ISO-NE continued work on the second phase of its Capacity Auction Reform (CAR) project with NEPOOL members Dec. 9 and 10, discussing modeling of the region’s gas constraints, seasonal auction design and its approach to evaluating the impacts of the auction changes.

Discussions around the CAR project are poised to take up a large portion of NEPOOL technical committee meetings throughout 2026. The second phase of CAR centers around resource accreditation changes and splitting annual capacity commitment periods (CCPs) into six-month winter and summer seasons.

The accreditation changes likely will be the most controversial aspect of the project, as the changes would directly affect how much capacity each resource can sell in the market. ISO-NE aims to complete the seasonal and accreditation design by the end of 2026.

Steven Otto, manager of economic analysis at ISO-NE, discussed the RTO’s thinking regarding the development of a gas capacity demand curve, which would be intended to account for the “shared physical constraints” limiting gas resources’ ability to access gas during cold periods.

As envisioned by ISO-NE, the gas demand curve would reduce how much gas resources are paid for their capacity relative to other resources during the winter season. Gas capacity backed by firm supply contracts would not be subject to the curve but likelywould affect the amount of gas available to remaining non-firm capacity.

The RTO “will construct a non-firm gas capacity MRI [marginal reliability impact] curve by measuring the reliability impact of substituting incremental megawatts of non-firm gas capacity with other capacity in the system,” Otto explained.

He added that, “in conjunction with the simultaneous clearing of the systemwide demand curve, the intersection of the gas capacity supply and demand curves determines how much non-firm gas-only [capacity supply obligations] will be awarded and how much less that CSO will be paid.”

The gas demand curve process would be separate from the accreditation process for gas resources; gas accreditation values would be determined largely by forced outage rate, maximum capacity and deliverability.

To determine how much gas is available to gas-only generators, ISO-NE plans to rely on modeling by the Analysis Group, which presented the initial results of its study of the region’s winter gas constraints at the meeting. The consulting firm estimated the hourly energy supply for gas resources based on 10 modeled winters intended to represent the full range of supply scenarios.

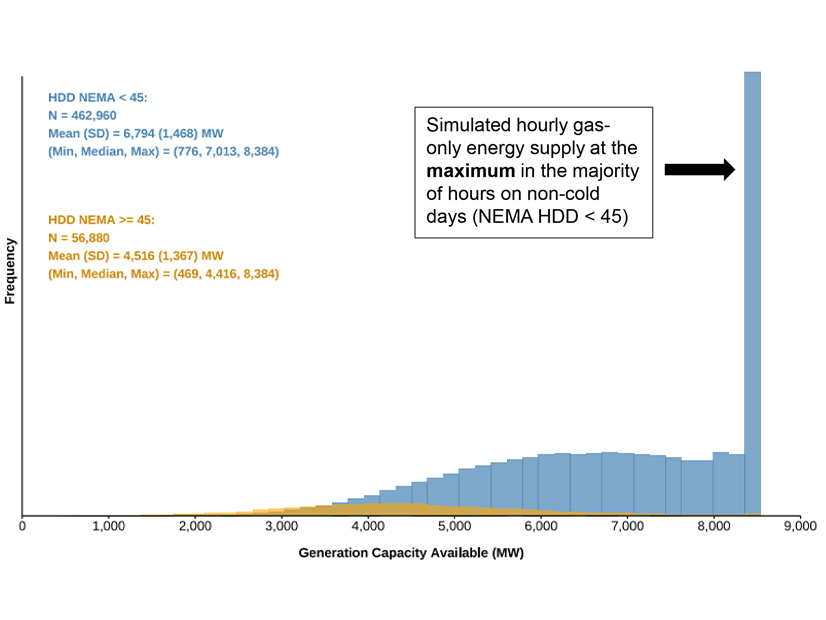

On cold days, defined as heating degree days (HDDs) at or above 45 — which equates to temperatures at or below 20 degrees Fahrenheit — the amount of available gas-only capacity averaged 4,516 MW, with a minimum of 469 MW and a median of 4,416 MW. On warmer days, available capacity averaged 6,794 MW, with a minimum of 776 MW and a median of 7,013 MW.

Gas resources did not face constraints during most days with an HDD below 45. Generation capacity equaled 8,384 MW during these days.

Responding to stakeholder questions, Todd Schatzki, principal at the Analysis Group, said the company did not find major geographic differences in access to fuel, noting there is a complex array of supply inputs to the gas system during tight system conditions.

He said it is difficult to accurately quantify local constraints, adding that constraints on the Algonquin G-Lateral appear to affect just two gas-only plants and about 5% of gas-only capacity.

ISO-NE’s proposed gas demand curve would apply equally to all non-firm gas capacity, but some stakeholders have argued that some resources are better situated geographically to access pipeline gas during tight days and should not be treated as equal to more constrained gas capacity.

The RTO plans to update the gas constraint modeling annually to account for changes in the amount of gas available to generators.

Seasonal Market

In the shift to a seasonal capacity market, ISO-NE proposes to “employ a similar approach to setting seasonal NICR [net installed capacity requirement] values and the corresponding demand curves” to the approach it uses in the current annual capacity auction format, said Chris Geissler, director of economic analysis at ISO-NE.

ISO-NE plans to split its loss-of-load expectation (LOLE) of 0.1 days per year into seasonal LOLEs set at 0.05 days per year. This is intended to maintain the one-day-in-10-years standard.

The RTO would calculate the seasonal NICR based on the amount of capacity needed to meet the LOLE requirement.

“This means, at the corresponding NICR values, the resource adequacy model predicts the same number of expected loss-of-load events in summer and winter,” Geissler said. Although the frequency of events would be the same, the severity and duration of events likely would differ, he noted.

Several stakeholders expressed concern that evenly splitting LOLE between winter and summer seasons could cause the region to under-procure capacity in the summer and over-procure in winter.

Geissler said ISO-NE does not expect the proposed LOLE distribution to skew demand curves, saying the risk split should not have significant impacts on seasonal capacity costs. He said ISO-NE will work to provide more examples in future discussions on the topic.

Impact Analysis

Geissler introduced ISO-NE’s proposed approach to evaluating the market impacts of the proposed suite of CAR changes. He said the impact analysis will focus on identifying differences between modeled results using current auction rules and CAR auction rules.

ISO-NE presented an initial impact analysis for its Resource Capacity Accreditation project in May 2024 before the RTO suspended the project, incorporating it into the broader CAR effort. (See ISO-NE: RCA Changes to Increase Capacity Market Revenues by 11%.)

ISO-NE plans to split the impact analysis into two main focuses: changes to the amount of capacity resources can sell, and changes to market clearing outcomes, he said. The RTO plans to look at metrics including clearing prices, capacity costs, cleared capacity by resource type and season, and revenues by technology type.

He noted it will be difficult for ISO-NE to predict supply offers for all resource classes amid the changing market design and broader changes in the energy landscape, including a potential increase in pay-for-performance risk.

To address the issue of uncertainty, the RTO plans to rely on a “consistent set of assumptions to derive offer prices,” which should “help to provide an apples-to-apples comparison between the current rules and CAR cases and reduce the impact of over- or underestimating offer prices,” he said.

ISO-NE plans to evaluate “multiple sets of offer prices to reflect the uncertainty of how resources may offer going forward and clearly articulate the basis for each to help participants develop their own expectations about market outcomes,” he added.

Geissler said ISO-NE will try to incorporate stakeholder-requested scenarios and analyses, but he noted “the considerable stakeholder interest and the resource-intensive nature of this work” may make it hard to follow through on all requests.