By Robert Mullin

Gas-fired generation continues to rapidly gain market share at the expense of coal, a trend likely to accelerate this year and into the near future, according to two reports released this week.

A U.S. Energy Information Administration report released Monday showed the power sector pushed U.S. natural gas consumption to record levels last year as gas-fired generators continued to steadily displace coal plants.

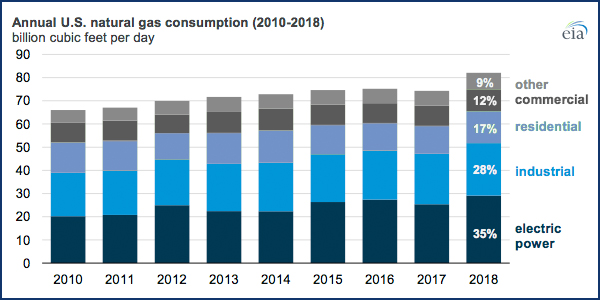

Gas consumption surged by 10% in 2018, rising across all economic sectors but boosted largely by a 3.8-Bcfd increase in uptake by power generators, EIA found. Gas-fired capacity additions of 14.5 GW and weather-related factors drove the increase.

The power sector consumed 29 Bcf of gas per day last year, 35% of domestic consumption. The sector set an all-time consumption record of 39.9 Bcfd in July, hitting its second-highest level of 38.6 Bcfd in August.

Gas-fired plants accounted for 35% of all generator output during the year, followed by coal (27%), nuclear (19%) and hydro (7%). Renewables accounted for 6.5%, according to an EIA report issued last week. (See Report: U.S. Renewable Generation Doubled Since 2008.) Nearly 13 GW of coal generation were retired in 2018, EIA said. Gas first supplanted coal as the sector’s leading fuel source in 2016.

While EIA forecasts that coal’s share of power output will slip below 25% this year, a report released Tuesday by the Institute for Energy Economics and Financial Analysis (IEEFA) contends that outlook “could even be understating the decline.”

“We expect the erosion of the utility market for coal to accelerate through 2019 and into the coming decade due to a combination of factors that have fundamentally changed the domestic electricity generation sector, the prime market for the U.S. coal industry,” said IEEFA, which describes its mission as accelerating “the transition to a diverse, sustainable and profitable energy economy.”

Chief among those factors: price drops for natural gas and renewables; the aging of the utility coal fleet and a growing utility sector interest in retiring the plants; increased corporate interest in greener resources; and growing concerns about CO2 emissions and climate risk.

IEEFA noted that total U.S. coal consumption dropped 4% last year to 688 million tons (MT), falling below the 700-MT level for the first time in 40 years. The report showed that, based on EIA statistics, the electricity sector accounted for 93% of the country’s demand for coal from 2007 to 2018.

While EIA projects that utility-sector coal consumption could drop to 563.9 MT this year, IEEFA thinks the level “could even fall more given the amount of coal-fired capacity retired last year, coupled with expectations of more closures going forward.”

IEEFA says 2019 “is already shaping up to be another important year for coal plant retirements, with almost 10 GW of planned closures announced through the end of February.” The group acknowledges that a year ago, it sharply underestimated this year’s closures, projecting just 4 GW in retirements.

“That figure has shot upward over the past year and now is nearing 10 GW, which would put it on pace to be the third-highest total for coal plant retirements ever,” IEEFA wrote. “And more announcements could be on the way, as the sector’s worsening economics continue to force utility decision-makers to move ahead with closures.”

The institute noted that Georgia Power has recently asked state regulators to approve immediate closure of a combined 982.5 MW of coal-fired capacity at its Hammond and McIntosh plants, while Alabama Power plans to shutter its 1,062-MW Gorgas plant in April.

The IEEFA report also points to the decline in performance for coal plants relative to natural gas. Coal plant capacity factors, about 70% in 2009, has held at about 54% over the past four years.

“It is important to point out here that this decline has occurred even as 75 GW of coal-fired capacity were closed from 2011 to 2018, much of it older and operated only occasionally. All else being equal, those retirements should have improved the average coal-fleet capacity factor, but that proved not to be the case,” the report said.

In contrast, average capacity factors for combined cycle generators have risen from 39.8% in 2009 to 57.6% last year.

The group’s report also points out that, for the first time last year, the capacity of natural gas combined cycle plants exceeded that of coal, 263 GW to 243 GW, “with the two sectors trending in opposite directions.”

That trend in buildouts “has fundamentally changed market operations in the utility sector to coal’s lasting detriment,” IEEFA said.

The industry has made it clear, with the support of President Trump and Energy Secretary Rick Perry, that it will not go down without a fight. On Wednesday, coal trade group ACCCE (which no longer spells out the unrealized potential of its original name, American Coalition for Clean Coal Electricity) released its latest white paper making the case for coal’s “fuel security” and “fuel diversity” value.