Price Cap Increases in 2026/2027 BRA Planning Parameters

VALLEY FORGE, Pa. — PJM presented on how the planning parameters for the 2026/27 Base Residual Auction (BRA) affected the variable resource rate (VRR) curve, which intersects with supply and demand to determine auction clearing prices.

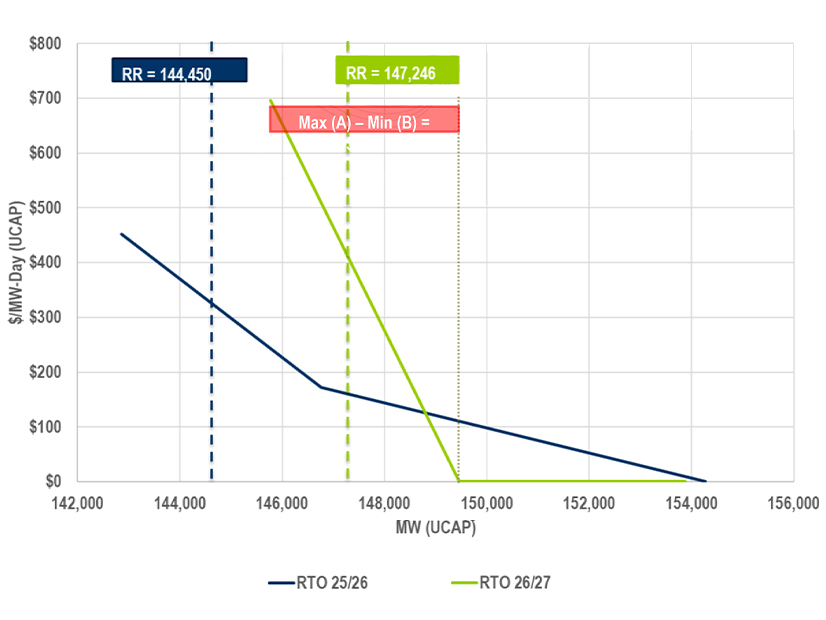

The curve is taking a more linear and steep shape in this auction, with the RTO-wide price cap increasing to $696/MW-day should 145,774 MW or less clear the auction. Point B, set at net cost of new entry (CONE), quickly falls to a $0 clearing price at 149,455 MW capacity clearing and remains at zero through to Point C at 153,873 MW.

The planning parameter posting comes weeks after the completion of the 2025/26 BRA and as stakeholders digest a significant jump in clearing prices, including two regions clearing at their price caps. (See PJM Market Participants React to Spike in Capacity Prices.)

Scheduled for December 2024, the 2026/27 auction will be the first to use a combined cycle generator as the reference resource (RR), which is the generation class for which the CONE estimates construction costs. Estimated net revenues for the RR and CONE values both are higher for CC generators than the combustion turbines previously used as the reference, steepening the curve and setting the maximum price higher.

The formulas defining the points along the VRR curve were also changed over the previous auction, with Point A now set at the greater of gross CONE or net CONE times 1.75, whereas the point was previously gross or net CONE times 1.5. The reliability requirement multiplier for each point was also changed.

AEP Energy Director of RTO Operations Brock Ondayko questioned whether auction design changes were intended to result in a 3,500-MW difference between clearing at the price cap or at zero.

“It’s not going to take much from allowing capacity resources to have some type or revenue to having them have zero revenues,” he said.

Market Monitor Joe Bowring said the use of gross CONE to set the maximum price on the VRR curve means that prices could reach approximately $700 per MW-day but that there is no logical or economic basis for capacity market prices at that level.

PJM’s Pete Langbein said the changes were drafted through the quadrennial review process by both stakeholders and PJM.

PJM Proposes Rules for Non-inverter Hybrid Resources

PJM presented its proposal for how non-inverter resources paired with battery storage can participate in its markets as a hybrid resource, such as a gas generator paired with storage.

The effort is the third phase in PJM’s development of hybrid market rules, with the first focused on solar and storage and the second looking at all inverter-based resources. While the hybrid model allows for different inverter-based generation types to be combined without storage, the non-inverter option requires generation and storage components.

Both inverter and non-inverter hybrids with storage would be able to provide reserves — except for non-synchronized and secondary reserve products — and be required to do so if committed in the capacity market. Generation-only hybrids would not be able to provide reserves unless granted an exception.

The make-whole and lost opportunity cost (LOC) design would be similar to the pumped-hydro rules, allowing make-whole payments for hybrids instructed to charge at a higher cost than their desired LMP, while hybrids reducing charging according to manual PJM dispatch would not be eligible for LOC payments.

The changes include several clarifications of existing market rules, including that non-inverter hybrids can provide regulation but, like inverter-based hybrids, they cannot only provide regulation. It also differentiates between station power and the storage charging mode, which must be reported to PJM separately through Power Meter.

