RENSSELAER, N.Y. — Demand response providers in NYISO last week expressed concern that proposed market rule changes will harm the economics of special case resources (SCRs).

“This has not been a good week for demand response,” said Aaron Breidenbaugh, senior director of regulatory affairs at CPower Energy Management, which aggregates demand response and distributed energy resources.

Breidenbaugh’s comment came at the Oct. 26 Installed Capacity/Market Issues Working Groups meeting, where the ISO presented proposed modeling changes that could significantly cut capacity accreditations for SCRs. It followed the Oct. 25 Management Committee meeting, where Potomac Economics, the ISO’s market monitoring unit, proposed that the ISO compensate some capacity suppliers based on their contribution to transmission security, which could also reduce payments to SCRs.

SCRs are demand-side resources whose load can be interrupted at the ISO’s direction or behind-the-meter generators rated 100 kW or higher that can reduce load on the transmission or distribution system.

The ISO says its current modeling of SCRs in the installed reserve margin (IRM), locational capacity requirement (LCR) and capacity accreditation studies is not aligned with SCRs’ actual performance.

It proposes to model SCRs as duration-limited resources with hourly response rates based on historical performance beginning in the 2025/26 capability year. In the interim, the ISO said it will treat SCRs as part of the four-hour energy duration limited capacity accreditation resource class. (See NYISO Previews Capacity Accreditation Modeling Work.)

Breidenbaugh said the ISO’s proposed changes could cut capacity accreditation of SCRs by 20%. He said his company will seek a change in the SCR program “to move from four hours to some other number … in order to avoid gutting the SCR program.”

Breidenbaugh said Potomac’s proposed changes would reduce the payments to SCRs even more than is being contemplated by changes to accreditation rules, saying, “I’d prefer having my revenues reduced by 50% as opposed to 75%, but neither one of them is terribly attractive.”

Breidenbaugh said he’s received “mixed signals,” from the ISO on potential changes to the SCR program, citing NYISO CEO Rich Dewey’s comments at the Multiple Intervenors annual meeting about being willing to make SCR programs more flexible when previous NYISO presentations had suggested no such flexibility. He also cited statements by officials of the New York State Energy Research and Development Authority at the Alliance for Clean Energy New York annual meeting about “how important demand response is and how we aren’t going to meet the requirements in the CLCPA [Climate Leadership and Community Protection Act] without significantly greater demand-side flexibility.” (See Mood Anxious as Renewable Energy Industry Gathers in NY.)

He added that the ISO has made clear “that the future of demand response is the DER participation model — not getting rid of [the SCR program] but [NYISO is] making it so unattractive that the only alternative is to go into the DER participation model.”

The ISO’s DER and aggregation participation model, which will allow heterogenous groups of technologies to be compensated for services that they can provide collectively, was approved by FERC in January 2020 (ER19-2276). (See NYISO DER Participation Model Gets FERC OK.) On Oct. 19, the ISO informed FERC that it would not be implementing the DER participation model until the commission acts on companion tariff changes in docket ER23-2040.

Engaging the Demand Side

Adam Evans, a staffer at the New York Department of Public Service, also expressed concern. Although the ISO’s Short-Term Assessment of Reliability report for the third quarter identified a need to respond to new loads and shrinking margins, he said, “there’s really not much coming out of the Engaging the Demand Side effort,” an initiative to identify problems or gaps in the ISO’s existing demand side programs.

“I am really concerned about the long-term viability of the SCR program,” said Jay Goodman, an attorney with Couch White, which represents large consumer stakeholders. “It seems that with every change layered onto the modeling, the impact generally seems to be in the direction of decreasing [SCRs’] capacity value.

“Our expectation is that SCRs being available is increasingly important, and so it doesn’t make sense to have a … market rule change at a time when we think we need to be able to rely on them more,” Goodman said.

In a presentation in September on the Engaging the Demand Side initiative, the ISO said it was not seeking to eliminate the SCR program but to respond to stakeholders’ requests to modify SCR rules so that resources are compensated for their true operating capabilities.

The ISO said some SCRs can respond to events more frequently than others, and with less than the current 21-hour advance notification requirement. Some also can operate for up to eight hours. “In short, some resources have expressed that they are more flexible than the SCR program allows, but not flexible enough to fully participate in the DER program on dispatch,” the ISO said.

The ISO said it would prefer to modify the DER participation model to tailor it to SCR operating characteristics rather than expanding the SCR program. Unlike the SCR program, which relies on manual actions by NYISO operators, demand-side resources in the DER model are automatically scheduled and dispatched based on the economics of their bids.

Maddy Mohrman, NYISO capacity market design specialist, told the ICAP/MIWG that “the goal of this project really is to come up with a modeling that just better represents the [SCR] program today.”

NYISO will bring the results from its enhanced SCR modeling to the Nov. 1 meeting of the New York State Reliability Council Installed Capacity Subcommittee, which may vote to recommend changes be implemented into future IRM/LCR modeling.

MMU Recommendation

Breidenbaugh said SCRs could also lose revenues under Potomac Economics’ suggestion to the Oct. 25 MC meeting that NYISO implement proposal No. 2022-1 from the MMU’s May State of the Market report.

Potomac’s Pallas LeeVanSchaick reiterated the monitor’s recommendation during a discussion of NYISO’s draft annual Comprehensive Reliability Plan, which the MC recommended be approved by the Board of Directors.

The CRP said that although the probabilistic resource adequacy analysis did not identify any reliability needs, the deterministic transmission security analysis predicts a deficiency for New York city starting in 2031 if the New York Power Authority’s small gas plants, totaling 517 MW, retire without replacement resources.

