Here’s the bottom line on carbon-free electricity: The proponents envision a massive portfolio of wind and solar generation. And somehow, the intermittent nature of these renewable resources will be covered by some type of storage.

In other words, wind and solar output in excess of demand from hour to hour will charge the storage, and the storage will discharge into the grid when wind and solar output cannot meet demand.

In theory, this can work. But as it is said, “In theory, theory and practice are the same. In practice, they are not.”1

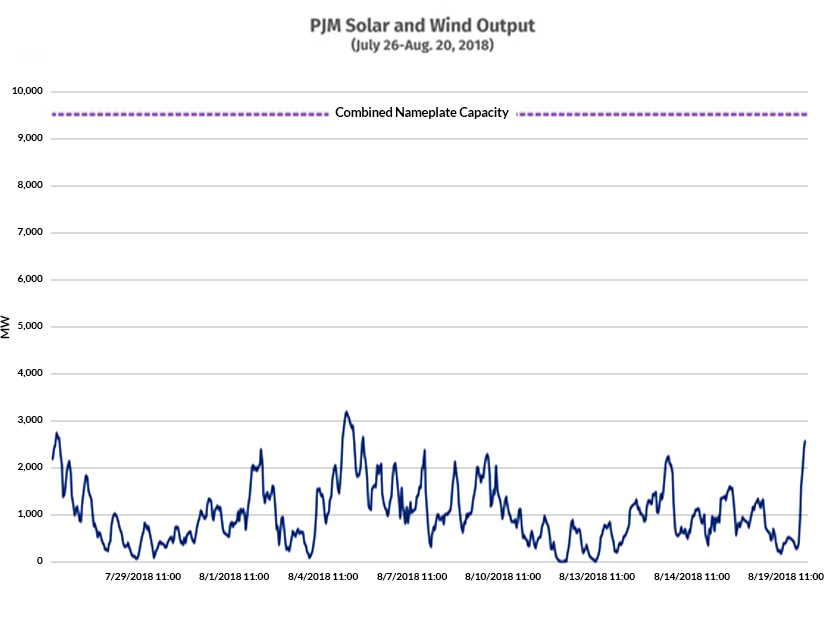

As I’ve discussed before, renewable resources may collectively produce little electricity for days or weeks on end.2 In 2018, there was a three-week period in PJM in which wind and solar resources averaged 10% of their combined nameplate capacity.3

Thus, short-duration storage — one to eight hours — is basically worthless to cover a demand/supply drought that lasts for days. Short-duration storage is discharged in Day 1; there’s no net supply to recharge the storage; and that’s that. Game over.

Enter Long-Duration Energy Storage

So that brings us to long-duration energy storage (LDES). This is now portrayed as the solution to extended droughts of wind and solar generation.

There are many potential types of LDES.4 The most commonly cited type of LDES is iron-air (a.k.a. iron-rust or metal-air) battery storage, as typified by Form Energy, which has raised almost $1 billion for this technology.5 (My take on green hydrogen for storage or anything else is here.6 )

But hard data suggest iron-air technology is not ready for prime time. Practice may trump theory again.

Poster Child: Form Energy California Project

Data points come from a California Energy Commission announcement of a $30 million grant to Form Energy for a 5-MW/500-MWh battery storage project in Mendocino County.7 This is what’s called a 100-hour storage project: 500 MWh divided by 5 MW is 100 hours. And $30 million divided by 500 MWh is $60,000/MWh.

Scoping the Challenge

As noted above, because wind/solar generation can be small for days at a time, maintaining reliability would require some way to cover net load8 for such a period. But how many days?

A study of such renewable droughts in the U.S. came out last year.9 The study analyzed hourly data on wind output, solar output and demand by region (balancing authority). The study is complex, but the gist is to confirm the need to somehow cover multiday renewable droughts across a given region, with California the most vulnerable, with six-day droughts to be expected. The study also found that load levels are positively correlated with droughts, so low load cannot be relied on to help cover renewable droughts.

What’s It Gonna Take?

We’ll assume needing battery storage to cover six days of severe renewable drought in California. With an average hourly load in California of 28.8 GWh,10 an average 80% supply/demand deficiency11 would be 23 GWh, which, multiplied by 24 hours and by six days, is 3,314 GWh.

What’s It Gonna Cost?

Batteries to store those 3,314 GWh at a capital cost of $60,000/MWh, based on the Form Energy project, would cost $198.8 billion, which at an annual carrying charge rate of 12%12 is $23.9 billion per year.

This is without any cost for the energy to charge the batteries, but let’s optimistically assume the batteries can be charged with wind and solar otherwise curtailed so the energy cost would be negligible. Is there some substantial offsetting economic value of the batteries, such as energy arbitrage between high- and low-cost hours? Well, the round-trip efficiency is 35%13, which suggests limited energy arbitrage opportunity.

