By Amanda Durish Cook

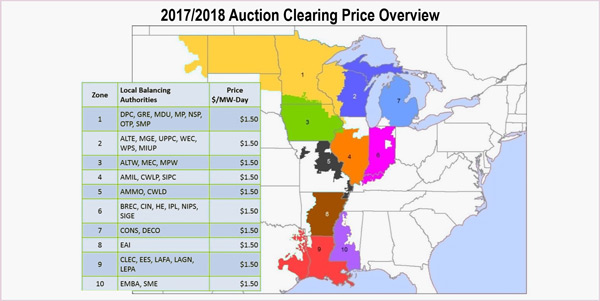

All 135 GW worth of capacity procured across 10 local resource zones in MISO’s fifth annual Planning Resource Auction cleared at $1.50/MW-day, a vast departure from the regional disparities of the last two years, when prices rose as high as $150.

MISO said the results for planning year 2017/18, which begins June 1, are reflective of new supply and lower demand in the Midwest.

“The 2017-18 auction results reflect a net regional increase in supply compared to last year’s results,” said Richard Doying, MISO executive vice president of operations. “Even as the generation fleet continues to evolve, the level of available resources positions the region well for reliable operations in the coming year.”

Because there were no binding constraints between the zones, all zones’ prices were set by an offer submitted by a resource in Zone 1, which encompasses parts of Wisconsin, Minnesota and the Dakotas, Doying said.

The year’s “uneventful” results were a function of more supply and less demand, and the lack of constraints. “When you combine those two, you get lower prices and uniform prices. … It doesn’t take much to have a significant impact on the clearing results,” he said during an April 14 press conference.

Doying also said results weren’t surprising given that even a small uptick in supply or a small reduction in demand can drop prices.

Capacity Needs Drop by 730 MW

MISO experienced an overall 730-MW decrease in capacity requirements, resulting from a roughly 1,000-MW decrease in MISO Midwest’s requirement and an approximate 300-MW increase in MISO South, indicative of regional economies, Doying said.

At an April 14 stakeholder conference, energy attorney Valerie Green of Michael Best & Friedrich asked if MISO had an explanation for the decline in load. MISO Manager of Resource Adequacy John Harmon said economic slowdowns were consistent across zones that experienced load declines.

Doying said this year’s offers included more demand, energy efficiency, solar and wind resources than the 2016/17 planning year auction. Auction results were reviewed and certified by MISO’s Market Monitor; no mitigation was required.

The single clearing price is in stark contrast to the RTO’s last two PRAs. In the 2016/17 auction, MISO South cleared uniformly at $2.99/MW-day and almost all of MISO Midwest cleared at $72/MW-day, with Zone 1 the lone outlier at $19.72/MW-day. (See MISO’s 4th Capacity Auction Results in Disparity.) MISO said last year’s disparate results were a product of retirements and capacity exports. This year’s clearing price also represents a hundred-fold decrease from the $150/MW-day price in Illinois’ Zone 4 in the 2015/16 planning year auction.

Illinois Clean Jobs Coalition spokesman Billy Weinberg said the 2017/18 auction results are evidence that market forces are favoring energy efficiency and more affordable renewables. “Now is the time to begin planning for new investments and jobs in Central and Southern Illinois in cleaner technologies like energy efficiency, wind and solar energy that grow cheaper by the day and improve public health,” he said.

MISO also said the prices were a result of the improved transfer capability between zones. MISO’s South-to-Midwest export constraint increased from 876 MW last year to 1,500 MW this year; the Midwest-to-South limit increased from 2,794 MW to 3,000 MW. (See MISO to Use Same Sub-Regional Limit Rules for 2017/18 PRA.)

This year, the RTO’s maximum offer using the cost of new entry ranged from $246/MW-day for Zone 10 in Mississippi to $265/MW-day for Zone 5 in eastern Missouri.

