By Rich Heidorn Jr.

FERC Chair Neil Chatterjee and Commissioner Bernard McNamee on Tuesday reversed the commission’s November 2018 order correcting a key calculation in evaluating ISO-NE’s capacity delist bids (ER18-1770-002).

At issue is how ISO-NE’s Internal Market Monitor calculates the economic life of resources that want to retire or permanently leave the capacity market. Such a resource must provide at least five years of cash flow estimates to justify their delist bids, which specify the price at or below which it would retire. The rule change was intended to correct calculations that ISO-NE said overstated the true economics of some resources and could result in improperly high delist bids.

“We find that the benefits of ISO-NE’s economic life revisions do not outweigh the disruption to market participants’ settled expectations associated with changing an FCM [Forward Capacity Market] rule regarding delist bids after the [Forward Capacity Auction] 13 qualification process for those delist bids had commenced,” the commissioners wrote. “Thus, we reject the economic life revisions in their entirety, effective Aug. 10, 2018.”

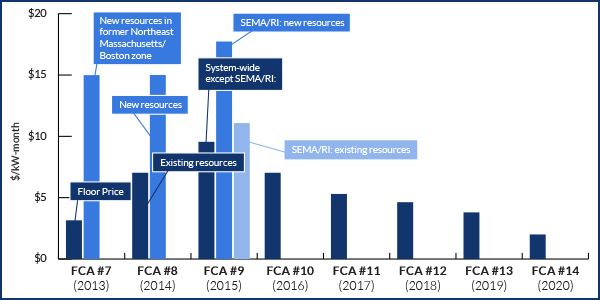

The 2-1 vote granted a rehearing request by the New England Power Generators Association (NEPGA), which asked that the commission make the economic life revisions effective, “if at all, beginning in FCA 14.” That auction was held last month. (See ISO-NE Capacity Prices Hit Record Low.)

In the 2018 ruling approving the calculation changes, Commissioner Richard Glick joined with then-Commissioner Cheryl LaFleur in the majority. Chatterjee filed a dissent saying that making the change effective for FCA 13 violated the commission’s rule against retroactive ratemaking because market participants had made commercial decisions based on Tariff rules in place before the ruling. (See Split FERC OKs New ‘Economic Life’ Rules for ISO-NE.)

This time around it was Glick dissenting, insisting that the original ruling “correctly balanced the harms and benefits of ISO New England’s proposal.”

“I note that nothing in today’s order precludes ISO New England from refiling substantially the same provisions tomorrow,” he added. “Today’s order, as I understand it, is concerned only with the timing of ISO New England’s previous filing and not its merits.”

ISO-NE spokesman Matt Kakley said Wednesday the RTO will determine its next steps after reviewing the order.

Chatterjee and McNamee agreed with NEPGA’s contention that a market participant that chose not to submit a retirement delist bid in FCA 13 based on the then-existing economic life calculation might have submitted such a bid under the revisions based on expectations of future FCA clearing prices.

But they declined to order FCAs 13 and 14 be rerun without the economic life revisions, saying that would create more harm than benefit.

“We acknowledge the harm to market participant confidence resulting from changing the economic life calculation for delist bids midway through the FCA 13 process,” they said. “However, we find that, because rerunning FCA 13 and FCA 14 would further decrease market participant confidence, such action is ill-suited to providing market participants relief in these circumstances.”

Deadline Waiver Granted

The commission also granted a waiver allowing market participants to adjust or withdraw their retirement or permanent delist bids for FCA 15 based on potential changes to ISO-NE’s Energy Security Improvements proposal (ER20-759).

ISO-NE is expected to file the ESI proposal on April 15, following a vote by the New England Power Pool Participants Committee on April 2 — after the FCA 15 delist deadline of March 13.

The RTO requested the waiver, saying that market participants’ retirement bid decisions may be affected by revenues they will earn or costs they incur under the ESI proposal.

The commission said it will extend the March 13 deadline through seven calendar days after the PC vote. If ISO-NE makes “a non-clerical change” to the ESI proposal after March 13, market participants will have seven calendar days following the vote to either withdraw their bid or update their retirement bids to reflect the changes.