PJM has revised elements of its proposal to create a non-capacity backed load (NCBL) product for large loads as the Critical Issue Fast Path (CIFP) embarks on determining how to address the reliability challenges posed by accelerating data center load growth. (See PJM Board Initiates CIFP Addressing RA, Large Loads.)

The proposal would create a new form of interconnection service in which customers would not receive, or pay, for capacity in a set delivery year, and the amount of load procured in the corresponding capacity auctions would diminish accordingly. It would be triggered in delivery years where forecasted supply for a Base Residual Auction (BRA) is less than the reliability requirement. In nearly 200 pages of comments submitted to PJM in response to its initial proposal, many stakeholders argued it would undermine investment signals for new generation and lead data center developers to look to other regions. They also said PJM proposed a solution without taking the time to fully understand the scope of the issue.

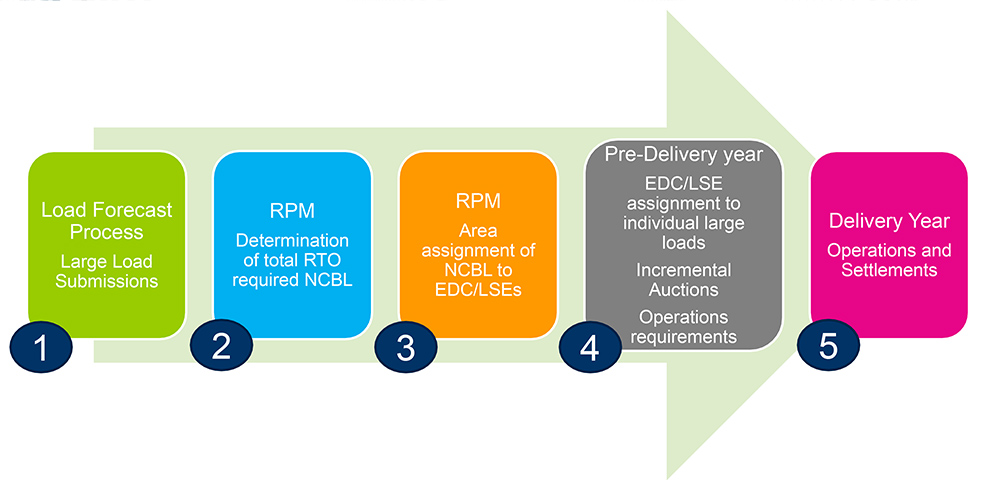

The core change PJM made to the proposal is how large load customers might receive a mandatory NCBL designation. Under the version of the proposal PJM presented at a CIFP meeting Sept. 15, the RTO would calculate the amount of NCBL that would be needed across its footprint and allocate a share of that to electric distribution companies and load-serving entities based on the amount of planned, unbuilt large loads expected to come into service in their service area during a delivery year in which a shortfall has been identified. It would then fall to each EDC and LSE to determine how to assign their NCBL allotment to customers.

When first presented, the proposal had a voluntary pathway for customers to request NCBL status when PJM determined there might be a capacity shortfall in an auction, followed by the RTO making mandatory NCBL assignments if the deficiency persisted. Much of the criticism in the subsequent comments argued that PJM lacks jurisdiction to assert how retail customers receive service.

PJM’s approach to determining how much NCBL would be distributed to each zone would exclude existing load and planned large loads that intend to participate in demand response or bring-your-own-generation (BYOG) programs. Because the final NCBL designation would be left to retail service providers, however, Senior Director of Market Operations Tim Horger said it is possible that EDCs and LSEs, with direction from state regulators, could opt to include large loads already in operation or planning to enroll in DR or BYOG.

Horger told RTO Insider in an email that if a planned large load’s DR or BYOG participation does not cover its expected load, the remainder would be added to the NCBL area calculation.

Data center representatives said the proposal appears to force customers to take flexible or inferior service unless they enroll in BYOG or DR, and even then there would be no certainty that they could entirely mitigate the risk of being required to take NCBL service. That uncertainty around who is subject to the proposal would impact the prospect of making investments in PJM for those in need of large amounts of energy, they said.

Horger said concern that large loads could face unreliable service would be present even if PJM does nothing because of the heightened risk of manual load shedding being needed. The proposal would at least provide customers with savings on capacity and possibly more advance notice on when they would need to curtail in real time. He characterized NCBL as changing the prioritization of the load-shedding procedures.

