ISO-NE provided updates on its proposals for generator retirements, market power mitigation, and resource qualification and reactivation.

ISO-NE continued work with stakeholders on its capacity market overhaul at NEPOOL Markets Committee meetings, giving updates on its proposals for generator retirements, market power mitigation, and resource qualification and reactivation.

Deactivations

ISO-NE has modified its proposed timeline for resource owners to notify the RTO of resource retirements, cutting the notification lead time from two years prior to the capacity commitment period (CCP) to just one year. In the forward capacity market, resource owners historically have been required to submit retirement notices about four years prior to the relevant CCP.

The change came in response to stakeholder feedback that a lengthy lead time for retirement notifications could create risks of premature retirements.

“Some stakeholders wondered whether a shorter, irrevocable notice [would] provide more certainty to the market,” said Kevin Coopey, principal analyst at ISO-NE. He added that Potomac Economics, the RTO’s External Market Monitor, “voiced concerns with a comparatively long notification lead time and the lack of revocability.”

He said a shorter timeline “allows resources to consider as much relevant information as possible, maintaining as much option value as possible, hence improving the probability of efficient deactivation decisions.”

Under the proposal, retirement submissions would be binding, though resource owners would have the option to accelerate retirements.

While some stakeholders have pushed the RTO to allow resource owners to rescind retirement notifications in some circumstances, ISO-NE said revocability could lead to “numerous thorny issues,” including coordination of transmission upgrades triggered by the resource deactivation and the release of capacity for interconnecting resources.

“The shorter notification lead time achieves most of the benefits of allowing revocability while being significantly simpler in scope and execution,” Coopey said.

Bilateral Trading

ISO-NE does not plan to include the development of new bilateral markets or changes to monthly reconfiguration auctions in the capacity auction reform (CAR) project, said Chris Geissler, director of economic analysis at the RTO. He said efforts would require a “considerable body of work that would jeopardize the ability to deliver the core changes” in time for the 2028/29 CCP.

He added that the RTO expects the move to a prompt and seasonal capacity market to create new opportunities for bilateral trading.

Some stakeholders have expressed interest in the development of new ISO-NE-administered voluntary forward markets, along with the introduction of sloped demand curves to monthly reconfiguration auctions to allow different amounts of capacity to be sold for each month.

Geissler said the RTO may consider both initiatives after the CAR project is completed.

Market Power and Mitigation

Also at the meeting, ISO-NE responded to feedback from the June MC meeting about the proposed approach to market power mitigation in a prompt auction. (See “Market Power Mitigation,” ISO-NE Internal Market Monitor Weighs in on Capacity Market Changes.)

At the June meeting, the ISO-NE Internal Market Monitor recommended ISO-NE replace its pivotal supplier test with a “conduct and impact test framework,” making the case that the pivotal supplier test could cause the “over-mitigation of resources” as the balance of supply and demand tightens.

Andrew Copland, economist at ISO-NE, said at the July MC meeting that the RTO still plans to include the pivotal supplier test in its prompt market tariff changes, adding that “developing a new mitigation framework falls outside the scope” of the CAR project.

He said ISO-NE plans to “conduct a more general evaluation of mitigation in the capacity market after completing the CAR project.”

Copland also provided details on the cost workbooks that suppliers are required to submit to show the costs included in their capacity offers and the use of an IMM offer floor price to mitigate buyer-side market power.

Resource Qualification

In a prompt capacity market, ISO-NE plans to hold resource qualification activities “as close as possible to the annual auction and monthly trading activities to increase opportunities for new projects to participate,” said Matt Brewster, senior manager of capacity requirement and qualification at ISO-NE.

For new resources, this will require the RTO to end its practice in the forward capacity market of monitoring the progress of non-commercial projects that have gained capacity supply offers.

Brewster said ISO-NE plans to continue its existing critical path schedule (CPS) monitoring approach until June 30, 2028. After that deadline, ISO-NE would return non-commercial capacity financial assurance for non-commercial resources that cleared in FCA 18 and non-commercial resources that cleared in earlier FCAs if their “CPS milestones are substantially complete.”

It would not return the financial assurance if a resource triggers termination before the deadline or is not meeting its CPS milestones.

Some stakeholders expressed concern that this approach could incentivize non-commercial resources that otherwise would withdraw to refrain from doing so until after the deadline.

For in-service resources, Brewster said ISO-NE still is considering adjustments to the resource audit requirements and how to estimate qualified capacity for resources with limited data on their performance.

The audit requirements in the new auction framework would be based on resource class and intended to determine a resource’s qualified capacity and verify it is in service.

Resource Reactivation

For retired resources, ISO-NE proposes removing the investment requirement for resource reactivation and requiring cost-of-service agreements retaining retiring resources to include “claw back” provisions which would take effect if a resource re-enters the market after its COSA expires.

“In all other ways, a reactivation project would have the same interconnection, qualification and mitigation review treatment as any other new resource for entry and participation in the market,” Brewster said.

Brewster noted that the existing investment requirement may deter re-entry or encourage unnecessary investments to meet the threshold and added that eliminating the investment requirement would “support the potential cost-effective and timely re-entry of previously deactivated resources.”

Meanwhile, requiring claw-back provisions in COSAs would prevent incentives for resources owners to fish for out-of-market resource retentions, Brewster said.

Next Steps

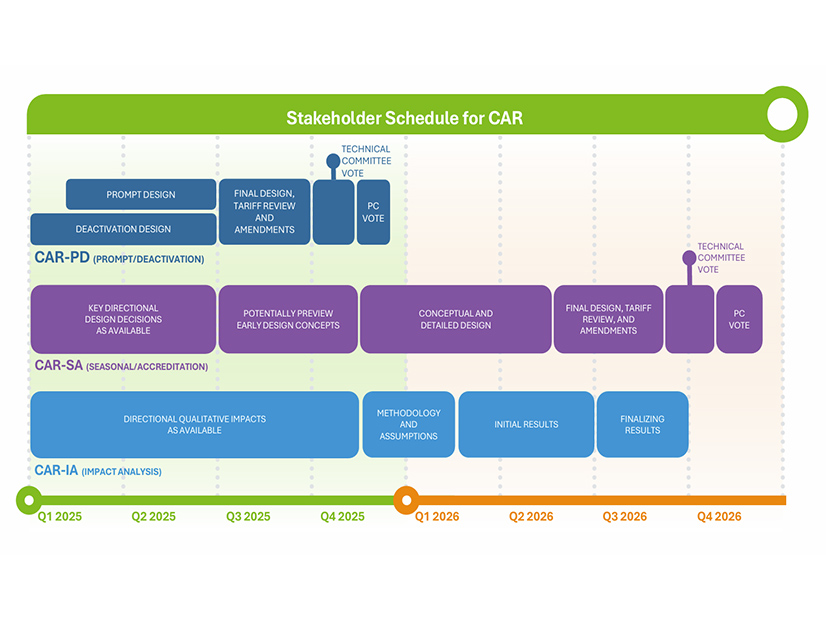

The RTO plans to present tariff changes for its qualification rules, annual auction mechanics, market power mitigation requirements and resource deactivations at the MC in August. It aims to vote on the changes in October and submit the filing to FERC before the end of the year.

The second phase of the CAR project, focused on seasonal auction changes and resource accreditation, will continue throughout 2026.