VALLEY FORGE, Pa. — Several stakeholders presented proposals for how PJM could address accelerating load growth as the Critical Issue Fast Path (CIFP) process on large load growth wraps up its second phase.

Many of the design components revolved around requiring large loads to bring their own generation (BYOG); pathways for fast-tracked interconnection studies for new resources; allocating capacity and interconnection costs to large consumers; and queues to delay them from coming online until there is sufficient capacity to serve them.

PJM updated its proposal at a CIFP meeting Oct. 1, during which Advanced Power, Enchanted Rock and a coalition of generation owners and tech companies presented alternatives. (See PJM Drops Non-capacity Backed Load, Shifts Focus to Resource Queue, PRD.)

The RTO opened a poll on the proposals following the Oct. 14 meeting to gauge support before moving on to the third phase of the CIFP process, in which the design components will be combined into holistic packages. Manager of Stakeholder Process and Engagement Michele Greening said Phase 3 packages should be designed to resolve all issues identified in the Board of Managers’ letter initiating the CIFP. The first of the Phase 3 meetings is scheduled for Oct. 24.

Eolian BIGPAL Proposal

The bilateral integration of generation portfolios and load (BIGPAL) proposal from Eolian would allow planned large loads to procure their capacity from adjacent resources coming online at the same time.

The resources would qualify for a 90-day interconnection study process and not participate in the capacity market; be assigned capacity interconnection rights (CIRs); or be derated by PJM’s effective load-carrying capability accreditation framework.

While the proposal’s definition of “adjacent” is not yet set, Eolian said siting the resource electrically near the load would reduce the need for transmission upgrades and allow it to perform under emergency conditions. While a performance assessment interval (PAI) is active, the BIGPAL configuration would be required to reduce its net load to zero. Load flexibility would serve as a backstop to resource performance.

The risk of the resource underperforming during a PAI would be shared by the parties to the contract, with penalties if there is a net draw off the grid.

The adjacent resource would be able to participate in PJM’s energy market and would be available to security-constrained economic dispatch. Brattle Group consultant Andrew Levitt, who helped prepare the proposal, said it would make sense for BIGPAL resources to operate as normal PJM resources when PAI risk is low and prioritize being available to serve the adjacent load when an emergency appears likely.

Brattle modeled how BIGPAL would perform in the 2030 delivery year, using PJM’s load and expected resource mix and two RTO scenarios: 6 GW of new unforced capacity and 8 GW of retirements, and 12 GW of new capacity and no deactivations. The firm developed a moderate weather scenario built off 2018 and a more severe weather year based on 2022. The model assumed 25 GW of BIGPAL load paired with 20 GW of storage and 5 GW of gas generation.

The analysis found there would be no load shed in a moderate weather year in the scenario where deactivations outpace new entry and 16 hours of load shed in a severe weather year.

Bruce Campbell, principal of Campbell Energy Advisors, said he’s concerned about any proposals that would create new forms of curtailable load that would be dispatched after demand response customers. Coming out of a summer with a high amount of pre-emergency load management deployments, he said participant fatigue may be a concern going forward with the prospect of substantially more dispatch as reserves shrink. He noted that “fatigue” can mean simply that customers are losing money with each hour of dispatch.

Glatz and Silverman Present Alternative NCBL Design

Abraham Silverman, research scholar at Johns Hopkins University, and Suzanne Glatz, principal of Glatz Energy Consulting, presented several design components intended to minimize the impact large loads would have on existing consumers.

They proposed a bifurcated capacity market in which the first round of the auction would set a clearing price for native and non-large load, followed by a second round clearing large loads and any generation that had not already cleared. The price for the second round of the auction would be inclusive of make-whole payments for resources that cleared in the first round, ensuring that all resources receive the same capacity price.

Building on PJM’s mandatory non-capacity backed load (NCBL) proposal, they recommended a variant that would subject large loads to curtailment in delivery years when the capacity market cleared above the midpoint on the variable resource requirement curve. Curtailments would fall ahead of all DR customers in the stack of emergency procedures. While mandatory NCBL is no longer PJM’s preferred solution, it remains a design component stakeholders can include in their packages.

Load-serving entities would be able to avoid being assigned NCBL allocations by ensuring that large loads can offset 80% of their peak load for at least four hours, 10 times a year. Glatz said this would create an incentive to participate in BYOG models.

NCBL load would be required to pay half of the capacity clearing price each delivery year to capture the benefits it receives from non-firm service when there are no curtailments.

The initiation of the CIFP process would be considered the cutoff point for any NCBL requirement, with existing load exempt.

Another component would exclude large loads from PJM’s forecast unless the relevant utility attests that all distribution and transmission upgrades needed to interconnect the load will be complete before the delivery year; the large load attests that it’s not planning similar new service requests that might result in the project being canceled or modified; and the customer provides evidence of commercial maturity, such as “take-or-pay” agreements for transmission service. If an NCBL model similar to PJM’s initial proposal were to be implemented, participating large loads also would be excluded from the forecast.

NRDC Supportive of NCBL

The Natural Resources Defense Council recommended an NCBL construct in which large loads would not receive firm service unless they were paired with new capacity or resources that did not clear in the capacity market.