Denise Foster Cronin, vice president of federal and RTO regulatory affairs for the East Kentucky Power Cooperative, said the proposal could result in scenarios where retail service providers bilaterally contract capacity for expected large customers, only for that load to be subject to NCBL and pulled out of the capacity market, while the self-supplied generation would remain on the supply side of the ledger. She argued that would effectively offer that paid-for capacity to other customers participating in BRAs.

“Additionally, despite having secured capacity to meet the totality of the load obligation, PJM would require its assessed amount of NCBL to be curtailed prior to emergencies. Since we are one of the transmission owners that PJM will require to execute the NCBL curtailment, that presents us with a Hobson’s choice, as none of our load should be curtailed,” Cronin told RTO Insider.

Responding to stakeholder inquiries on whether the NCBL proposal is being envisioned as a permanent addition to PJM’s capacity market or a temporary measure, Horger said it’s viewed as a way to bridge a gap across a reliability shortfall expected to last a few years. While a firm retirement for the product has not been included, he said the RTO is open to including a trigger to eliminate the process, such as after the reliability requirement has been cleared for a certain number of years.

PJM Associate General Counsel Mark Stanisz said the CIFP discussion demonstrates that the proposal impacts wholesale rates and supports the position that it falls under federal jurisdiction. He said PJM states have chosen to rely on the RTO’s markets and the courts have routinely determined that FERC and the Federal Power Act have jurisdiction over the rates, practices and mechanics behind RTO capacity constructs. He added that the federal energy policy ecosystem is rapidly evolving, with several executive orders since the start of 2025 and an artificial intelligence action plan in place.

In a statement responding to the proposal, the Natural Resources Defense Council recommended an approach requiring all new large loads to procure their own generation to avoid disruptions to the capacity market from individual customers. It argued that the proposal would leave data center load in the capacity market, causing customers to pay significantly higher costs and push data centers to install inefficient backup generation to cover periods where they are curtailed.

“PJM is creating rules for how to manage the reliability risk, essentially by proposing to shut off new data centers during any hour of the year when there is insufficient electricity. While this approach would preserve reliability in a draconian way, it will do little to protect residents from rising bills and require highly polluting backup generators to run many more hours each year,” the NRDC wrote.

Additional Package Details

PJM presented additional information on how it envisions the proposal being implemented, including specifying that NCBL curtailments would fall before pre-emergency load management deployments in the stack of emergency procedures.

Customers assigned NCBL status would be exempt from capacity payments by removing their load from the corresponding zone’s forecast peak load when determining how much capacity must be procured in each zone. The relevant EDC or LSE would be responsible for reducing its obligation peak load to reflect the reduced capacity requirement. PJM would shift the resource requirement and variable resource requirement curve, which determines the amount of capacity procured in a BRA, to reflect the RTO-wide NCBL designation.

The definition of a large load would be set at 50 MW, with a case-by-case review for including smaller customers.

PJM staff acknowledged many areas of the proposal require further refining, including what would happen if a customer or retail service provider failed to curtail NCBL.

PJM Broaches Alternative Proposals

PJM presented additional concepts that could develop into alternative CIFP proposals, including an alternate NCBL with only voluntary participation.

Eliminating the mandatory designation would grant states and retail service providers more ability to balance reliability risk against costs on their own, the RTO said. If participation is low, that could mean higher risk of manual load shedding, however.

Ongoing discussions around expanding provisional interconnection service could also be shifted from the Planning Committee to the CIFP. The changes being considered aim to identify resources that could enter partial operations before their full transmission network upgrades have been complete, making more energy available to dispatchers during emergency conditions. (See PJM Stakeholders Endorse Expansion of Provisional Interconnection Service.)

Another concept would require planned large loads to bid into capacity auctions for the year in which they intend to enter service, with a cost commitment that would hold even if they do not come online. Doing so would improve the certainty of the load forecast. Bids would be submitted either through the customer’s retail service provider, or the customer could become its own LSE, though PJM said both present jurisdictional quandaries. The proposal could be paired with a voluntary NCBL model, though the risk of manual load shed could still be high if many customers do not opt to participate.

The changes could be limited to how shed load is allocated, or they could be paired with other proposals, though PJM cautioned that if no other market design changes are made, the auction could repeatedly clear short of the reliability requirement, triggering the Reliability Pricing Model backstop auction.

An expedited interconnection option could create a parallel queue for a select number of resources with strict eligibility requirements, including being operational within three years. PJM’s Jason Shoemaker said it could deliver interconnection agreements in 10 months with minimal impacts to the overall queue. Because implementation would fall after the completion of Transition Cycles 1 and 2, he said there would be no disruption to projects already in the queue.

