No Consensus on Capacity Revisions

WILMINGTON, Del. — In a series of votes, stakeholders at last week’s Markets and Reliability Committee meeting declined to endorse any proposals to revise PJM’s capacity model, reiterating previously expressed support for the status quo.

The initial vote displayed in perhaps the most civil — and emphatic — way possible stakeholders’ disapproval of PJM’s decision to file its own changes for FERC approval instead of the plan endorsed by member committees.

At the behest of Bob O’Connell of Panda Power Funds, stakeholders postponed voting on the Tariff revisions previously endorsed by lower committees — an extension of the minimum offer price rule (MOPR-Ex) proposed by PJM’s Independent Market Monitor — to allow for members to register an advisory vote on the RTO’s proposed filing. That sector-weighted vote registered 3.93 out of 5 in opposition, definitively denouncing PJM’s plan, which would add a second stage to capacity auctions to isolate subsidized offers and subsequently revise the clearing price if approved. (See PJM Going it Alone on Capacity Repricing Plan.)

The unexpected vote came after PJM’s Stu Bresler defended the RTO’s decision and highlighted additional revisions from previous versions of the proposal, including an exemption from repricing for any generators of 20 MW or less and returning to the “net CONE [cost of new entry] times B” formula for developing subsidized units’ adjusted offers if their avoidable cost rate (ACR) couldn’t be used.

Several stakeholders critiqued the proposal.

“We’re concerned that what PJM has put on the table doesn’t quite get us there,” NRG Energy’s Neal Fitch said. He noted that his company has generally supported the two-stage repricing concept but prefers a version it proposed that would lower capacity commitments for bids that cleared in the first stage to address “in-between” units, with commitments for all resources then proportionally reduced below their offer amounts.

Carl Johnson, who represents the PJM Public Power Coalition, said the proposal goes “beyond accommodating state policies” and creates “a race to the bottom to secure state subsidies.”

“I just don’t feel like we’ve gotten” to the best option, said Greg Poulos, executive director of the Consumer Advocates of the PJM States.

“Subsidies are contagious. We think PJM’s proposal is not an adequate vaccine and MOPR-Ex is,” Monitor Joe Bowring said.

When focus returned to the MOPR-Ex proposal, proponents were left deflated by a series of failed votes. To acquire additional votes, the Monitor had previously revised the details of its proposal from the version that was endorsed by lower committees. However, PJM’s rules require a vote on the endorsed version, so stakeholders voted that down — with 3.83 opposed in a sector-weighted vote — so they could consider the revised version as an alternative proposal.

Exelon reiterated criticism of Bowring’s efforts to secure votes.

“They’re a product of wheeling and dealing to get a Section 205 filing,” Exelon’s Sharon Midgley said.

The Old Dominion Electric Cooperative and Panda received approval for some friendly amendments, but that vote failed the two-thirds threshold, with only 3.02. A vote without the friendly amendments followed, but that also failed with 3.19 in favor.

Transmission Flashpoint

Customers flexed their muscles at last week’s MRC meeting, rejecting proposed Manual 14F changes. The revisions, backed by transmission owners, would allow PJM to consider caps on construction costs when evaluating transmission proposals. A vote on the motion, which required two-thirds approval in a sector-weighted vote, instead received nearly two-thirds in opposition, gathering just 1.71 in favor out of 5.

The vote was prefaced by an alternative proposal brought by LS Power’s Sharon Segner that would require PJM to consider construction cost caps but also revenue requirement caps. Segner’s proposal garnered strong support from consumers, transmission customers and the Monitor, who urged support for any measures that increase competition.

The alternate proposal was the culmination of several months’ debate on the issue at special sessions of the Planning Committee, where proponents of additional cost-containment consideration consistently clashed with TOs, who argued that construction cost caps represented the limit of their willingness to compromise. (See “Cost Cap Discussion Continues,” PJM PC/TEAC Briefs: Jan. 11, 2018.)

Proponents of additional cost-containment provisions argue they’re used in other RTOs/ISOs, but PJM staff warned that the differences in the RTO’s proposed procedures make adding those considerations impossible. PJM’s sponsorship model allows bidders to propose innovative solutions to RTO-identified problems, whereas other grid operators’ processes define the parameters of the project and ask bidders to compete on price and innovative rate-recovery strategies.

