RAPID CITY, S.D. — Less than a year after enjoying a 2-cent reduction in SPP’s administrative fee, the RTO’s members are now facing the prospect of a 4-cent hike for 2017.

SPP’s Finance Committee announced the increase during last week’s Board of Directors and Members Committee meeting to minimal pushback. Members — with only three opposing votes — and the board approved the committee’s recommendation to hike the fee’s cap to 43 cents/MWh, which would allow room to raise it from its current 37 cents/MWh to a projected 41.1 cents/MWh.

The board’s approval means staff can file the necessary Tariff changes with FERC.

Staff said the move was necessary because the RTO expects 2016 expenses to exceed revenues by $6.7 million as a result of a 3.7% drop in peak loads since 2015.

SPP is forecasting revenue from the fee will be $5.4 million below budget for the year. Staff said raising the fee’s cap above 2017’s projected level would “accommodate any further reduction in peak load similar to what SPP utilities experienced in 2015.”

The committee said it will review the fee’s billing determinants to see “if a more predictable and equitable basis exists to allocate SPP’s costs of operations to its customers.”

“The admin fee is one of the places where the rubber hits the road,” said Oklahoma Gas & Electric’s Greg McAuley. “We just got done with a rate case, and I can tell you it is very, very difficult to raise rates.”

SPP’s addition of the Integrated System last October was expected to help keep the fee stable. However, the system’s reported loads have been 10% below expectations; SPP projected a 12% increase in transmission load last year with the system’s membership. (See SPP Board Approves Budget, SPC Expansion.)

“We thought we would bring the number down 5 cents with IS, but it actually brought them down by 3,” Board Chairman Jim Eckelberger said.

“The costs in all of this equation didn’t change very much,” SPP CEO Nick Brown said. “The load in the footprint changed a lot, so what we’re collecting from each market participant will be roughly the same, regardless of what that rate is. It’s just the denominator” that changed.

This year’s budget assumed transmission volume of 407.2 million MWh. SPP’s draft 2017 budget projects 395 million MWh.

The Finance Committee said the 2017 budget still includes “several unknowns,” primarily because SPP has just started its 2017 planning process. A final budget will be presented to the board during its December meeting, when members will also vote on next year’s administrative fee.

Committee Chairman Harry Skilton noted that one favorable variable is the scorching summer heat that’s settled over the Great Plains. Skilton said SPP’s manpower costs have resulted in a $1.2 million hit above costs, “but we will carry on.”

Cybersecurity Insurance

Skilton also said cybersecurity insurance is becoming an available product, remarking, “Anything can be insured.” He said his committee will meet with Little Rock-based Stephens Insurance “once that market is a little solidified” as part of SPP’s overall insurance package.

Following the committee’s recommendation, members unanimously approved the selection of SPP’s controls, financial and benefit plan auditors KPMG, BKD and Thomas & Thomas. Members also authorized Brown and CFO Tom Dunn to negotiate the origination of a $30 million line of credit.

First Competitive Tx Project Pulled; ND 345-kV Line Approved

SPP members and its board wasted little time in approving the withdrawal of SPP’s first competitive project under FERC Order 1000, the 22.6-mile, 115-kV line from Walkemeyer to North Liberal in southwest Kansas. (See SPP Cancels First Competitive Tx Project, Citing Falling Demand Projections.)

The group also approved modifying Basin Electric Power Cooperative’s notice to construct (NTC) for a 33-mile line between two substations in western North Dakota. The modification will allow Basin Electric to build the Kummer Ridge-Roundup project — part of a larger project that is already under construction — as a 345-kV line, a motion rejected two weeks ago by the Markets and Operations Policy Committee.

The project is expected to cost $45 million as a 345-kV line, compared to $24.9 million at 115 kV. Staff determined the 345-kV version performed better over a 10-year planning horizon, given projected 2.5% annual load growth driven by the nearby Bakken shale play.

Mike Risan, Basin Electric’s senior vice president of transmission, called the region the “sweet spot of the Bakken,” though field loads have proven to be volatile with the price of oil.

“The load is still coming here,” he said. “We have a pent-up demand from a number of wells already drilled and waiting to frack.”

Several members questioned whether Basin Electric was trying to run around SPP’s planning process by having the project — which was planned before the utility joined the RTO last year as part of the Integrated System — zonally allocated when it could be considered a regional project.

“We’re not trying to beat the system,” Risan said, saying the company was balancing serving load, planning for the future, transitioning to SPP and understanding new processes at the same time.