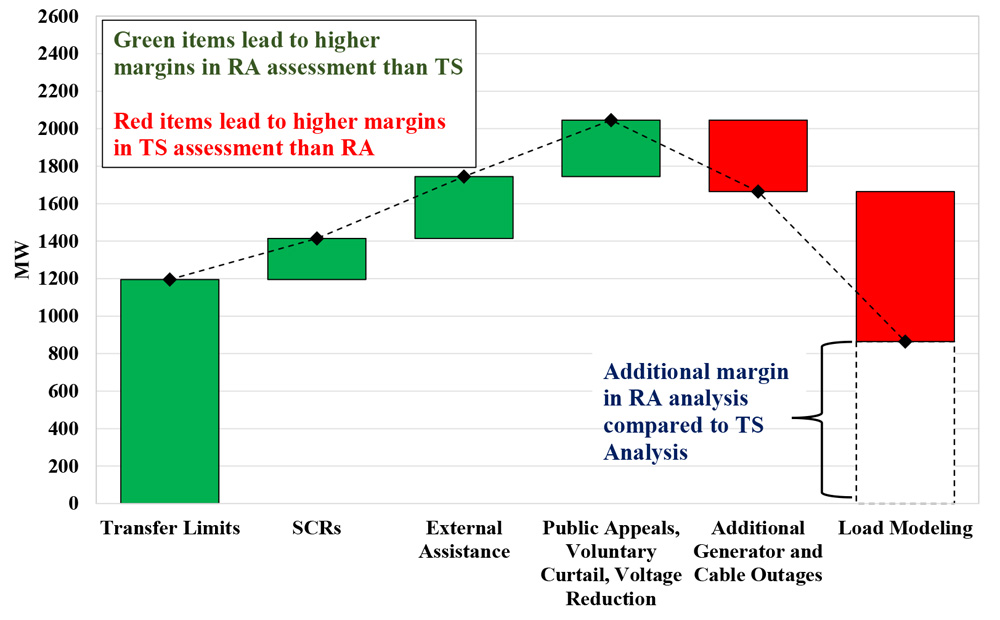

The MMU’s memorandum summarizing its comments on the CRP’s resource adequacy assessment assumes that up to 1,180 MW of “emergency” resources in New York City for 2025, including 219 MW of SCRs. The transmission security assessment does not include emergency actions.

The MMU’s State of the Market report found that SCRs and large resources whose size causes the transmission security planning contingency to increase “provide limited value towards satisfying reliability requirements based on transmission security criteria.”

“Transmission security requirements are increasingly likely to cause higher [locational capacity requirements], especially in New York city. When this occurs, SCRs and large resources will be overcompensated and have inadequate incentives to take actions that would improve system reliability. In the upcoming 2023-24 capability year, we estimate that large resources and SCRs in New York City could be over-compensated by up to $52 million. (See NYISO MMU Calls for Improved Shortage Pricing, More Capacity Zones.)

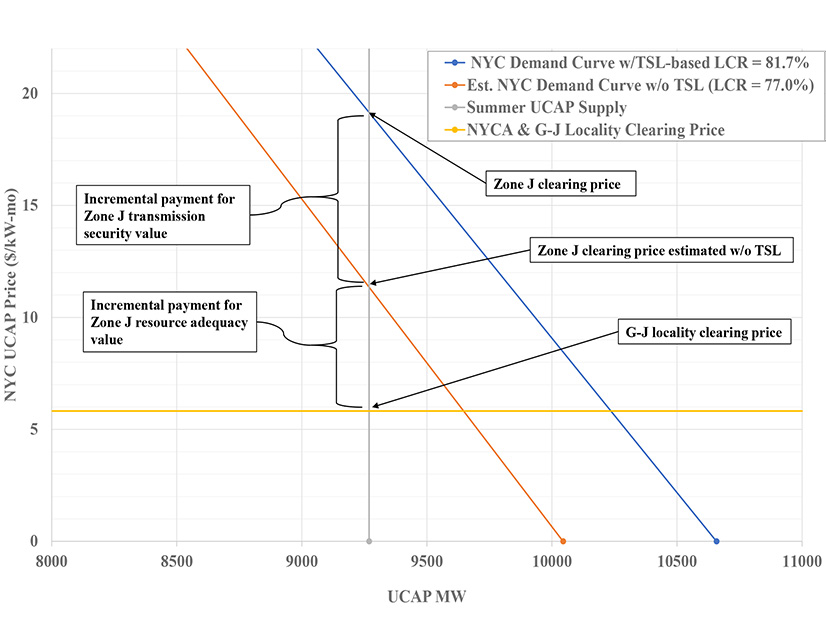

LeeVanSchaick said the MMU proposes a two-part pricing mechanism that separates resource adequacy and transmission security when transmission security criteria determine the LCR, ensuring SCRs, large contingency resources and intermittent renewables are appropriately compensated based on their contributions to the planning reliability requirements.

LeeVanSchaick pointed to a chart in Potomac’s presentation to the MC that showed a roughly 800-MW difference in the marginal requirement needs for New York city projected by the two assessments. “If you calculate the margins [for New York city] using a transmission security assessment, there’s a deficit in 2025, while a resource adequacy assessment would tell you there’s a surplus,” LeeVanSchaick said.

Breidenbaugh said that under the MMU’s proposal, “you pretty much wouldn’t have any SCRs in New York city.”

Both NYSIO and Potomac acknowledged stakeholders’ concerns but stressed more discussion is forthcoming.

LeeVanSchaick emphasized that Potomac “wanted only to highlight these differences to increase people’s understanding of how the emergence of transmission-security-based capacity requirements are likely to affect investment incentives.”