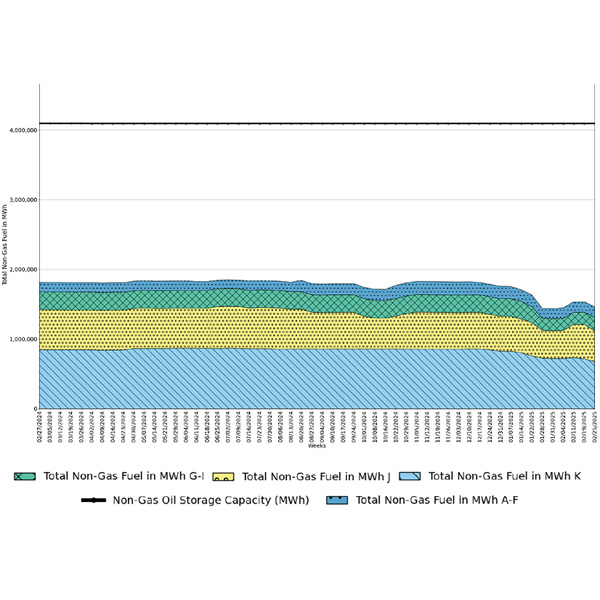

oil-fired generation

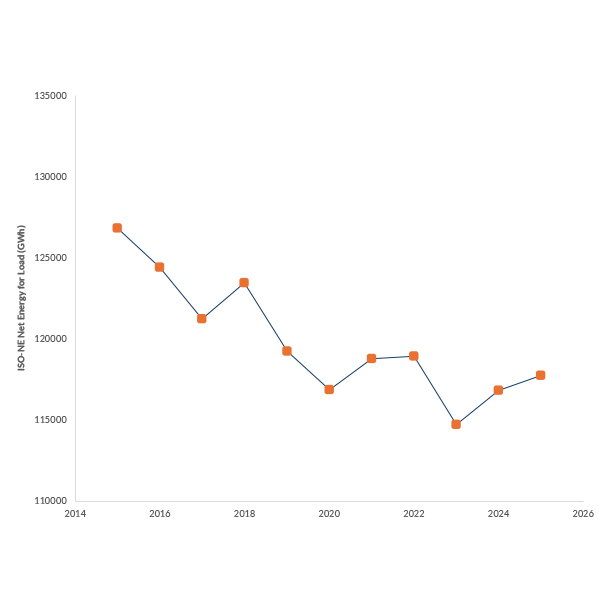

The winter of 2025/26 was the most expensive winter in the history of ISO-NE’s wholesale markets, driven by the lowest average temperatures in 20 years.

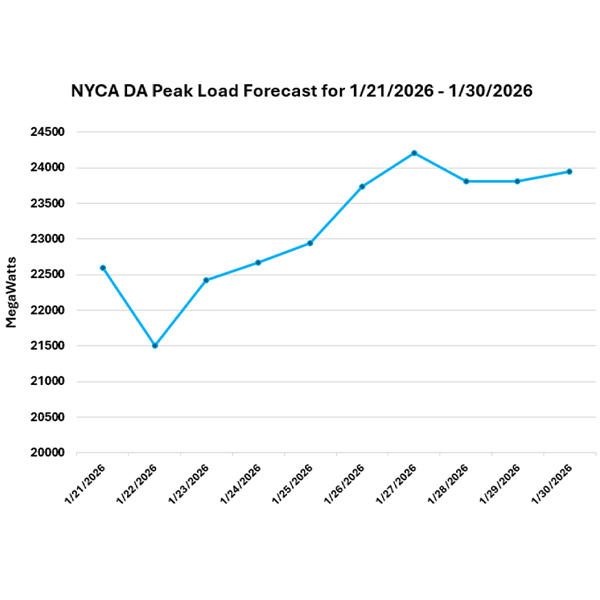

The NYISO Operating Committee discussed the challenges it faced while successfully navigating through several events in January, including a major winter storm.

New England experienced record high energy costs in the month of January amid cold weather, high gas prices and a heavy reliance on oil-fired generation.

New York generators had to rely on oil as gas was scarce throughout the Eastern Interconnection during the Jan. 25-27 winter storm, NYISO said in a preliminary analysis.

After years of declining or stagnant power demand in New England, annual energy demand ticked up for the second straight year in 2025, potentially indicating the start of a broader upward trend.