Bob Harris, senior vice president and regional manager of the Western Area Power Administration’s Upper Great Plains Region, stuck up for his fellow new member.

“The IS facility inclusion process was more restrictive than the SPP planning process,” he said. “I would submit if we had been part of SPP and part of SPP’s planning process back when we began this plan, it would have been in the SPP plan. It’s only because of the transition [to SPP] that we’re in this dilemma.”

SPP’s vice president of engineering, Lanny Nickell, said staff did not previously identify Kummer Ridge-Roundup as a “regionally needed” project, and it believes the project should be treated as a sponsored upgrade. “We didn’t determine any regional needs in the study.”

However, Nickell acknowledged that with its increased capacity, the line could have benefits that address regional needs identified in SPP’s Integrated Transmission Planning’s 10-year assessment.

“As I understand our model-build process, this project was not assumed to be built at 345, so it’s possible some of those ITP10 needs will go away.”

Most members agreed with the 345-kV solution. “I think that’s the best plan of action,” Xcel Energy’s Bill Grant said.

The board altered another MOPC recommendation from two weeks ago when it delayed until next quarter a decision to withdraw an NTC for American Electric Power’s $31 million rebuild of a 69-kV line in West Texas. Nickell said SPP is working to confirm AEP’s contention that the line suffers from congestion, saying reliability coordinators have not been able to observe the congestion in real time.

“AEP has addressed congestion on the line locally. Our findings may not necessarily change our recommendation to the board, but the situation warrants further investigation to accurately identify the frequency and significance of the congestion,” Nickell said.

The board and members also unanimously approved issuing an NTC for AEP’s rebuild of a 138-kV line near Shreveport, La. The project was initially expected to require a reactor, but that NTC was withdrawn, saving $3.55 million.

SPP Making FERC-Directed Changes to MMU

Oversight Committee Chairman Josh Martin told the board and members that SPP’s Market Monitoring Unit is well into the process of implementing changes recommended by FERC’s recent audit of the unit’s independence.

The commission last month released a report on its 17-month inquiry into the MMU, listing 16 recommendations to improve its independence. (See FERC Calls for Changes to Protect SPP Market Monitoring Unit Independence.)

Martin said the committee has begun holding “MMU-only” meetings, “consistent with the direction we got from FERC.”

He also said SPP has begun plans for the physical separation of the MMU from RTO staff, also recommended by FERC. Martin said it would be similar to the Regional Entity’s setup with SPP’s headquarters building, which requires key-card access and only allows RTO employees entrance when accompanied by an RE employee.

“There were a number of findings and recommendations that frankly were minor, in my opinion, considering the length of time and resources that went into this audit,” Martin said. “We were able to demonstrate we have a good structure and operate efficiently.”

CEO Brown noted FERC found no instances of the RTO “exerting inappropriate influence” on the MMU.

The committee has also begun discussing plans to replace MMU Director Alan McQueen, who has agreed to delay his retirement until 2017.

MMU Shares Draft State of the Market Report

McQueen shared a draft report of the MMU’s 2015 State of the Market report, the second such evaluation since the Integrated Marketplace went live in 2014.

According to the report, the Integrated Marketplace is a “significant maturing” market reflected in high levels of participation, lower levels of make-whole payments and mitigation compared to other markets, and a modest level of scarcity pricing. The MMU said the market was affected by continually declining natural gas prices, increasing wind generation capacity and output, and declining levels of overall congestion, but with increased congestion in wind-generation areas.

Golden Spread Electric Cooperative’s Mike Wise disagreed with the report’s assertion that a “vast majority” of market participants running combustion turbines are able to recover their avoidable operations and maintenance costs.

“That is just not true. One of the reasons make-whole payments are so low is because you’re not allowing combustion turbines to get those start-up charges,” Wise said. “You have the view these are long-term charges. Is there an opportunity for us to continue this dialogue, not just Golden Spread, but all market participants?”

“We’ve had this discussion about the differences between what’s being used in mitigation and what’s being collected by any resource,” McQueen responded. “My disagreement with your interpretation of variable O&M is different when it comes to short run.

“I’ll reiterate my offer to look at specific units,” he continued. “If someone wants to come forward and have us look at those costs and see whether there’s adequate revenue on an annual basis, we’d love to have that conversation. The MMU can’t do it alone.”

