By Christen Smith

FERC halted PJM’s plan to run its capacity auction next month in a surprise order issued Thursday, just hours after the Markets and Reliability Committee reaffirmed the RTO’s decision to move forward as planned.

The commission refused to “rule prematurely” on PJM’s request for clarification that if it ran the 2022/23 Base Residual Auction using the existing minimum offer price rule (MOPR) — while the revised version awaits approval — that FERC would enforce any new rates prospectively, saving the August auction from being rerun (EL16-49).

PJM argued that if the commission granted its request, filed in April, the “critical” confidence in auction results necessary for market participants would be preserved. (See PJM to Hold Capacity Auction in August.) The RTO’s Board of Managers also maintained that the rejected MOPR only impacts a small number of resources, meaning an updated commission ruling on the matter wouldn’t change prices too much within the current environment.

“PJM asserts that, here, refunds would not be warranted because the basis of the underlying complaint is that the relevant rates are too low, not too high, which is a required finding for refunds under Section 206 of the Federal Power Act,” FERC summarized in its ruling.

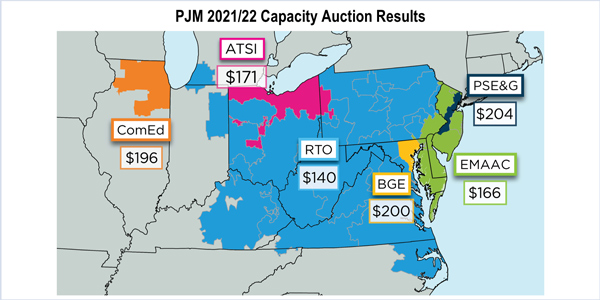

FERC advised PJM to cancel its August capacity auction. | PJM

PJM delayed the BRA once already after FERC ruled in June 2018 that the RTO’s MOPR was unjust and unreasonable because it didn’t address price suppression arising from state subsidies for renewable and nuclear power. The RTO proposed a new rate in October and had hoped for a ruling from the commission by March 15 to no avail.

The RTO said in April it would run the auction in August after many stakeholders expressed support for doing so. Others, however, pushed for a second delay until April 2020. (See Capacity Market Sellers Anxious over Uncertain PJM Auction Rules.)

PJM entities including American Municipal Power, Dominion Energy, Exelon, EDP Renewables, FirstEnergy and its subsidiaries, Talen Energy and its subsidiaries, the Electric Power Supply Association, Direct Energy, the American Wind Energy Association, the Solar Council and the Illinois attorney general’s office all filed in support of the RTO’s decision to run the auction in August, agreeing that further delays have proved detrimental to the market and interfered with the necessary forward pricing signals that sellers need.

The entities also agreed that should FERC reject the clarification, PJM should delay the auction because running it without the guarantee from the commission would “undermine the very certainty the BRAs are designed to provide.”

The Illinois AG’s office further argued that if FERC granted the request, it should also “address flaws in the existing capacity market rules that facilitate market power abuse by requiring PJM to release generator bidding data and to replace the algorithm that PJM uses to increase clearing prices above the highest bid.”

In the end, FERC advised PJM to cancel the auction until it provides a suitable replacement rate, though it’s unclear when that decision may come. ClearView Energy Partners speculates that if the commission doesn’t provide a ruling on the MOPR before November, PJM won’t have enough time to implement Tariff changes in time to hold the 2022/23 auction in April.

“We recognize the importance of sending price signals sufficiently in advance of delivery to allow for resource investment decisions,” FERC said. “However, we believe that in the circumstances presented here, on balance, delaying the auction until the commission establishes a replacement rate will provide greater certainty to the market than conducting the auction under the existing rules.”

PJM spokesperson Jeff Shields said on Thursday that the RTO will follow the commission’s guidance.

“In its ruling today directing PJM Interconnection to postpone its capacity auction, the Federal Energy Regulatory Commission recognized that confidence in the auction and its results is vitally important to all of our stakeholders and the integrity of the market,” Shields said in an emailed statement. “We look forward to additional guidance from FERC on the design of PJM’s capacity market.”

Commissioners Debate

While concurring with the order, Commissioner Richard Glick issued a scathing indictment of FERC’s inaction on PJM’s proposed changes, saying the RTO and its 65 million customers deserve better.

“One year later, Commissioner [Cheryl] LaFleur’s description of the June 2018 order as ‘regulatory hubris’ seems more apt than ever after the commission has shown an absence of leadership that has caused us to drift rudderless into the position in which we find ourselves today,” he said.

As the lone dissenter on the June 2018 order, Glick said he agrees with his colleagues that running the auction next month provides only a “short-term palliative effect … that would be outweighed by the long-term uncertainty” of allowing capacity commitments under Tariff previsions found unjust and unreasonable, leaving PJM vulnerable to years of litigation.

But he blamed FERC for putting PJM in the situation in the first place.

“If ever the Pottery Barn Rule applied to a regulatory proceeding, it is this one,” he said, referencing what Secretary of State Colin Powell told President George W. Bush in the lead-up to the War in Iraq: “You break it, you own it.”

LaFleur took her previous criticisms a step further in her own statement.

“Given the passage of time, the uncertainty created by the commission might better be labeled an act of regulatory malpractice,” she said. “The commission, whatever concerns it has with the PJM capacity market, should not have put PJM, the states and customers served by its markets, and its stakeholders in this position.”

Commissioner Bernard McNamee — who joined FERC after the June 2018 order — called Glick’s usage of the Pottery Barn Rule “misleading.”

“To suggest the commission is the source of the problems presently facing PJM is to ignore nearly a decade of proceedings attempting to address the interaction between competitive markets and out-of-market subsidies,” he said. “More importantly, such a statement only makes sense if one ignores the impetus behind PJM’s original filing in Docket No. ER18-1314, which was PJM’s desire to address issues arising from state out-of-market support for generation resources in its footprint.”

Glick argued that McNamee “misses the point.”

“It was the commission — not PJM — that made the finding that has prevented PJM from running its capacity auction,” he said. “And it has been the commission — not any party to this proceeding — that has failed to act, even though we are now more than six months past the date promised in the June 2018 order. Meanwhile, neither the facts nor the law have changed, and the time for deliberation has long passed. The commission is now fully responsible for the damage done to date and whatever comes next.”

Chairman Neil Chatterjee did not weigh in on the controversy.