What is the rate impact of this? If we divide that $23.9 billion per year by California’s annual electric usage of about 252,000 GWh per year,14 the rate impact is 9.5 cents/kwh. This would about double the generation component of California’s average electric rate and increase the already-high average retail rate by about 50%.15 Yikes!

And this is just for the battery storage. The cost of the renewable generation itself is not included.

Alternatives

There are other alternatives for covering California’s renewable droughts, but I’m going to focus on the existing natural gas fleet. Let’s assume we can keep 23 GW around to cover the average net load of 23 GW during a renewable drought.16 According to the California Energy Commission, the cost of retaining gas plants is between $34.26 and $43.05/kW/year.17 I’ll use the higher figure. So, the annual cost would be $990 million.

We’ll need 3,314 GWh (calculated above) of generation to cover six days. We’ll use the National Energy Technology Laboratory’s (NETL) gas supply and other variable cost of $36.4/MWh.18 For one six-day drought, the total fuel/variable cost is $121 million.

So, the cost to retain natural gas plants and to cover their variable costs for a six-day drought is $1.1 billion.

Comparing Battery Storage and Retained Gas Plant Costs

Comparing the annual cost of battery storage of $23.9 billion to the annual cost of retaining gas plants of $1.1 billion means it would cost 20 times as much to employ battery storage to cover renewable droughts as to retain gas plants for that purpose. Yikes!

And What About Greening Those Gas Plants?

This is where things get really interesting.

What’s the additional cost to get to no (or very low) carbon using the retained natural gas plants? There are at least three options: (1) purchasing carbon offset credits for the carbon emissions from the gas plants; (2) purchasing carbon offset credits that are solely carbon capture and storage (CCS); and (3) retrofitting the gas plants with CCS facilities.

Regarding the first option, Bloomberg forecasts carbon offset credits to cost $13/ton in 2030 and $20/ton for “high-quality” offset credits under tighter rules.19 Let’s use the higher price and convert the $20/ton to $9/MWh using an Energy Information Administration conversion rate of 0.97 pounds/kWh.20 For 3,314 GWh per year, the cost is about $30 million per year.

The second option involves carbon offset credits that are solely CCS. Bloomberg forecasts a 2030 price for such credits of $146/ton.21 Climeworks, a developer of direct air capture plants, is forecasting a $300 to $350/ton cost in 2030 for new plants.22 Using the highest of these costs and the preceding EIA conversion rate for 3,314 GWh per year entails a cost of about $525 million per year.

The third option is retrofitting gas plants with CCS facilities at a capital cost, according to an NETL study, of $1,212/MW23, which for 23 GW is $27.9 billion, which at an annual carrying cost rate of 12% is $3.3 billion per year.

The Bottom Line

Now let’s compare the annual costs of long-duration battery storage with the costs of no-/low-carbon gas plant retention alternatives:

Long-duration battery storage: $23.9 billion

Gas plants with carbon credits: $1.1 billion

Gas plants with CCS credits: $1.6 billion

Gas plants with CCS retrofit: $4.4 billion

See the difference?

What About Future Cost Reductions in LDES?

This comparison of options is based on the cost of the Form Energy California project. There are claims of future large reductions in iron-air battery costs — let’s assume the cost per megawatt-hour goes down by two-thirds in line with Form Energy’s claimed future reduction in the kilowatt-per-year cost relative to its California project24 and a similar two-thirds reduction hypothesized in an MIT study.25 The economics remain dreadful relative to keeping gas plants around. And, of course, carbon offset and CCS retrofit costs may decline as well.

Near-term Implications

“It is difficult to make predictions, especially about the future.”26 But it’s this sheer uncertainty that militates for keeping natural gas plants around in some form. For example, instead of decommissioning gas plants perhaps mothball them at relatively low cost. This would preserve the option of using carbon credit offsets and/or CCS retrofit in the future.

Big Picture Implications

LDES is extremely expensive. It does not make economic sense relative to retaining natural gas plants with various carbon-abatement alternatives.

Policymakers — legislative and regulatory — should insist on apples-to-apples comparisons of alternatives for abating carbon while maintaining reliability.

Columnist Steve Huntoon, principal of Energy Counsel LLP and a former president of the Energy Bar Association, has been practicing energy law for more than 30 years.

1 https://quoteinvestigator.com/2018/04/14/theory/

2 https://energy-counsel.com/wp-content/uploads/2022/11/More-Happy-Talk.pdf; https://www.energycounsel.com/docs/cue-more-pixie-dust.pdf; https://www.energy-counsel.com/docs/Cue-the-Pixie-Dust.pdf; https://www.energy-counsel.com/docs/German-La-La-Land.pdf; https://www.energy-counsel.com/docs/No-CarbCalifornia.pdf; https://energy-counsel.com/docs/Grid-Batteries-Kool-Aid-Once-More-with-Feeling-RTO-Insider-12-5-17.pdf; https://www.energy-counsel.com/docs/Battery-Storage-Drinking-the-Electric-Kool-Aid-FortnightlyJanuary-2016.pdf.