“If we’re going to pursue this approach … we’re going to have to look at the entire competitive construct because we cannot fit that amount of evaluation into the planning cycle we have,” PJM’s Steve Herling said. “It would require, I think, a fairly fundamental structural reworking. We can certainly do that, but we cannot proceed by simply shoehorning this into our current cycle.”

TOs criticized the lateness of the alternative proposal, pointing out that the primary proposal was developed through the stakeholder process while the alternative set a precedent that members can just bring their own proposals to the MRC when they don’t get their way in the lower committees.

The primary proposal included “considerable compromise,” FirstEnergy’s Jim Benchek said, and “holding [the issue] hostage” with an alternative proposal “to restart the debate” is “both wrong and a disservice to the stakeholder process.”

State consumer advocates defended the proposal, saying the focus should be on the quality of the proposal rather than when it was filed, and criticized the primary proposal for having no mechanism to hold contractors to the construction cost caps they set.

Segner’s proposal was seconded by Erik Heinle of the D.C. Office of the People’s Counsel.

“We believe this is really in the best interest not just of our consumers but everybody in this room,” he said.

EDP Renewables’ John Brodbeck asked whether either proposal moved the ball forward on the overall goal of getting transmission projects completed faster.

“The purpose here is really to evaluate what is the right project to expand the system, so we want to encourage innovative projects without impeding innovative rate structures,” PJM’s Sue Glatz said.

Proponents of the main motion beat a tactical retreat after its defeat, calling for a deferral on the alternative motion for more discussion at the PC. Several transmission customers agreed, and members approved a motion to defer the vote until no later than May’s MRC meeting.

Resilience Definition

PJM’s Chris O’Hara asked stakeholders for comments on the definitions of “resilience” proposed by FERC and the RTO. PJM’s definition is more concise than FERC’s, but it misses some of the mitigation nuance that the commission’s includes.

The commission has ordered RTOs and states to weigh in on the meaning of resilience after it rejected the Department of Energy’s Notice of Proposed Rulemaking that would have provided price supports to ailing coal and nuclear generators.

O’Hara asked for comments to be submitted by Feb. 9 so they can be incorporated into a discussion of the issue at the Feb. 13 Liaison Committee meeting and a special session of the MRC on Feb. 23. PJM’s responses to FERC are due March 9.

Generators Performed Better During Cold Snap than 2014

PJM staff said data show generators responded better during the cold snap than the infamous cold streak in January 2014 known as “the polar vortex,” proving that PJM’s subsequent Capacity Performance changes have had their intended impact.

The difference from 2015 to 2018 in the fuel mix of the dispatched fleet during peak winter conditions showed that nuclear rose slightly while gas and coal declined slightly. Hydro disappeared, and oil increased from 4% to 10% while wind was stable at 2%.

PJM didn’t track the fuel mix during 2014, but the 2015 numbers “were about the same,” PJM’s Chris Pilong said. “We’ve done some checks.”

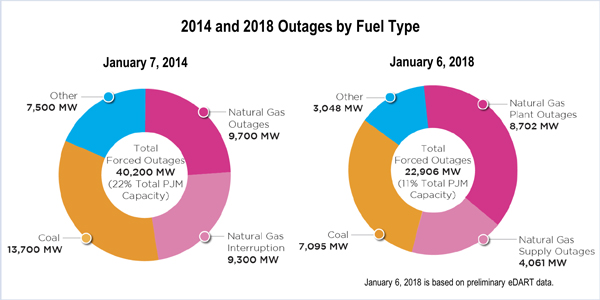

Outages also decreased from their peak periods in 2014 to 2018. Outages that peaked at 40,200 MW on Jan. 7, 2014, were cut nearly in half during the peak period during the cold snap earlier this month. Outages on Jan. 6, 2018, totaled 22,906 MW. Coal outages decreased by roughly 6,600 MW to 7,095 MW, while overall gas outages similarly dropped about 6,200 MW to nearly 12,800 MW.

PJM CEO Andy Ott briefed the Senate Energy and Natural Resources Committee on the data last week. (See related story, FERC, RTOs: Grid Performed Better in Jan. Cold Snap vs. 2014.)

PJM not Done on UTCs

PJM staff plan to push back on a recent FERC order that denied the RTO’s plan for allocating uplift costs to up-to-congestion (UTC) virtual transactions. The move, part of which could include asking FERC to temporarily prohibit UTC trading, elicited disapproval from financial stakeholders.

“We essentially believe that FERC inserted its own judgement as to what was more just and reasonable than something else,” PJM’s Bresler said. “We believe they erred in doing so.” (See FERC: PJM Uplift Proposal for UTCs Falls Short.)

