Markets and Reliability Committee

Stakeholders Endorse IRM and FPR for 2026/27 Capacity Auction

VALLEY FORGE, Pa. — The Markets and Reliability Committee endorsed by acclamation PJM’s recommended installed reserve margin (IRM) and forecast pool requirement (FPR) values for the 2026/27 Base Residual Auction (BRA), with 40 load-serving entities and consumer advocates abstaining over what they called a lack of transparency into how the RTO arrived at the figures.

The IRM would increase to 19.1%, up from 17.8% in the 2025 Third Incremental Auction (IA), and the FPR would fall to 0.917 from 0.938. PJM’s Patricio Rocha Garrido said almost all of the change is being driven by increasing demand in the load forecast, particularly in the winter. The seasonal balance of risk tilts to 65% loss-of-load expectation in the winter, increasing from 54.5% in the third IA; for the expected unserved entry metric, 93.9% of the risk would be in the winter.

The effective load-carrying capability ratings for most classes would also shift in line with increased winter risk. The rating for offshore wind would increase by 7%, to 69%, followed by onshore wind at a 3% increase, to 41%. In addition to having strong winter performance, Rocha Garrido said resources in the wind categories received transitional capacity interconnection rights (CIRs), which boosted the class’s overall ratings.

Demand response resources would see their ratings fall by 8 points to 69%, while storage ratings would decline between 5 and 7% depending on the resource duration. Gas resources would see more modest drops, in part because of changes in class membership, while other thermals would be flat or fall by 1%.

Rocha Garrido said PJM ran a sensitivity using the 2025 resource portfolio and found there was minimal impact on ratings compared to 2026 expected resource mix, which he said supports the conclusion that most of the changing dynamics are being prompted by the load forecast. He explained the reason there is more winter risk is because of extreme peak loads increasing in the 2025 forecast relative to 2024, while the summer peak loads are not growing relative to the 2024 forecast.

Scope of Deactivation Task Force Widened to Include RMR Agreements

Stakeholders endorsed charging the Deactivation Enhancement Senior Task Force with exploring the creation of a pro forma reliability-must-run agreement.

The MRC endorsed the change with 85% support, followed by the Members Committee endorsing by acclamation the same day. (See “PJM Presents Changes to DESTF Issue Charge,” PJM PC/TEAC Briefs: March 4, 2025.)

The revisions to the task force’s issue charge add a new key work activity (KWA) to draft a pro forma arrangement that recognizes the possible resource adequacy that RMR units can contribute and be effective for the 2028/29 delivery year. That year is when a temporary tariff provision allowing PJM to model the output of some RMR resources as capacity is set to expire (ER25-682). (See FERC OKs Changes to PJM Capacity Market to Cushion Consumer Impacts.)

The new language also expands the scope of the issue charge to allow consideration of a pro forma RMR agreement and changes to the capacity market rules around generators that have requested deactivation but which PJM has determined are necessary to maintain reliability. The out-of-scope section also was revised to carve out the new KWA.

Several generation owners noted PJM’s target of submitting a proposal to FERC around the end of the year would prevent changes to how RMR resources interact with the capacity market from being considered in the Quadrennial Review, which is in its early stages at the Market Implementation Committee.

Vistra’s Erik Heinle said each RMR resource is unique and any pro forma agreement should retain the ability for a generation owner to pursue a cost-of-service rate at FERC. He suggested including language in the issue charge stating that owners of a deactivating unit can develop an agreement with PJM outside of the pro forma approach.

PJM Senior Counsel Chen Lu said he does not believe the proposed language would preclude that ability, adding it would be up to stakeholders to come up with rules that govern that.

Stakeholders Endorse Manual Language Expanding SIS

The committee endorsed revisions to Manual 14H implementing expanded eligibility for surplus interconnection service (SIS), reflecting tariff changes FERC approved in February. (See FERC Approves PJM’s One-time Fast-track Interconnection Process.)

