SPP staff are taking yet another crack at adding counterflow optimization (CFO) to the congestion-hedging process following a late-August workshop with the Board of Directors, Members Committee and other stakeholders.

Staff offered more than a dozen alternative congestion-hedging solutions, culled from surveys and meetings with stakeholders. Stakeholder groups will get another opportunity to discuss the final recommendations before they are brought to the governance committees and the board during their October meetings.

“My hope is the things that staff has developed, and the feedback we’ve heard today, provides us with a pathway to do some work with stakeholder groups to help shape whatever comes back to the board in October,” board Chair Larry Altenbaumer said. “I don’t want to presuppose staff’s recommendation or what it should be, but I want to make sure we’re being as thorough as possible in providing constructive guidance on whatever that solution might be.”

It hasn’t been easy for CFO to get this far. The Holistic Integrated Tariff Team recommended in 2019 that CFO, limited to excess auction revenue, be added to SPP’s market mechanism that hedges load against congestion charges. The process, which keeps system transmission flows between two points in balance, was meant to address concerns about how congestion rights instruments are awarded and the current process’s efficiency.

The Market Working Group spent months trying to reach agreement on how best to add CFO, only to eventually turn it over to the Strategic Planning Committee. (See SPP SPC Takes on Congestion Hedging Issues.)

In April, the Markets and Operation Policy Committee rejected a recommendation to stick with the status quo, three months after agreeing with staff to leave the market construct untouched. (See SPP Markets and Operations Policy Committee Briefs: April 11-12, 2022.)

That was when Altenbaumer stepped forward and suggested staff and stakeholders work together and reach consensus on how best to add CFO to the market. (See “Counterflow Optimization not Dead Yet,” SPP Board of Directors/Markets Committee Briefs: April 26, 2022.)

“There’s been no shortage of analysis. It’s simply a lack of consensus,” Altenbaumer said. “Lack of consensus doesn’t mean we have a lack of an issue. It’s reached a point where it doesn’t mean we should delay our concerns.”

Altenbaumer, who facilitated the Aug. 30 workshop’s panel discussions, alluded to the difficulties that still lie ahead for SPP’s staff and stakeholders.

“Facilitating this reminds me of a game show host,” he said. “I’m not sure whether it’s ‘Jeopardy,’ ‘Let’s Make a Deal,’ ‘The Price is Right’ or, God forbid, ‘Family Feud.’ We’ll see what happens when we get into this.”

That the positions in the opposing camps have only solidified quickly became evident. Some stakeholders say SPP’s congestion-hedging process is unfair and continue to ask for changes. Others says the status quo works for them.

John Stephens, who manages City Utilities of Springfield’s (Mo.) generation fleet and transmission system, said most market participants who nominate financial positions before transmission congestion rights (TCRs) are awarded are “absolutely happy” because they’re getting all of their nominated congestion hedges.

“This is not a complicated problem. There are a lot of details and we could spend hours and hours digging into those details, but essentially, we have 25 people in line, but we have 20 widgets to give away,” he said. “How we allocate those limited numbers of widgets is the problem in my mind. The first 20 guys in line are getting widgets, and the last five are not. We would like to see a more equitable process, where people get a similar percentage of the widget.”

“The main factors that have prevented stakeholders from moving forward is comfort with the status quo on a complex issue,” Southern Power’s Chase Smith said. “There’s the risk and uncertainty that is probably viewed by implementing something new and not completely understanding how it will impact each of the market participants. Some market participants are impacted by ARR [auction revenue rights] allocations more than others. There’s concern some moderate counterflows may impact the current congestion-hedging mechanism.”

“Unfortunately, the problem is that some people and their actions are not harmed directly by the actions of others, but the actions that they are taking or not taking is affecting someone else. And that’s hard to sort of grasp,” said Keith Collins, SPP vice president of market monitoring.