In March, MISO predicted that all local resource zones would have enough capacity to meet their individual clearing requirements, with 172 GW worth of total installed capacity easily meeting the RTO’s 135-GW planning reserve margin requirement. (See “Preliminary PRA Data Show Capacity Excess,” MISO Resource Adequacy Subcommittee Briefs.)

Harmon said auction results will be presented to stakeholders in a more detailed presentation at the May 10 Resource Adequacy Subcommittee meeting.

In a research note Friday, UBS Securities analysts Julien Dumoulin-Smith and Jerimiah Booream called the results “a material disappointment for MISO, sending prices back to their historic lows of 2012 and 2013. … This will prove difficult to shift out of given the impacts from [the Mercury and Air Toxics Standards] and other environmental regulations that drove the improvements in prior periods.”

UBS had predicted prices would clear no lower than $12/MW-day. The analysts said prices would have been closer to $10/MW-day based on the lower demand but that the offer curve was also “flatter” because of Illinois’ approval of zero-emission credits for Exelon’s Clinton nuclear plant, which left the company less concerned with maximizing its capacity revenue. “This was the decisive factor in holding prices lower,” they wrote.

Same Auction Process

The auction was unchanged from its usual format, despite MISO’s attempt at a redesign that would have bifurcated the capacity market by holding a forward auction for competitive load three years prior to the prompt PRA. In February, MISO abandoned the changes after a curt FERC rejection. (See MISO Won’t Seek Rehearing on Auction Redesign.)

Doying said MISO has “other priorities” than reviving the Competitive Retail Solution. He said the RTO will continue a discussion about resource adequacy in Michigan and Illinois.

Exelon’s decision to keep its Quad Cities nuclear plant operating — thanks to Illinois’ approval of zero-emission credits to provide the plant additional revenue — has eased some of MISO’s concern, Doying said.

External Zones, Seasonal Classification

That does not mean MISO is dropping plans to improve the PRA. While a possible two-season classification is on ice for the remainder of 2017, the RTO is currently navigating the stakeholder process on creating external capacity pricing zones.

“Industry forces continue to indicate significant shifts in the fleet,” Doying said. “MISO will continue to address seasonal and locational issues with our stakeholders while ensuring that market signals provide incentives for investment where and when they are needed.”

At an April 12 RASC meeting, MISO’s Laura Rauch asked stakeholders how different classes of external resources should be treated. She presented stakeholders with examples of pseudo-tied resources, border resources and coordinating owners such as Manitoba Hydro. She also asked about contracts signed before the formation of the MISO market in 1998 or FERC’s 2012 approval of the PRA construct.

“What is the best method to recognize the contracts of existing resources?” Rauch asked stakeholders.

MISO is also asking stakeholders what rules should dictate external zone pricing. The RTO has proposed that the external zone price be based on the sink of the external resource.

Last month, the Monitor suggested pricing be based on balancing authority boundaries, with resources connected to both sides of Midwest-North constraint receiving a blended price. (See “IMM Offers Own PRA External Zone Design,” MISO Resource Adequacy Subcommittee Briefs.) Rauch said MISO will use stakeholder input to draft Tariff language and address the Monitor’s proposal at the May RASC meeting. Rauch said MISO staff is still evaluating the proposal.

Illinois Municipal Electric Agency’s Rakesh Kothakapu said MISO needed to be careful with pricing, especially considering if external zones continue to be priced low while supply continues to tighten. “We don’t want to end up in a situation where we price them lower even when it has nothing to do with a constraint,” he said.

A seasonal auction classification is beginning to look less certain.

“There’s a general thought that stakeholders aren’t as interested in a seasonal construct as they once were. The informal feedback I’m receiving is along those lines,” RASC Chair Chris Plante said.

In January, some stakeholders said the seasonality proposal had fallen out of favor after MISO revealed design specifics last year. (See MISO Plans Additional Capacity Auction Revamps for 2017.)