SIS allows generation owners with resources that are not using their full injection rights to co-locate additional resources at the same point of interconnection, so long as the host resource’s CIRs are not exceeded and no network upgrades are triggered.

The new language eliminates categorical restrictions on what resources — battery storage in particular — are eligible for SIS; changes how PJM models projects proceeding through SIS alongside those in the general interconnection queue; expands eligibility to applications where the host generator still is in development; and allows projects that consume transmission headroom but do not require network upgrades. It also would allow projects that require additional interconnection facilities for the service while still prohibiting new network upgrades.

Applications that could affect the network upgrades required for projects in the interconnection queue that have not had PJM determine if they will require upgrades also no longer would be prohibited from proceeding as SIS projects. The changes also eliminated language preventing SIS applications from proceeding if PJM has identified that the project would have a “material impact” on dynamic system stability response, steady-state thermal and voltage limits, or short-circuit capability limits.

The manual language was endorsed by the Planning Committee during its March 4 meeting. (See PJM Stakeholders Approve SIS Manual Language.)

PJM Presents 1st Read of Proposal to Rework Black Start Compensation

PJM’s Glen Boyle presented a first read of a proposal to rework the base formula rate (BFR) used to compensate black start resources not carrying investment costs for providing the service.

The proposed tariff revisions were endorsed by the MIC during its March 5 meeting. (See PJM Stakeholders Endorse Changes to Black Start Compensation.)

The BFR includes numerous variables, including fixed and variable costs, training, fuel storage, and an incentive factor. The proposal would revise the fixed cost element to replace the zonal net cost of new entry (CONE) with a fixed value derived from the five-year RTO-wide CONE, which thereafter would be adjusted using the Handy-Whitman Index. Boyle said PJM does not see a correlation between net CONE and the need for black start resources, nor should there be a locational element to the price.

Boyle said PJM is concerned that if compensation for existing black start units is not increased, more resources will cease participation and they will have to be replaced on the more costly capital recovery factor (CRF), which is used to determine compensation for resources that require upgrades to provide black start. PJM is not proposing any changes to the CRF.

Since 2019 there have been 29 resources that stopped providing black start service, 26 of which were replaced through requests for proposals. All but two of the new black start units began providing the service on the CRF. Boyle said about 85% of the black start fleet is compensated through the BFR.

Independent Market Monitor Joe Bowring said there should be a focus on finding a way to compensate resources that fully considers their costs and ensures they see an appropriate return. He argued that the proposal, which was sponsored by PJM at the MIC, does not have a definition of an appropriate payment.

The Monitor’s proposal, which did not win the MIC’s support, would have used the RTO-wide net CONE, rather than zonal values, and included a recommendation that a more holistic stakeholder discussion be initiated to reconsider compensation.

“This is simply refusing to address the underlying issue and making vague and unsupported allegations,” Bowring said.

In previous meetings, Bowring noted the process was instigated by the net CONE for future BRAs falling with the shift to a combined cycle turbine as the reference resource. FERC since has granted PJM’s request to keep the reference resource as a combustion turbine.

Gregory Poulos, executive director of the Consumer Advocates of the PJM States, said the advocates have been troubled by the lack of a metric to demonstrate the RTO’s concerns that generation owners may be considering pulling their resources out of black start service.