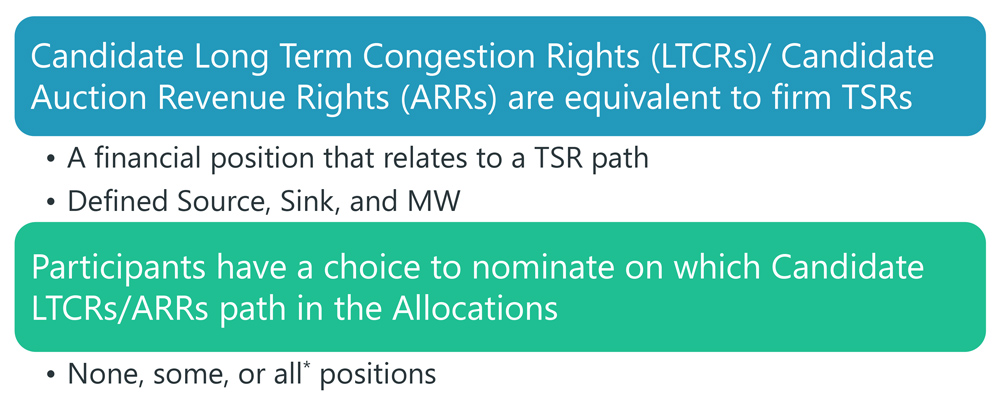

A consultant’s review last year determined market participants have too much latitude over the congestion-hedging process, staff said. It determined ARRs are set equal to transmission service rights requests, with 75 GW of candidate ARRs and a 50-GW nomination cap. The consulting firm found nomination patterns generally pursue highly valued paths, resulting in increased curtailments and asset owners leaving too much unclaimed monetary value.

Staff’s proposed solutions include aligning commercial and transmission models and using a planning feedback loop to provide a list of congested elements for considering in the planning processes. They said this will provide incentives for transmission expansion projects.

Under this proposal, SPP would also model load to ensure settlement locations, match network integrated transmission service agreements and model generators to better match candidate ARRs with generation in the day-ahead market.

Other proposals included:

- adding an additional round to the long-term congestion rights process and allowing participants to keep their positions for a year;

- baseload a percentage of the nomination cap for each participant based upon a ratio of every transmission service request’s path;

- use CFO after the first round of the ARR allocation process, uplifting its cost to the market participants that opt in;

- changing the nomination caps in the annual ARR process; and

- limiting system capacity to 50% for each of the annual ARR and TCR process.

Stakeholders expressed their interest in further developing the alternative proposals, although there was pushback from those who have been heavily involved in the CFO effort.

“I certainly want to make sure what we’re doing is consistent with where we think we need to be in five, six or seven years downstream, and that we don’t put a Band-Aid on something that will certainly change,” Altenbaumer said. “We need to have a good understanding of the interdependencies. We don’t want to solve this problem in the marketplace if there are some options to develop strategic transmission that provides overall benefits to the system.”

“To the extent we need to run some of these ideas to ground, I think we can do that,” American Electric Power’s Richard Ross — chair of the Market Working Group that has been responsible for much of the development — told Altenbaumer. “I may perhaps be a little pessimistic, but I’m not sure that I’ve heard one [idea] that I feel like is going to minimize the impact on others quite as much as the option that we’ve been talking about for so long.”

SPP’s Micha Bailey, who conducted the workshop, said his concern remains future uncertainty.

“Look at the [generator interconnection] queue and look at all the solar and the batteries that are right behind [wind requests],” he said. “Once again, I wish I had a crystal ball. I wish I could say, ‘Look all y’all, we’re great. All y’all are protected.’ If we don’t work towards a solution together, it’s very bleak for me to say, ‘Hey, we’re in a good spot.’”

Refunds on Overlapping Congestion Charges

Staff also told stakeholders Wednesday during a Seams Advisory Group meeting that SPP and MISO will issue refunds in October to AEP and the city of Prescott, Ark., for overlapping congestion charges on pseudo-tied loads and resources between the two markets.

FERC approved a settlement agreement on Sept. 7. Under its terms, the RTOs will refund $142,768 to AEP and $53,017 to Prescott, split evenly between the grid operators (ER22-2221).

The commission opened an investigation in 2019 into the overlapping charges following complaints from AEP subsidiary Southwestern Electric Power Co. and Prescott that both the host and attaining markets were charging for congestion across the same transmission path. It accepted the RTOs’ proposed” predictive flow factor process” solution in December and directed them to refund the complainants. (See FERC Accepts MISO-SPP Congestion Charge Solution.)

SPP will recover its portion of the settlement payments through a revenue neutrality uplift from market participants that either provide generation, consume generation, have scheduled interchange transactions, or have virtual bids or offers.

The predictive flow factor process improves the exchange of market flow data and better predicts impacting market flows when determining relief obligations during market-to-market. The two RTOs have more than 2.7 GW in combined pseudo-tied generation or load.