3 https://www.energy-counsel.com/docs/Cue-the-Pixie-Dust.pdf

4 https://energy.mit.edu/wp-content/uploads/2022/05/The-Future-of-Energy-Storage.pdf, pages xiii-xvii.

5 https://www.scientificamerican.com/article/rusty-batteries-could-greatly-improve-grid-energy-storage/

6 https://energy-counsel.com/wp-content/uploads/2023/12/Hydrogen-Reality.pdf

7 https://www.energy.ca.gov/news/2023-12/cec-awards-30-million-100-hour-long-duration-energy-storageproject; https://www.energy.ca.gov/sites/default/files/2023-10/CEC-500-2023-055-D.pdf. The economics of this project don’t reconcile with the description of a Form Energy project in New York said to be twice the size at less than half the cost, https://www.nyserda.ny.gov/About/Newsroom/2023-Announcements/2023-08-17-GovernorHochul-Announces-Nearly-15-Million-in-Long-Duration-Energy-Storage, although one difference is that New York limits its contribution to half the project cost, https://portal.nyserda.ny.gov/servlet/servlet.FileDownload?file=00P8z000001ocKUEAY.

8 Net load is gross load net of wind/solar generation.

9 https://www.sciencedirect.com/science/article/pii/S0960148123014659?via%3Dihub The press release summarizing the results is here, https://www.pnnl.gov/news-media/energy-droughts-wind-and-solar-can-lastnearly-week-research-shows

10 https://efiling.energy.ca.gov/GetDocument.aspx?tn=254463, page 13.

11 This means that average hourly renewable generation is covering 20% of average hourly gross load. The remaining 80% (net load) must be met by storage. This definition of severe renewable drought comes from this study, https://www.sciencedirect.com/science/article/abs/pii/S0960148118302829?via%3Dihub, page 581 and Figure 2.

12 An annual carrying charge rate reflects return of and on capital. It is currently 11.8% in PJM. https://www.pjm.com/-/media/committees-groups/committees/teac/2023/20230711/20230711-informational—market-efficiency-analysis-assumptions—july-2023.ashx

13 https://www.energy.ca.gov/sites/default/files/2023-10/CEC-500-2023-055-D.pdf, page 44.

14 https://efiling.energy.ca.gov/GetDocument.aspx?tn=254463, page 13.

15 https://www.eia.gov/outlooks/aeo/supplement/excel/suptab_54.22.xlsx, focusing on the generation sector average component around $0.10/kWh, and average total end-use prices around $0.20/kWh. Other EIA data suggest a higher current end-use price around $0.25/kWh, https://www.eia.gov/electricity/monthly/epm_table_grapher.php?t=epmt_5_6_a.

16 https://www.energy.ca.gov/data-reports/energy-almanac/california-electricity-data/electric-generationcapacity-and-energy

17 https://www.energy.ca.gov/sites/default/files/2024-01/CEC-500-2024-003.pdf, page 10.

18 https://www.osti.gov/servlets/purl/1961845, Exhibit 4-6, page 26.

19 https://about.bnef.com/blog/global-carbon-market-outlook-2024/

20 https://www.eia.gov/tools/faqs/faq.php?id=74&t=11 $20/metric ton divided by 2,205 pounds/ton is $.009/pound, which is $.009/kwh or $9/MWh.

21 https://about.bnef.com/blog/global-carbon-market-outlook-2024/

22 https://www.cnn.com/2024/05/10/world/video/largest-carbon-capture-factory-opens-vause-wurzbacher-intvcnni-climate-or-business-fast

23 https://www.osti.gov/servlets/purl/1961845, Exhibit 4-5 on page 25, averaging the all-in TASC $/kw for the two 95% capture projects. Transportation and storage of the carbon is projected by DOE/NETL to cost $3.7/MWh, Table 4-6, page 26, which for 5,328,000 MWhs per year is a small cost of about $20 million per year. Another DOE retrofit study is here, https://www.energy.gov/sites/default/files/2024-04/OCED_Portfolio_Insights_CC_part_i_FINAL.pdf

24 https://www.edockets.state.mn.us/edockets/searchDocuments.do?method=showPoup&documentId={00AE3887-0000-C24C-BFC6-45EC1209A3DB}&documentTitle=20233-194396-08, Table 1, making reduction from the California project $6,000,000/MW to $1,900,000/MW (converting kW to MW).

25 https://energy.mit.edu/wp-content/uploads/2022/05/The-Future-of-Energy-Storage.pdf, page 37.

26 Dutch saying, c. 1937, https://quoteinvestigator.com/2013/10/20/no-predict/.