The proposal would also clarify how generation-only inverter hybrids are subject to the must-offer requirement. The resource would be required to offer an economic maximum (EcoMax) value into the day-ahead market equal to or greater than its hourly forecast. For inverter hybrids with storage, the energy offered over 24 hours must add up to forecast generation, “grossed up” with the efficiency of the storage.

Non-inverter resources would participate in the energy and ancillary service markets similarly to the standalone storage model.

PJM’s Maria Belenky said staff have received inquiries regarding the number of existing resources that would be subject to the non-inverter hybrid rules, but PJM does not yet have a total that can be shared.

PJM Proposal Would Allow Changes to RPM Auction Deadlines

Stakeholders reacted sharply to a PJM problem statement and issue charge that would consider revising governing documents to add language saying that BRA deadlines are subject to change and the posting of planning parameters does not carry legal consequence.

The issue charge states that the notice would allow PJM to make “potential corrections to capacity market rules that are filed in advance of the commencement of the relevant auction window.”

PJM Associate General Counsel Chen Lu said the changes are being contemplated in response to the 3rd U.S. Circuit Court of Appeals vacating a FERC order allowing PJM to revise the locational deliverability area (LDA) reliability requirement for the DPL-S region in the 2024/25 BRA. The court determined that making such a change so far into the auction process would violate the filed rate doctrine. (See Following Court Ruling, FERC Reluctantly Reverses PJM Post-BRA Change.)

Adrien Ford, Constellation’s director of wholesale market development, said the expected deliverables listed in the issue charge seem overly prescriptive and would guide stakeholders towards a predetermined outcome. She also argued more language should be added around how far in advance any change in auction deadlines would have to be noticed.

Vitol’s Jason Barker said market participants need certainty around rules, and it would be imprudent to establish a paradigm where PJM can make after-the-fact rule changes in market design that mandates participation. Instead, he said, the RTO should bring concerns that arise after commencement of mandatory pre-auction activity to stakeholders and FERC for review.

Bowring said the proposal would give PJM unprecedented and inappropriate discretion over deadlines, including those related to the Monitor’s responsibilities as well as deadlines for market participants and PJM itself. In addition, he said, the suggestion that market participants cannot rely on the parameters posted by PJM is not consistent with transparency and efficient markets.

External Resource Capacity Clearing

The North Carolina Electric Membership Corp. (NCEMC) presented a problem statement and issue charge focused on how PJM accounts for external, pseudo-tied capacity resources outside the RTO’s footprint which are being committed to serve a load-serving entity.

The documents say the utility is focused on three areas: recognizing when there is a direct transmission path between external generation and LSE load; reflecting the LDA price in the region the external generation is serving in how the resource is compensated; and including that generation in LSE self-supply obligations.

When modeling and clearing capacity resources, the problem statement says, external generation is not assigned to a specific LDA, even when there is a direct path between the unit and an internal region. However, PJM does assign those resources to an LDA to assess Capacity Performance (CP) penalties or bonuses for over- or underperformance during emergencies. The practice of ensuring deliverability to the rest-of-RTO, but not to an LDA, is not reflected in the manual language.

“There is an opportunity to review certain existing provisions pertaining to external capacity resources to determine if there are modifications that would better align the external capacity resource transmission pathway with external capacity resource LDA modeling, the applicable sink LDA used in RPM clearing, and resource performance obligations and mapping. Such mismatches are particularly harmful to Load Serving Entities self-supplying resources to serve load,” the problem statement reads.

Calpine’s David “Scarp” Scarpignato said it might be prudent to also consider the interaction with the stop-loss limit to CP penalties, noting that PJM has changed the annual limit to penalties that can be assessed against a generator to be based on auction clearing prices, rather than the CONE parameter. For major emergencies, the stop-loss limit can be a more significant factor than the penalty rate for individual performance assessment intervals, he argued. (See FERC Approves 1st PJM Proposal out of CIFP.)

Bowring said the Monitor has also said there is a mismatch between external resources getting rest-of-RTO pricing, regardless of the actual electrical path it takes to be delivered to PJM.

Other Committee Activities

-

- Stakeholders endorsed by acclamation revisions to Manual 15: Cost Development Guidelines drafted through the document’s periodic review. The changes focus on correcting formulas and updating section numbers. The alterations also remove a table displaying variable operations and maintenance costs, which PJM said could give a false impression that the values are fixed in the manual language; the values are updated annually and posted to its website. (See “First Reads on Several Manual Revision Packages,” PJM MRC/MC Briefs: Aug. 21, 2024.)

- The committee endorsed by acclamation a quick fix proposal brought by PJM to eliminate the high/low and marginal cost proxy interface pricing options. PJM’s Phil D’Antonio said they have not been used since the dynamic schedule agreement with Duke Energy Progress was terminated in 2019. (See “PJM Proposes Elimination of 2 Interface Pricing Options,” PJM MIC Briefs: Aug. 7, 2024.)