In New England, increasing winter reliability concerns are driving questions about how long the region’s aging fleet of oil-fired power plants can, or should, remain on the system.

While NYISO operated reliably last winter, the season provided “continued examples of limited flexibility on the gas system,” ISO staff told the Operating Committee.

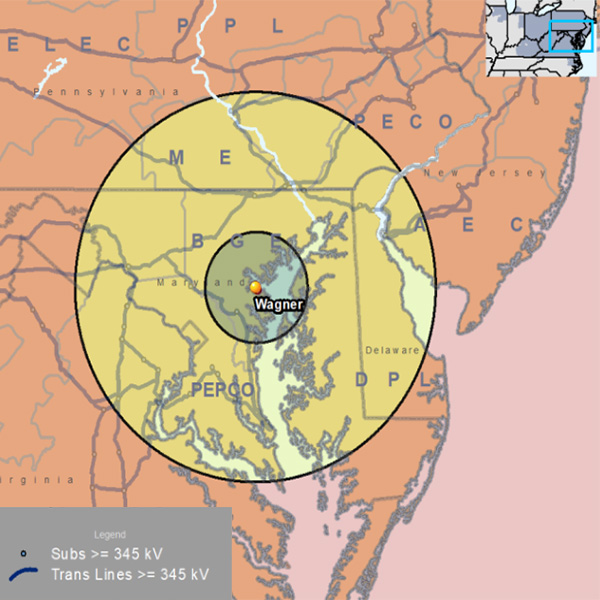

PJM has requested that Talen Energy continue operating a portion of its H.A. Wagner Generating Station an additional three years beyond its requested 2025 deactivation date.

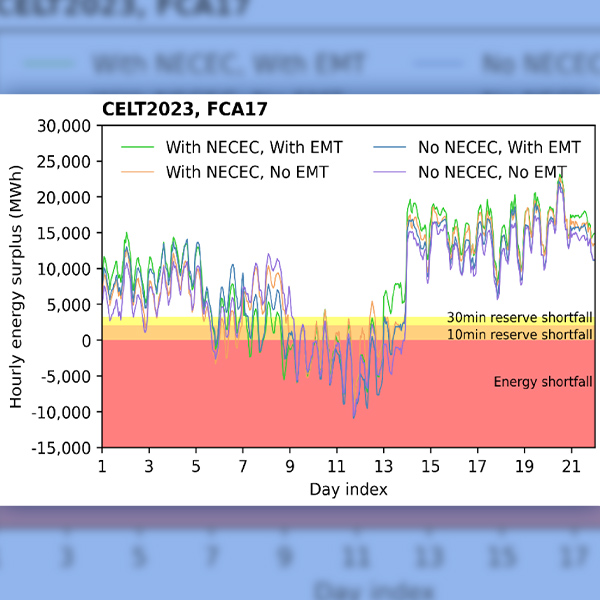

ISO-NE presented the final stage of its Operational Impact of Extreme Weather Events study to stakeholders at the NEPOOL Reliability Committee on Nov. 14.

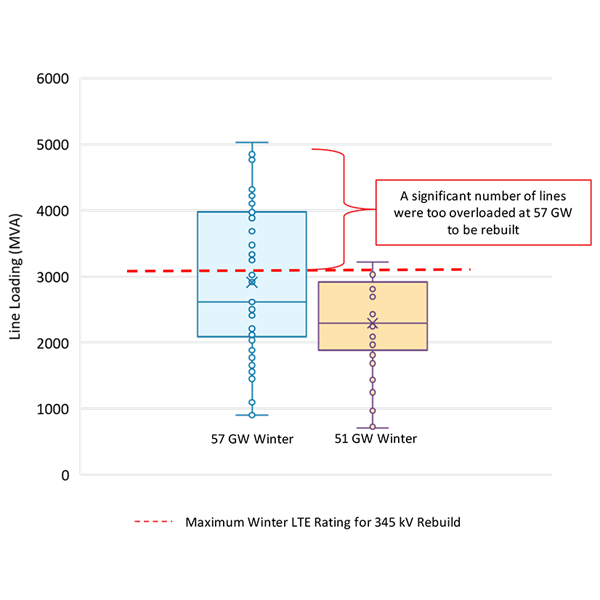

Transmission upgrades that are needed to avoid overloads in a fully electrified New England by 2050 could cumulatively cost between $22 billion and $26 billion, ISO-NE told its Planning Advisory Committee.

Want more? Advanced Search