PJM could also develop more transparency for planned generation and large loads and assist in identifying opportunities to create partnerships between the two.

RA Scenarios Highlight Capacity Shortfall in 2030

PJM Senior Manager of Policy Initiatives Susan McGill presented five scenarios looking at how different levels of supply growth could impact a capacity deficiency PJM has projected in 2030. Each built off the 2025 Load Forecast, which estimated that net energy load growth will increase by about 4.8% annually over the following decade.

The first scenario assumed new resources would come on at the historically slow rate, bringing 6.6 GW of unforced capacity online, while policy-driven deactivations would take 8.1 GW of supply offline. Paired with 22.9 GW of load growth, that would result in a 24.1-GW UCAP deficiency.

The direst scenario assumed a 25% faster rate in resources interconnecting, offset by 29.2 GW of load growth from requests to co-locate load with new resources, resulting in a 24.7-GW shortfall.

Removing the co-located load requests and holding generation deactivations flat would result in a 10.4-GW shortfall, while adding the highest DR participation seen in the last five years to the equation would add 3.3 GW of supply and shrink the gap to 7.1 GW.

The final scenario assumed additional load flexibility would participate, resulting in the market clearing with no surplus.

Wide-ranging Comments Submitted on CIFP

Dozens of organizations and individuals submitted comments to PJM, many of which debated the merits of the NCBL proposal or urged the RTO to extend its focus to load forecasting, DR and the interconnection queue.

The governors of Pennsylvania, New Jersey, Maryland and Illinois jointly wrote that a CIFP process is needed to address rising load growth and correspondingly high capacity prices while stating that the impact of the NCBL proposal is difficult to model and could carry unintended consequences. If it were to be implemented, they recommended limiting it to the 2028/29 and following auction.

“An explicitly temporary and more broadly applicable NCBL methodology that is mandatory for only the next two BRA performance periods … could provide a partial and short-term solution. However, we feel strongly that this temporary solution must be accompanied by additional measures that address more fundamental issues and will not risk artificially perpetuating extremely high capacity prices through a potentially flawed trigger mechanism,” they wrote.

They said the CIFP scope should explore overhauling load forecasting, creating incentives for large loads to bring their own generation, using regional transmission planning to create new interconnection opportunities and speeding the interconnection of energy-only resources.

Exelon said the original iteration of PJM’s proposal would infringe on state jurisdiction and create a compliance trap for utilities stuck between the RTO imposing civil penalties if they fail to curtail NCBL customers and state regulators that might object to that curtailment.

“The proposal establishes a new category of retail service for certain large loads whereby those customers would receive service on an interruptible basis subject to curtailment in emergencies and would be exempted from paying capacity charges. This is not simply a tweak to PJM’s wholesale market rules; it is the creation of a novel form of retail electric service, with specified terms and conditions set on a regionwide basis by PJM,” the utility wrote.

Rather than rushing to a solution without understanding the problem, Exelon said that PJM should more thoroughly study the resource adequacy threats and hold education on the load shed risk in the Mid-Atlantic.

“Ultimately, we owe it to our customers, current and future, and our state policymakers and regulators to begin informing them of the real and increasing possibility of load shedding in the not-to-distant future, even as we continue efforts to build both the transmission and generation needed to address and mitigate that risk,” Exelon said. “Doing so may also result in additional creative solutions that would further mitigate and address this risk. Without being informed of the imminent need, we may lack the collective alignment amongst policymakers, regulators and operators to more aggressively tackle these issues.”

Advanced Energy United argued that PJM should focus its efforts on a BYOG pathway, which it said is likely the only way for significant amounts of supply to interconnect in time to make an impact, and address the load forecast to avoid mismatching transmission and generation development against load growth.

United argued the proposal would suppress capacity prices and hold back new investment in a manner that would make it hard to backtrack from.

The Digital Power Network said data centers lend themselves to load flexibility, which is underutilized because of outdated programming and inaccurate modeling of load-shedding events. Rules around when data centers could be curtailed must be clear and transparent, but PJM’s proposal would leave them in the dark, it argued.

“Flexible digital loads should be incentivized to participate in resource adequacy initiatives rather than be excluded from them. A framework that encourages voluntary participation through programs such as demand response while rewarding flexibility would strengthen adequacy and preserve reliability,” it wrote.