By Rich Heidorn Jr.

Retail-choice states wanting to reduce their reliance on RTO capacity markets need to improve how their retail markets handle resource procurement, according to a new study produced for the Wind Solar Alliance.

“When competitive retail states restructured, there was insufficient focus on designing the market structure to support long-term contracting,” said the study, authored by Rob Gramlich of Grid Strategies and Frank Lacey of Electric Advisors Consulting. “Expansion of renewable energy and issues with wholesale capacity markets now require a focus on the competitive retail entities’ incentive and ability to procure power.”

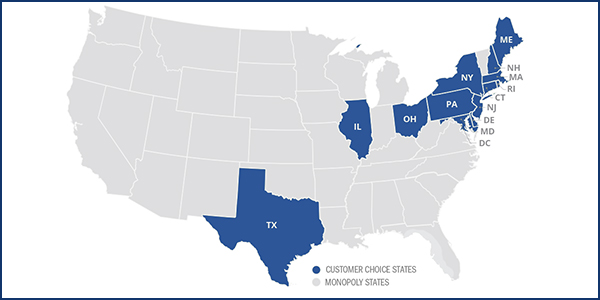

The report notes that at least five states — all of which have retail competition — have begun proceedings over the last year to consider leaving FERC-regulated capacity markets.

New York regulators opened a proceeding last year to determine whether NYPSC Opens Resource Adequacy Proceeding.)

Connecticut regulators held a public hearing in January on whether Connecticut Weighs Pros, Cons of ISO-NE Markets.)

In New Jersey, Illinois and Maryland, regulators and legislators are considering leaving PJM’s MOPR Quandary: Should States Stay or Should they Go?)

“If states wish to rely less on capacity markets, they will need to make sure their retail markets are designed to handle resource procurement,” the study said. Yet among the 14 states with retail competition, only Texas clearly assigns responsibility for resource procurement to customers or their load-serving entities. “No entity in those [13 states] has both the incentive and ability to procure power, given the rules and structures currently in place,” Gramlich and Lacey say.

The other 13 states have “hybrid” competitive retail structures with “a monopoly default service provider offering rates that are subsidized to varying degrees and some form of a free option for customers to move in and out of competitive service. This dynamic reduces the incentive for retailers to procure supply.”

Clean Energy Transformation

The study says the transition to a decarbonized economy will require a market structure with entities able and willing to sign long-term contracts because generation developers and lenders are reluctant to finance 20- to 40-year assets based on expected future hourly prices.

This is especially the case for renewables, which are capital-intensive, with no fuel expenses and minimal ongoing costs. “Prearranged contracts provide the certainty necessary to finance those capital costs at a reasonable rate before the investment is made,” said the authors, who also noted that increasing penetration of renewables with zero production costs can depress spot energy prices. “Contracts provide upfront revenue certainty for lenders prior to committing capital.”

The failure of most restructured states to assign responsibility for ensuring resource adequacy caused a “free-rider” problem, leaving supply “under-procured and underpaid,” the authors say. “That is one reason RTOs in those areas stepped into the resource adequacy role with mandatory capacity markets.”

Recommendations

The study includes a scorecard on state retail market rules and their impact on competitive retail energy providers’ incentive to invest in generation resources. Texas gets straight “A’s,” while New Jersey, Maryland and Pennsylvania score mostly “D’s” and “F’s”.

The report identifies several reforms the authors say would improve retail market operations:

- Eliminate Subsidies for Default Service: Utilities typically do not include in default service rates the costs for billing systems, accounting services, call centers or other functions required to deliver default service, resulting in a subsidy the authors estimate to be about 1 to 2 cents/kWh. In Baltimore Gas and Electric’s 2019 rate case, for example, the cost of providing default service was estimated to be about $170 million, only $12.3 million of which BGE planned to allocate to default service customers. The remainder was recovered through BGE’s distribution rates, which are paid by all customers, including those choosing competitive suppliers.

- Unbiased Initial Placement: Default service is really a “provider of first resort” in many states instead of the “provider of last resort” as it is sometimes referred, the authors say, noting that only about one-third of residential customers in the 13 states have chosen competitive suppliers. Retail electric providers’ (REPs) “ability to maintain their customer base is eroded where new customers or moving customers are automatically placed on utility default service,” the authors say. “If customers were compelled to choose a supplier when enrolled for new service, they would be empowered with many options, including the option to purchase renewable energy.”

- No Free Option: Consumers in hybrid restructured states are free to return to default service at any time. “The option imposes costs on default service wholesale providers (they lose load when market prices decline because the default service price decline lags the market) and onto REPs and onto other entities that provide customer services. (REPs lose load to default service when market prices increase because the default service price increase lags the market.) The free option eliminates the incentive for REPs to procure power on a long-term basis on a customer’s behalf.”

- Creditworthiness: High and enforceable creditworthiness standards are needed to ensure REPs can make the long-term resource commitments needed to serve their loads.

- Utility Neutrality on Default Service: Utilities profiting from providing default service are likely to steer customers away from competitive suppliers, the authors say. In its latest distribution rate proceeding, it was estimated that BGE will earn $8.3 million annually above its approved distribution revenue requirement from providing default service. By contrast, Texas has eliminated utilities’ role as default service provider.

The report says the recommendations would “enable broader wholesale market improvements.”

“One key market design element that is not widely used yet but is important to ensure retail providers have the incentive to sign long-term contracts, as well as to provide appropriate long- and short-term incentives for efficient behavior, is to accurately price energy at times of scarcity,” the authors say. “In Texas, prices can rise to $9,000/MWh at these times, as they did in the summer of 2019. This feature along with the rest of the Texas structure appears to be working to achieve supply-demand balance.”