By Marji Philips

In December 2019, FERC issued an order addressing the participation of subsidized resources in the electric capacity market. The order has been met with a highly politicized reaction from those who believe — wrongly — that the order is an attack on renewables and unfairly advantages fossil fuels like coal. The facts do not support that position.

Rather, the FERC order protects consumers from subsidies that would interfere with the electric capacity market’s essential goal of ensuring a reliable supply of electricity to meet future demands. For ratepayers, the capacity market ensures reliable power to their homes and businesses even when demand peaks. If the market stops operating the way it is intended — for example, when suppliers can underbid prices because of subsidies — the result will be less reliable energy supply and extraordinary increases to utility bills. The FERC order protects against that possibility.

PJM/Capacity Market Background

PJM operates competitive wholesale electricity markets and manages the high-voltage electricity grid with a mandate to ensure reliability for more than 65 million people. To achieve this, an important tool for PJM is the capacity market. The PJM capacity market ensures long-term grid reliability by securing power supply resources that are capable of responding quickly when needed to meet expected energy demand in the future. Using a competitive auction system, PJM ensures reliable energy delivery at the lowest cost. PJM also administers other markets that procure electricity for consumers at the lowest possible cost including the energy market and ancillary services market.

FERC Order Key Points

In review of the FERC order, we highlight the following:

The FERC order supports grid reliability.

The FERC order pertains solely to PJM’s capacity market, where it determined that “unjust and unreasonable” subsidies represent a threat to the competitiveness of PJM’s capacity market, which is tasked with maintaining reliability. After a lengthy process involving detailed submissions from all interested parties, FERC found that PJM’s capacity market is negatively affected by various state policies that provide subsidies to certain specific generators. These payments distort the capacity market and discourage non-subsidized generators from continuing operation or entering the market. Consequently, the subsidies’ impact on this market ultimately threatens PJM’s ability to maintain system reliability.

The FERC order is fuel neutral.

The order does not favor one fuel type over another. Any type of generation resource that receives a state subsidy will be subject to a minimum bid price in the capacity market auction. This restriction applies equally and across the board, whether it is a solar farm participating in a state renewable portfolio standard program, or a nuclear or coal facility receiving a state-sponsored subsidy.

The FERC order will not affect renewable energy development.

Renewables are among the best generating resources to provide low-cost energy. However, they are not reliable capacity resources. Solar and wind resources are only able to generate energy when the sun is shining or the wind is blowing. The intermittent nature of their operation does not fit well with ensuring the grid is capable of meeting energy demand at all times. While PJM has more than 15,000 MW of installed wind and solar capacity, less than 2,000 MW participate in the capacity market. This is because wind and solar have limited effectiveness as a capacity resource — and there are significant penalties if a generator that sells capacity fails to perform when it is needed.

Importantly, the economics for renewable energy development decisions is not supported by anticipated capacity market revenues. Renewable developers do not make investment decisions based on anticipated capacity payments, which generally comprise less than 10% of the revenue for a typical PJM solar or wind project (before taking into account failure-to-perform penalties that can reduce revenue even further). New Jersey, for example, has attracted more than 3,000 MW of solar projects, but less than 20% of those are eligible for participation in the capacity market. States that have experienced significant renewable development have accomplished this through well-structured RPS programs or competitive procurements. In short, the capacity market has minimal or no effect on the development of renewable energy sources or states’ ability to attract renewable generation projects.

The FERC order does not prevent states from subsidizing renewable development or reducing energy demand.

The FERC order has a narrow impact: Subsidies cannot directly reduce clearing prices for capacity in PJM’s energy capacity market. But the order does not prevent states from offering subsidies, incentives or other programs to encourage the development of renewable energy (or whatever energy resources a state chooses to prefer). Nor does the order prevent those subsidies from making those sources more attractive than non-subsidized sources in other energy markets — including the markets that are focused more on meeting immediate and short-term demand than the capacity market.

Beyond subsidy and incentive programs, states will of course retain significant tools to address carbon emissions and encourage consumers to transition to renewable resources. The FERC order — and the PJM capacity market — do not affect demand-side restrictions like carbon caps, emission standards, offset programs and other policies that can indirectly affect the cost of non-renewable energy generation or encourage the adoption of renewable energy sources.

Conclusion

We look forward to the day that our grid can be powered by renewable generation backed up by batteries and storage. While we are making great strides in this direction, it is ultimately PJM’s responsibility to ensure reliability. The capacity market is its critical tool to carry out this function, for which we expect that this FERC order will have little, if any, impact on renewable growth, and uneconomic coal plants in PJM will continue to retire.

As such, we support the FERC order and PJM in their aims to ensure grid reliability and protect ratepayers.

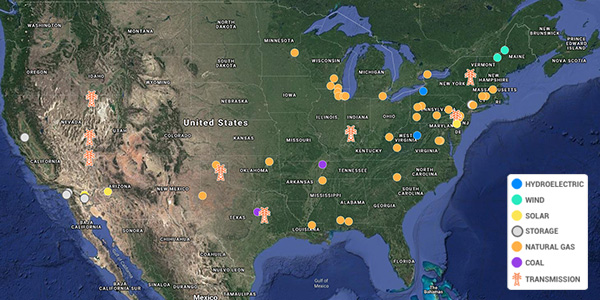

LS Power is a development, investment and operating company that has developed, constructed, managed or acquired more than 41,000 MW of utility scale solar, wind, hydro, natural gas-fired and battery storage projects and 630 miles of transmission in North America. It also invests in businesses and platforms focused on distributed energy resources and energy efficiency.