a memo submitted by Mark Karl, the RTO’s vice president of market development.

The central purpose of an MPA is to determine whether market power is an empirically supported concern. If so, an MPA helps to identify the specific conditions, frequency and extent to which individual participants may be able to profitably exercise market power, the memo said.

ISO-NE Chief Economist Matt White said the memo addresses stakeholder concerns by laying out what the RTO expects External Market Monitor David Patton to address in his market mitigation analysis:

-

-

- How mitigation of co-optimized day-ahead energy and ancillary services are implemented in other regional markets where Potomac Economics is also the EMM, and the EMM’s perspective on the effectiveness of those mitigation measures;

- Whether and how the mitigation lessons from those regions could be usefully applied to the co-optimized day-ahead energy and ancillary services market proposed by ISO-NE;

- Any expectations regarding potential competitiveness of the proposed day-ahead energy and ancillary services market in New England, given the information presently available and Potomac Economics’ experience; and

- Its perspectives on must-offer requirements for resources with capacity supply obligations (CSOs).

-

“Our understanding is this is a voluntary market, and if there is any change that will be known to stakeholders before moving forward,” White said.

Stakeholder Proposal Updates

Jeff Bentz, NESCOE director of analysis, reiterated the states’ position.

“We continue to believe that the possible modifications to the strike price formula, a must-offer requirement as part of a market power mitigation approach and no [replacement energy reserves] in the non-winter months, benefit consumers and will do so without adversely impacting the changes ISO-NE is trying to achieve,” Bentz said.

“Our main concern continues to be market power and mitigation, and the must-offer requirement is only a component of this, so we look forward to the continued work on mitigation in the following months,” he said.

Christina Belew, of the Massachusetts attorney general’s office, confirmed that the office has withdrawn its alternative proposal prepared by London Economics that recommended a simple auction format of sealed bids with a uniform clearing price.

With respect to proposed amendments to ISO-NE’s ESI design, Belew said, “We wanted to let you know that the three amendments we offered in September are still in play, and depending on how ESI develops over the coming months, we may re-urge one or more of them, perhaps offer new ones.

“Like NESCOE, we have requested additional analysis that we haven’t received yet, so the results are going to inform our actions,” Belew said. “We expect to be back with substantive comments after the first of the year.”

NESCOE Intent on EER Revisions

Bentz presented NESCOE’s proposal for Tariff revisions regarding energy efficiency resources (EER) and related capacity obligations during scarcity conditions.

He said that NESCOE is seeking stakeholder feedback and intends to move forward in proposing a Tariff change that would implement Shaping Option A as taken from the Demand Resources Working Group final report issued in July.

Shaping Option A would estimate hourly EER performance as a function of established on-peak EER savings and system load levels.

“Under the current implementation, such resources are guaranteed to always incur a penalty during any event that occurs outside of on-peak or seasonal peak hours, which contradicts the language in the FERC order,” Bentz said.

FERC ruled in May 2014 that energy efficiency capacity performance payments should be calculated only for capacity scarcity conditions occurring during peak hours (ER14-1050).

Providing certainty to EERs is important to New England states, he said.

EERs are not similarly situated to other capacity resources because they do not actively perform in real time — they represent a predetermined level of load reduction that is constant as a percentage of that resource’s load — and therefore are not able to respond to the ISO-NE proposal’s performance incentive.

NESCOE will work with the RTO to create the appropriate Tariff and manual changes needed to implement Shaping Option A and present those changes at next month’s MC meeting ahead of a vote in January 2020. The organization will then seek a Participants Committee vote in February.

IMM Reports Q3 Energy Costs down 27% Y-o-Y

The RTO’s Internal Market Monitor issued a quarterly report showing summer 2019 energy and capacity market costs down significantly, with energy costs at $967 million, down 27% from a year ago, driven by a decrease in natural gas prices and lower loads.

Wholesale market costs totaled $1.74 billion, a 26% decrease from $2.36 billion in summer 2018, IMM David Naughton said.

COO Vamsi Chadalavada reported earlier in the month that prices in the region’s energy markets have been hitting historic lows. (See NEPOOL Participants Committee Briefs: Nov. 1, 2019.)

Naughton highlighted that two new rule changes went into effect on June 1: delayed commercial operation rules; and must-offer requirements for do-not-exceed (DNE) dispatchable capacity market resources such as wind. Early market reaction has been consistent with expectations, he said.

The first change shifted responsibility for covering “undemonstrated” capacity from the RTO to the participant, to address new resources that fail to meet their commercial operation target. Late resources that fail to shed their CSOs in secondary markets face a failure-to-cover charge for the “undemonstrated” capacity.

Over the first three months, 19 resources, predominantly demand response, were charged $500,000 for capacity shortages. Charges declined as resources reacted by offloading CSOs.

In addition, he said three new gas-fired generators with a combined CSO of more than 1,000 MW achieved commercial operation and did not incur failure-to-cover charges: Canal 3 (333 MW), Bridgeport Harbor 5 (484 MW) and the Medway Peaker (195 MW).

Naughton said wind generation offer behavior changed as expected now that DNE dispatchable generators with CSOs must offer all of their expected real-time generation into the day-ahead market. DNE wind generators increased their quantity of energy offered in the day-ahead market and offers reflected the expected level of real-time production, Naughton said.

Cleared volumes increased in the first month but declined to pre-rule change levels as offer prices began to increase, while cleared virtual supply at wind nodes decreased from 25% to 16% of real-time wind production.

State Changes to GIS, Rules

The MC by a show of hands unanimously approved sending changes to the NEPOOL Generation Information System to the GIS Operating Rules Working Group.

The Maine Public Utilities Commission and the Massachusetts Department of Energy Resources requested the changes, which relate to the Maine renewable portfolio standard and the Massachusetts Clean Peak Standard (CPS).

The Maine Legislature in September made several changes to the state’s RPS that require changes to the GIS.

The CPS was signed into law in August, and the addition of the CPS certificates to the GIS would require, at a minimum, the addition of “CPS Resources” and “Clean Peak Standard” to various provisions of the rules, NEPOOL Counsel Lynn M. Fountain said.

The changes to the GIS and the rules related to the CPS would become effective on July 1, 2020.

Sunset of Fuel Security Reliability Review

The MC voted to recommend the PC approve the sunset of the fuel security reliability review provisions following Forward Capacity Auction 14, one year earlier than currently planned.

The RTO’s assistant general counsel, Chris Hamlen, presented the proposed changes to Market Rule 1.

The MC in September approved amending Market Rule 1 to limit the retention of resources needed for fuel security to a two-year maximum.

The RTO wants the change to become effective prior to March 13, 2020, the FCA 15 deadline for retirement delist and permanent delist bids.

— Michael Kuser