MISO has settled on a probability weighting for the futures analysis in its 2017 Transmission Expansion Plan, with existing trends given 31% consideration, policy regulations given 43% and accelerated alternative technologies receiving 26%.

The RTO relied on stakeholder feedback to tweak the weighting and used an average of weighting that each sector recommended. MISO had originally proposed using a 30% weighting for existing trends, 40% for policy regulations and 30% for accelerated alternative technologies. (See “MTEP 17 Futures Process Enters Stakeholder Inspection,” MISO Planning Advisory Committee Briefs.)

MISO’s J.T. Smith said stakeholder feedback played a major role in developing the final weightings, and stakeholders said the process has gone well.

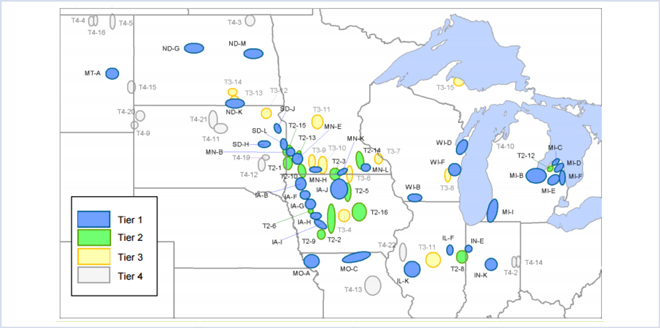

The RTO also released its refinements to the MTEP 17 futures siting methodology, vowing to represent zonal resource adequacy requirements and solar and expanded wind zones and develop distributed generation siting methodology. It will consider National Ambient Air Quality Standards nonattainment areas in the siting process.

MISO will share final MTEP 17 capacity forecasts and siting locations at the September Planning Advisory Committee meeting and is urging participants to submit comments in early August.

With a number of plant shutdowns looming in the next five to 15 years, MISO is also looking to improve its generation retirement sensitivities beginning with MTEP 17. The RTO is proposing to consider age-based retirements of coal, oil and gas units in the five-year MTEP reliability assessment. The study will identify necessary projects that will require lead times of more than five years and low-cost upgrades that can be implemented in advance of retirements, said Neil Shah, a seams administration adviser at MISO. The analysis would assume a lifespan of 65 years for coal plants and 55 years for oil- and gas-fired facilities, but would not assume any for nuclear stations.

The proposal received substantial inquiry and criticism from participants, who said it could be redundant and presumptuous. Among the concerns were questions about whether this planning was addressed in existing protocols and how MISO chose specific parameters, such as the plant lifespans. The plan also doesn’t currently address non-transmission alternatives to avoid engaging system support resources.

MISO contends the study could eliminate the need for an SSR agreement for most generation retirements. Staff is requesting stakeholder input on the study enhancements by Aug. 3.

The RTO is also requesting that feedback on the MTEP 17 scope be submitted by September. A summary of the feedback will be presented at the October Planning Advisory Committee meeting and the project’s scope will be adjusted by the end of the year. Beyond core studies to maintain reliability of the system, which are required by FERC and NERC, the MTEP includes targeted studies to optimize market efficiency. Participants may make requests for the targets of those studies; however, not all of them may be able to be accommodated. All feedback should be sent to Adam Solomon.

Meanwhile, a first draft of MTEP 16 is set to be released for external review by MISO on Aug. 8, with stakeholder review and comments expected to roll in by Aug. 22. The draft has been circulating within MISO since July 22. A second draft is slated for release on Sept. 19, with PAC review on Sept. 28 and a vote on Oct. 19. The timeline is aimed for approval at the Dec. 8 Board of Directors meeting.

As of the second quarter of this year, MISO reports there are 633 active MTEP projects totaling $11.1 billion. Another 130 projects valued at $1.9 billion are under construction, while 11 MTEP-approved projects, at $200 million, have been withdrawn. By the end of 2016, MISO expects another $2.5 billion worth of projects to be operational.

Duff-Coleman Selection Moves into the Evaluation Phase

MISO staff is conducting a tariff-required completeness check of developer proposals for the Duff-Coleman transmission project, the RTO’s first Order 1000 competitive solicitation. The identities of the bidders will be released by Aug. 19. Project selection is expected by Dec. 30.

Competitive Transmission Protocol Modifications

MISO is requesting feedback on proposed modifications to Business Practices Manual 20 and 27 and a draft joint functional control agreement.

The BPM 20 modifications would adjust status reporting requirements for market-efficiency and multi-value projects and create variance analysis requirements. MISO Transmission Owners and Wisconsin Electric submitted comments during a previous request for feedback. The BPM 27 modifications would change timing and deadlines for various steps in the RFP process.

The agreement ensures that MISO retains functional control of transmission infrastructure if a portion of the transmission owners decide to leave MISO. All comments or questions are requested by Aug. 3 and should be sent to TDQS@misoenergy.org.

Merchant HVDC Task Team Proposed

The Interconnection Process Task Force is proposing the development of a task team to develop HVDC interconnection procedures. The Merchant HVDC Task Team would meet at least monthly from August through December and report on its activities at PAC meetings.

MISO Tries to Please FERC with Second Attempt at Queue Reform

In another bid to win FERC approval for its interconnection queue reform, MISO plans to cut an initial milestone payment by $1,000/MW of new capacity and assess subsequent milestone payments based on a percentage of upgrade costs.

The revised M2 milestone would become a flat charge of $4,000/MW of new capacity instead of the proposed $5,000/MW. The M3 and M4 milestones will be redefined as 10% and 20% of upgrade cost, respectively.

MISO said it will define the upgrade cost the same way it does in the initial payment section of its generation interconnection agreement, which includes network upgrades, distribution/generator upgrades and TOs’ interconnection facilities and system protection facilities.

MISO said the revised milestone payments will be applied toward the GIA initial payment. It also said it will settle any over- or underpayment after it completes a final facility study.

The RTO plans on posting Tariff redline changes for stakeholder review on July 29 and wants to file the revised queue process at the end of October for a Jan. 1 effective date.

If the new batch of adjustments is accepted by FERC, MISO plans on transitioning completely to the new queue beginning with projects that enter next August.

In March, FERC rejected MISO’s proposed changes, calling the revised milestone payments a barrier to entry and rebuffing the RTO’s explanation that the current project backlog was due to “speculative” projects. (See MISO Queue Changes on Hold Pending Technical Conference.)

So far in 2016, MISO has received 105 new queue requests representing a possible 16.9 GW, and the RTO reports that 12 projects worth 1.9 GW have newly signed interconnection agreements.

MISO is also proposing to move two study deadlines four months ahead under Business Practices Manual 15, which governs generator interconnection. Under the changes, MISO’s annual interim deliverability and energy resource interconnection service studies would be completed by Oct. 31 instead of the current June 15.

“We did not meet [the current deadline] this year, and we did not meet it last year,” said Tim Aliff, MISO’s director of resource interconnection and planning.

— Amanda Durish Cook & Rory D. Sweeney