Large loads could gain firm service by committing to participate in DR or price-responsive demand programs, or contracting with other consumers to participate on their behalf.

The proposal aims to recognize the jurisdictional questions around PJM defining particular consumers as being subject to NCBL and leaving implementation to the states. The RTO would determine the amount of NCBL needed across its footprint and distribute that figure across locational deliverability areas (LDAs); from there, states and utilities would determine how to assign that to customers.

The proposal would designate curtailment as either the final energy emergency alert Level 1 action or the initiator for Level 2. This would lead to it being instituted either prior to or concurrent with the start of scarcity pricing.

Few planned resources expected to come online in time to participate in the 2026/27 Base Residual Auction (BRA) have submitted offers, which is creating a false tightening in the market, according to the NRDC. Reducing the risk of participation could mitigate that, including by PJM making a commitment that it will not seek to reinstate the minimum offer price rule in place before 2018. (See 3rd Circuit Rejects Challenges to PJM MOPR, Affirms Authority over FERC Deadlocks.)

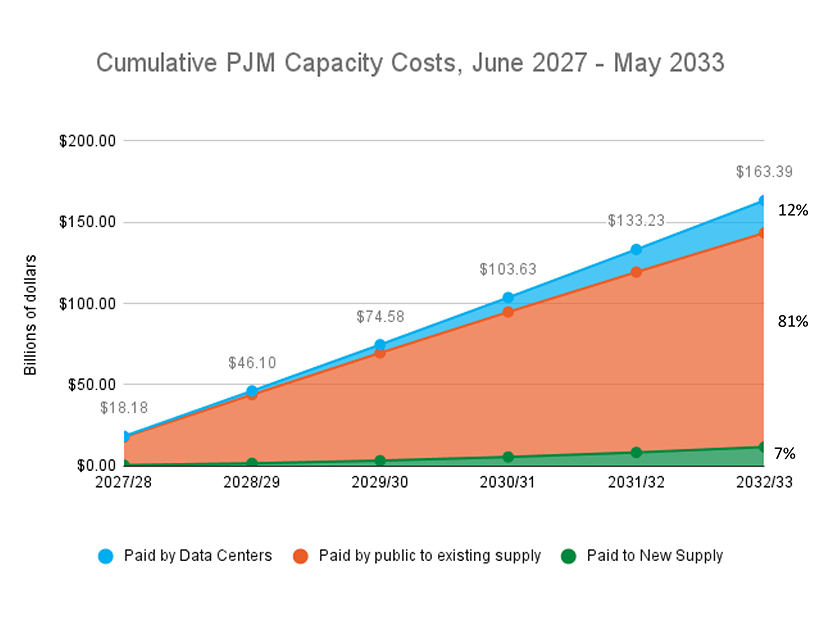

The NRDC conducted analysis on the cost of the load growth and reliability gap that PJM predicts, finding that consumers would pay $163 billion in capacity costs between the 2027/28 and 2032/33 BRAs. Data centers would pay a small amount of those increased capacity costs, and most of the revenue would flow to existing supply, which the NRDC found would create a scenario where 81% of the $163 billion are “deadweight” payments that existing consumers pay to existing supply.

Monitor Recommends Load Interconnection Queue

The Independent Market Monitor proposed creating an interconnection queue for large new data center loads in which they would be interconnected only when any required transmission upgrades are complete and there is enough capacity and energy to serve them reliably.

Large loads would be eligible to bypass the queue via an expedited interconnection process if the loads brought new generation (BYONG). The new generation would have to be deliverable to the grid, deliverable to the new load, and capable of matching the amount of time the load will be online. Monitor Joe Bowring gave the example of intermittent resources combined with storage, or thermal generation, both qualifying for the duration component.

Participation in DR would not fall under the BYONG model, as Bowring argued it does not match the duration of the load and is not equivalent to bringing new generation capacity online.

Bowring said the proposals to treat large new data center loads as on the demand side would have them interrupted only after existing demand-side resources are interrupted and only if there is a reliability emergency. That treatment would impose significantly increased interruptions on existing demand-side customers and risks those customers leaving the program, he argued. It also would increase the occurrence of scarcity pricing in the energy market, which imposes higher energy costs on all customers.

“Demand side is not generation,” Bowring said in an email to RTO Insider. “If the large new data center loads are going to enter without capacity, they should be interrupted whenever existing capacity is needed by the customers that pay for it.”

Bowring said if PJM is not capable of serving a new load, the RTO should not be obligated to allow it to interconnect. He said the premise of all the other CIFP proposals is that PJM must interconnect large new data center loads when there is not enough capacity to serve them reliably.

“That premise is not correct,” he said. “Allowing the interconnection of large new data center loads without matching capacity imposes costs and risks on all other customers, increasing prices and the risk of blackouts for other customers. That is not consistent with PJM’s stated objective of putting reliability first.”

It also increases the demand for energy without increasing the supply of energy, increasing energy costs for all customers by an estimated $2 billion to $3 billion per year, Bowring said.