PJM will be requesting rehearing on the order, arguing that FERC’s logic is flawed in determining that it’s unfair to allocate uplift to UTCs in the same way it is applied to incremental supply offers (INCs) and decrement demand bids (DECs). Once an UTC clears, Bresler said, “substantively, there is exactly zero difference.”

Because UTCs are a voluntary product, Bresler said PJM is “very seriously considering” asking FERC to suspend them until there’s an approved way to allocate uplift to them.

“We think the current situation is inequitable … and as such, we think we need to deal with that as soon as we possibly can,” he said.

Several stakeholders, including Monitor Bowring, Susan Bruce of the PJM Industrial Customers Coalition and Joe DeLosa of the Delaware Public Service Commission, supported PJM’s plan, but financial traders criticized its characterization of UTCs as voluntary.

“I think the biggest substance is PJM is thinking about terminating a product that provides benefit to the stakeholders,” DC Energy’s Bruce Bleiweis said.

“That, we believe, has not been proven at all,” Bresler responded.

Vitol’s Joe Wadsworth suggested using an uplift allocation philosophy that FERC has previously outlined.

“I think you would get a lot of support from stakeholders on something like that,” he said.

Stakeholders Approve Variety of Actions

Stakeholders endorsed by acclamation several manual revisions and other operational changes:

- Manual 38: Operations Planning. Revisions developed from periodic review to include protection system/relay communication outages and PJM assessment of impact.

- Manual 40: Training and Certification Requirements. Revisions developed to accommodate new exams and other training changes.

- Tariff and Reliability Assurance Agreement revisions associated with the demand response subcommittee proposal for the relevant electric retail regulatory authority (RERRA) review of energy efficiency resource participation in the capacity market. (See “Rules Endorsed for Enforcing Regulator Requirements on EE,” PJM MIC Briefs: Jan. 10, 2018.)

- A problem statement and issue charge at their first reading to address how gas-fired generators should be compensated if PJM orders them to switch to alternative fuel sources, such as oil or a different pipeline. (See “Emergency Pipeline Switching Instructions Sparks Rights Debate,” PJM MIC Briefs: Jan. 10, 2018.)

Members Committee

Stakeholders Endorse Proposals

Stakeholders endorsed by acclamation the committee’s consent agenda along with several other Operating Agreement and Tariff changes:

- Tariff revisions related to the procedures associated with the study of transmission service requests and upgrade requests in the new services queue process. (See “Interconnection Study Process to be Rearranged,” PJM Planning/TEAC Briefs Oct. 12, 2017.)

- Tariff and Reliability Assurance Agreement revisions also endorsed by the MRC (see above).

FTR Revisions Approved over Financial Dismay

Members endorsed revisions resulting from special sessions on financial transmission rights issues, but not before financial stakeholders lodged one final critique. Two of the less controversial sets of revisions — to address changes to long-term FTR modeling for future transmission expansion and streamlining management of overlapping FTR auctions — were endorsed by acclamation, while the final set required a sector-weighted vote. The revisions allocating any surplus funds from day-ahead congestion and FTR auction revenue were endorsed with a vote of 3.94 in favor out of 5. (See “FTR Changes in the Works,” PJM MIC Briefs: Dec. 13, 2017.)

“Those who bear the risk of FTR revenue shortfalls should also receive the benefit of FTR excesses,” Bleiweis said. “We’re getting away from that. … We’re going to end up with another series of protests before the commission.”

Wadsworth argued that PJM would be better served by allocating more auction revenue rights to transmission customers prior to the year so they can preserve their tradeable rights, rather than “just moving money around at the end of the planning year.”

Though ‘Not Perfect,’ Incremental Auction Changes Endorsed

Members endorsed proposed revisions to the Incremental Auction process with a sector-weighted vote of 3.38 in favor out of 5. The revisions would reduce the number of IAs from three to two following each Base Residual Auction. PJM says the change will reduce the opportunities for BRA sellers to “shop” for the cheapest replacement capacity while allowing them to cure a physical inability to satisfy their commitments. (See “Incremental Auction Revisions Endorsed,” PJM Markets and Reliability Committee Briefs: Dec. 21, 2017.)

“It’s not the perfect, from anyone’s perspective,” Bruce said, but she urged members to endorse it as a “really quite good and, in fact, just and reasonable” alternative.

— Rory D. Sweeney