Stakeholders discussed new proposals to revise PJM’s capacity market and discussed updates to the RTO’s risk modeling methodology during a meeting of the Critical Issue Fast Path (CIFP) process July 17.

The meeting included a second proposal from Daymark Energy Advisors and the East Kentucky Power Cooperative (EKPC) that would modify PJM’s proposal and a presentation from American Municipal Power (AMP) that suggested several changes to the Independent Market Monitor’s proposal.

Daymark CEO Marc Montalvo described its second joint package with EKPC as a trimmed-down version of the PJM proposal, with changes including retaining the annual Base Residual Auction structure instead of moving to a seasonal auction and preserving the fixed resource requirement structure. (See “Daymark and EKPC Propose Base and Emergency Capacity,” PJM Completes CIFP Presentation; Stakeholders Present Alternatives.)

While the proposal retains PJM’s proposed marginal effective load-carrying capability (ELCC) accreditation model, Montalvo said it’s not the preferred long-term solution for a forward market structure as more renewables come online.

The proposal would use an hourly reimbursement model that would pay resources for the capacity they provide in each hour of a delivery year, meaning they would offer their committed capacity into the real-time and day-ahead markets and follow dispatch. Generators would not be paid for their capacity for hours in which they do not do so.

Natural gas resources that have an offer in the markets but are called on too late to nominate for fuel according to the gas pipeline procurement timelines would retain their capacity commitment. Montalvo said the interaction between the gas and electric timelines are an operational issue and ensuring that dispatch doesn’t conflict would be PJM’s responsibility.

Resources would be able to engage in bilateral contracts to meet their capacity obligations and would be expected to do so when prolonged outages are anticipated.

Montalvo said the objective in drafting the proposal was to create a penalty framework that incentivizes performance without jeopardizing the viability of long-term resources when they’re assessed.

AMP Suggests Changes to Monitor Package

AMP’s Lynn Horning gave an overview of several changes the organization believes would build on the sustainable capacity market design proposed by the Monitor.

AMP has its own CIFP proposal that would create subannual accreditation and replace the Capacity Performance penalty construct with a reward and penalty system built around testing performance and providing “pay as you go” capacity payments. (See “AMP Seeks Subannual Accreditation,” PJM Stakeholders Refine CIFP Capacity Market Proposals.)

Horning said the Monitor’s proposal has the benefit of focusing on defining demand for each hour and matching that with adequate load. It also includes locational elements and simplifies the auction clearing process. She said the Monitor’s proposal to create a new accreditation model, the modified equivalent availability factor, also is preferable to PJM’s marginal ELCC approach because it avoids the latter’s interactive effects and improving the focus on real-time operations.

The changes to the Monitor’s proposal made by AMP include allowing natural gas generators to submit start, notification and minimum run time parameters on a shorter time frame based on pipeline conditions and to permit them to reflect a wider breadth of costs related to pipeline service in capacity or energy offers.

The AMP proposal also calls for retaining energy efficiency resources in the capacity market — the Monitor’s package would remove them — and differentiating the availability of demand- and supply-side demand response resources.

Planned capacity resources would be required to notify PJM if they plan to submit an offer in the BRA prior to the posting of the planning parameters for that delivery year, which has been a topic of stakeholder discussion since the absence of planned resources in the 2024/25 BRA was attributed to PJM delaying the release of auction results last year. Resources that do not indicate that they plan to participate in the auction would be permitted to offer only energy bids. (See FERC OKs PJM Proposal to Revise Capacity Auction Rules.)

AMP also called for a second CIFP phase to discuss holding BRAs closer to their associated delivery year, creating a subannual procurement system with time-of-day procurement assessments and exploring additional ways of creating comparability between the capacity market and FRR systems.

PJM Updates Risk Analysis Figures

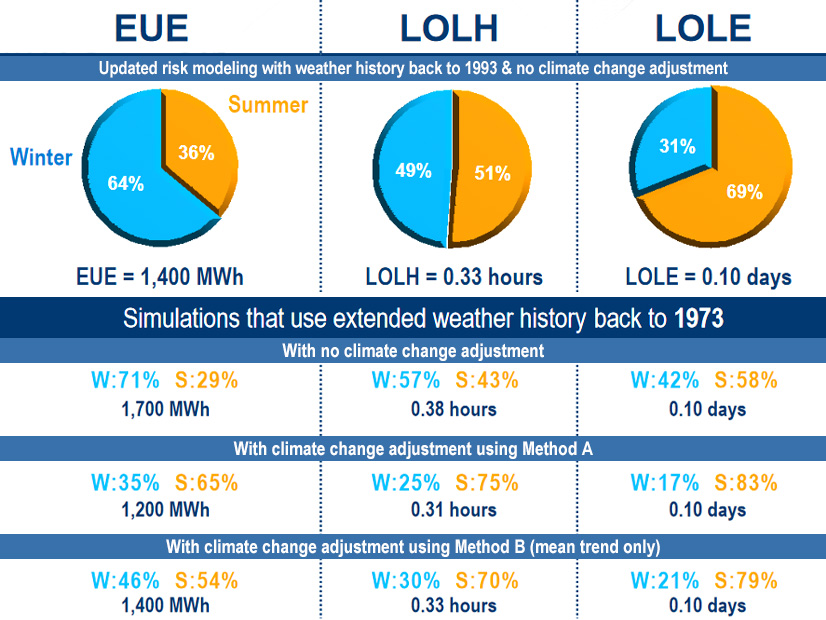

PJM also presented updated reliability risk modeling figures, aiming to capture a broader range of threats to reliability and evaluate the differences between how an expected unserved energy (EUE) method of deriving the requirement would capture risk and the status quo loss-of-load expectation. (See PJM Continues CIFP Discussion of Seasonal Capacity Market Proposal.)

The new data pare back the preliminary findings PJM presented at the May 30 CIFP meeting, which showed a sharp shift in risk toward winter, particularly under the EUE model. While the new data still have risk concentrated in the winter, the season now makes up only about 64% of the risk under the baseline model, rather than the 96% in the preliminary data.

The presentation also included three additional models that include a longer historical weather lookback — going back 50 years instead of 30 — and two adding in climate change adjustments as well. The longer historical lookback increases the winter risk to 71%, but the two climate change variants both swing risk back to being predominantly in the summer.

Method A, which results in the higher summer risk, estimates the trend that climate change is having on seasonal minimum, mean and maximum temperatures to create adjustments that are applied to historical temperatures to consider how past weather would manifest under future climate conditions. Method B follows the same system, but only for mean temperatures.