Pointing to Part A of the Monitor’s report on the 2026/27 BRA, Bowring said data center load growth has caused capacity costs to increase by $16.6 billion over just the past two auctions — costs that should not be shifted to existing consumers, he said.

Vistra Seeks Penalties for Utilities Short on Capacity

Vistra proposed instituting penalties for utilities that do not cover their own capacity needs with the aim of incentivizing bilateral contracts that take strain off the capacity market.

The proposal includes variants for triggering penalties if the load forecast for a capacity auction signals it may be tight, during emergency procedures or a combination. Assessing the penalties in advance carries the advantage of providing more incentive to get contracts in place before the auction, while implementing them during emergencies creates more flexibility on the amount of risk a utility is willing to accept. Several penalty rates also were presented for each option.

Operational penalties would create incentives for utilities to offer load flexibility products to customers to mitigate the risk the utility might not have enough capacity in place, while planning-based penalties would create more incentives to contract with DR providers.

EKPC Recommends Requirements for Self-supply

The East Kentucky Power Cooperative proposed “significant” penalties for LSEs that enter a BRA without enough owned or contracted supply to cover its capacity obligation. The penalties would be assessed against all deficient LSEs within an LDA if an auction does not procure enough supply for that zone.

Large loads would be required to identify the LSE that will serve them before they are included in the load forecast as a large load adjustment (LLA), which feeds into the amount of load to be served in a given BRA; if an LSE is not identified, it could be treated as being served by the default provider. That is intended to serve as a “reality check” that the load is likely to come into service in that delivery year and reduce duplicative LLA requests. State involvement in the load forecasting process could further advance the reality check. Large loads would be defined as a site with load exceeding 50 MW.

The penalties would be distributed to LSEs that had procured enough capacity for that delivery year as compensation for the price pressure and load shed risk they faced. State regulators would be encouraged to create retail rate structures that allocate penalties to large loads and reduce the impact on existing consumers.

NOVEC Proposes Changes to NCBL

NOVEC proposed modifications to PJM’s NCBL proposal that would remove the load from the capacity market and place its curtailment as the penultimate step in the RTO’s emergency procedures, after all other DR products and just before load shed.

If an EDC or LSE cannot assign enough NCBL to meet PJM’s allocation for its region, it would be assessed a daily deficiency penalty for the amount it is short, which would be refunded to other utilities. If NCBL load does not curtail, it could be subject to FERC and NERC compliance and financial penalties.

NOVEC’s Rory D. Sweeney said that if NCBL is to be implemented, it should be structured as a permanent late-stage emergency procedure.

Maryland OPC Focuses on Load Forecast and BYOC

The Maryland Office of People’s Counsel recommended changes to PJM’s load forecast process, a bring your own capacity (BYOC) model, a large load-specific DR product and assigning more load shed obligation to regions with large loads not backed by new capacity.

The proposal would have PJM develop scenarios accounting for the uncertainty around LLAs coming online when it develops its load forecast, with the modeling tied to the advanced nature of the capacity market and Regional Transmission Expansion Plan (RTEP). The amount of load included in the forecast for each utility could be reduced if they do not establish a tariff for large loads or a dedicated oversight process for their interconnection that includes project milestones and financial commitments.

The BYOC element requires new large loads to either bring enough capacity to meet their own needs or offer the equivalent of their peak load into a load-offset demand response (LODR) product — a temporary program designed for large loads to net to zero either by curtailing or activating behind-the-meter generation. The capacity would have to be deliverable to the load and come online at the same time.

Mainspring Seeks Changes to EIT

Mainspring Energy presented several changes to PJM’s proposals, including shifting the focus of its expedited interconnection track (EIT) to prioritize resources that can be built quickly, rather than prioritizing the size.

The EIT model presented on Oct. 1 would create a 10-month interconnection study process for projects at least 500 MW and capable of being in service within three years.

The revised eligibility requirements would allow projects above 50 MW to participate, including projects to uprate or repower existing generation. It also would make state sponsorship of projects voluntary, removing a requirement PJM said was intended to reduce the risk that a project would be expedited through its queue only to become mired in state siting and permitting processes.

Director of Wholesale Market Development Brian Kauffman said the majority of data centers are on the scale of 50 MW and could be served by comparably sized resources.

It also recommended that PJM include a voluntary NCBL model in its package and for states to develop non-firm or flexible service models for retail load. Kauffman said speed-to-market is the priority for data center developers, who might be willing to accept less firm service in exchange for faster interconnection.

Pa. and Va. Governors Offer Perspectives

Presenting on behalf of Pennsylvania Gov. Josh Shapiro and Virginia Gov. Glenn Youngkin, Pennsylvania Deputy Secretary of Policy Jacob Finkel overviewed their perspective that efforts to streamline the entry of new supply and minimize the impact to residential and commercial ratepayers should be prioritized.

Models that offer a carrot rather than a stick are preferred, particularly those with voluntary short-term flexibility paired with incentives for long-term resource development, Finkel said.

The governors support Eolian’s BIGPAL proposal as a way of reducing delays in getting generation built, though more market design changes would be needed to ensure proper incentives are in place, Finkel said. Load forecast changes would also be welcome, but he noted that would not change the supply and demand challenges PJM faces.