Stakeholders Discuss Uplift Costs Seen During January Storms

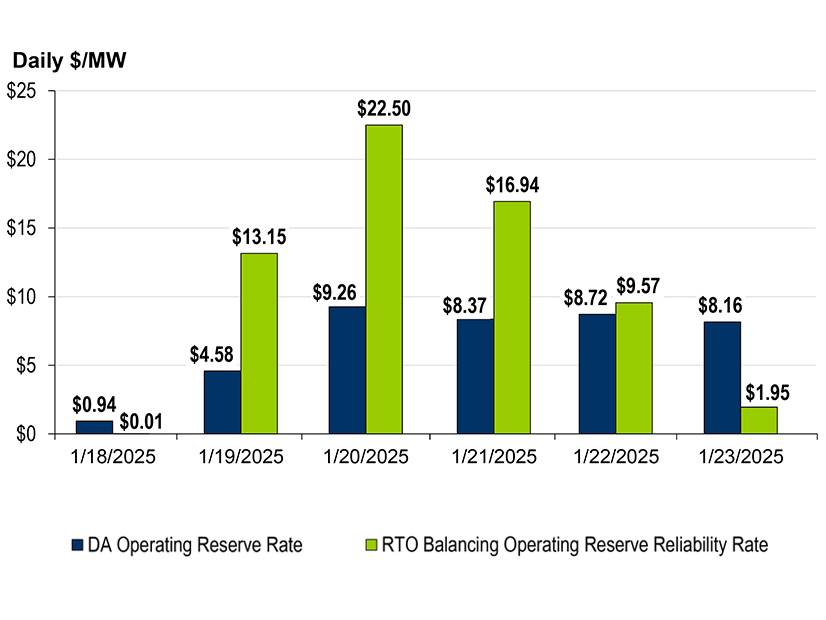

PJM presented the impact winter storms during January had on uplift payments, which amounted to nearly $332 million between Jan. 19 and 23.

Storms falling on long holiday weekends have proven to be a challenge for PJM, as gas resources typically must purchase a package with a steady rate of fuel when nominating for supply on weekends and holidays. (See PJM: ‘Conservative Operations’ Maintained Reliability During Jan. 2024 Storm.)

Senior Dispatch Manager Kevin Hatch said the Martin Luther King Jr. Day weekend saw highly variable load, which complicated efforts to block schedule gas. The start of the weekend was forecast to have fairly modest loads, but ramped up to some of the highest winter peaks PJM has seen. Gas pipelines already had restrictions in place going into the weekend, and there was uncertainty about whether resources connected to those pipelines would be able to get fuel on the spot market.

PJM also had some resources start ahead of time so that any equipment failures associated with start-ups could be resolved before the storms rolled in. Once those units were online, Hatch said operators sought to avoid cycling them on and off throughout the storm to ensure they could remain available.

The RTO employed a new conservative operations procedure established after December 2022’s Winter Storm Elliott, allowing operators to commit resources in advance when they believe those units could have difficulty procuring fuel or otherwise are at risk of not being able available. Several stakeholders have argued the practice violates market principles and significantly increased uplift costs.

The majority of the uplift was balancing operating reserve credits, amounting to $206 million, while day-ahead operating reserve credits accounted for an additional $126 million.

In addition to impacts on the energy market, the amount of uplift paid during the January storm had a notable effect on the net CONE aspect of the capacity market, said Adrien Ford, director of wholesale market development for Constellation Energy.

“This is not acceptable to continue on the path that we’re on,” she said. “I’d like to note that this tie in is not just energy and uplift … but also net CONE.”

Members Committee

Stakeholders Endorse Changes to MC Webinar Scope

The MC endorsed reducing the number of reports delivered to the committee via the webinars held between its face-to-face meetings.

The revisions to Manual 34 were advanced by Calpine and seconded by Vistra in an effort to move substantive discussions to venues that are attended by a wider spectrum of PJM’s membership. (See “Manual Revisions Seek to Reimagine Role of MC Webinar,” PJM MRC/MC Briefs: Feb. 20, 2025.)

Vistra’s Heinle said the March 17 webinar included a fervent discussion about how load bids in the day-ahead market. He argued it would have been beneficial for more participants to be involved.

The language also shifts PJM’s regulatory, system and market operations reports to the MC, along with reports delivered by the Monitor and the Organization of PJM States Inc. Interregional coordination reports would be moved to the MIC.

The changes also would move the timing of the webinars to be held on the week following MC meetings, with the possibility of it being canceled if there is little to discuss. Currently it is held on the Monday before the committee meets.