Eckelberger closed the discussion by suggesting to McQueen that the final report include language indicating “the membership doesn’t agree with your conclusion.”

Board Approves Maher, Whitley as New RE Trustees

The board doubled the size of the RE’s trustees by approving the nomination of industry veterans Mark Maher and Stephen Whitley. The two were selected from an initial field of 22 candidates and will join Dave Christiano, the trustees’ chair, and fellow trustee Gerry Burrows.

“The two best candidates we thought we had,” Christiano told the board and members.

Both new trustees bring ample RTO leadership experience, Maher as former CEO of the Western Electricity Coordinating Council, and Whitley as NYISO’s former president and CEO and ISO-NE’s former COO.

Maher retired from WECC in 2014 after eight years of service. Before that, he was vice president of transmission services for PacifiCorp, where he was responsible for strategic and operational planning, developing transmission policy and ensuring FERC compliance. He also served as senior vice president at the Bonneville Power Administration. He is a graduate of the University of Washington.

Whitley served as NYISO’s CEO between 2008 and 2015 and was the COO and a senior vice president at ISO-NE from 2000 to 2008. He also spent 30 years at the Tennessee Valley Authority after earning an electrical engineering degree from Tennessee Technological University. He is a retired colonel in the U.S. Army Reserve.

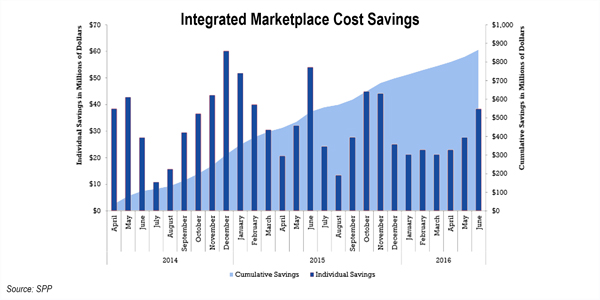

Brown: Market Savings to Top $1B Before Year’s End

Brown said the Integrated Marketplace is on track to top $1 billion in accumulated savings by year-end. During his regular report, Brown said the markets yielded $802 million in net savings in 2014-15, after having opened in March 2014.

SPP did not add any new market participants during the quarter. The markets currently have 172 participants, with 110 registered as financial-only and 62 as asset-owning.

Brown also said SPP has responded to the Mountain West Transmission Group’s request for proposal to develop an organized market. The group consists of a number of SPP members. (See Mountain West RTO Could Pose Competition for CAISO.)

Consent Agenda

The board’s consent agenda included issuing an NTC for a 17-mile, 115-kV line in West Texas (Mustang-Seminole) that was identified as a short-term reliability project in the 2016 ITP Near-Term assessment. The project could have been competitively bid, but because it has short-term reliability needs, it was awarded to the incumbent.

The board also re-set the baseline costs for a pair of projects both more than 20% under budget: a 69-kV Westar Energy rebuild and a 138-kV Mid-Kansas Electric transmission project.

The board also approved modifications to NTCs for four network upgrades, reducing the required emergency ratings, and approved a modification to a Nebraska Public Power District NTC for a new 345/115-kV transformer and a 22-mile, 115-kV line that resulted in no price change.

Eight revision requests were included on the consent agenda:

- MWG-RR 7 MPRR155, revising instructions for dispatching generators out of merit order into two categories: reliability issues and emergency conditions.

- MWG-RR 153, eliminating the requirement that market participants make two separate submissions for a single intraday change.

- MWG-RR 161, changing the method for calculating make-whole payments for multi-configuration combined cycle resources; the new rules allow use of a netting approach in calculating the commitment-level costs eligible for recovery.

- MWG-RR 166, removing references from the protocols and Tariff to the interim transmission congestion rights process developed for the transition into the Integrated Marketplace.

- MWG-RR 167, avoiding Tariff violations resulting from the incorrect submission of annual revenue rights or TCRs.

- ORWG-RR 159, moving requirements regarding the outage-coordination function into SPP Operating Criteria Appendix OP-2 “Outage Coordination Methodology,” eliminating redundant language elsewhere.

- RTWG-RR 160, clarifying the ITP manual to note which generation interconnections and associated upgrades are required to be modeled in ITP assessments.

- RTWG 163, correcting Tariff language to specify that the ITP manual includes references to requirements.

RR 165, which removes references to the retired Mitigated Offer Task Force from the Tariff’s Appendix G, was removed from the agenda because it does not require board approval.

– Tom Kleckner