By Amanda Durish Cook

FERC on Thursday denied what might be a final bid to recalibrate the results of MISO’s 2015/16 capacity auction, blocking Public Citizen’s request for rehearing over the highest capacity prices ever seen in the footprint.

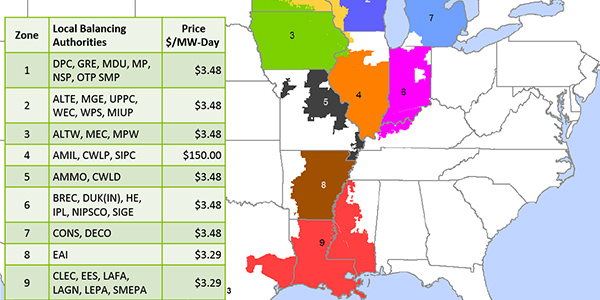

MISO’s 2015/16 Planning Resource Auction has lived on in legal proceedings for more than five years. FERC last year wrapped up a three-year investigation into the PRA when it ruled the RTO’s Zone 4 $150/MW-day clearing price just and reasonable, declining to set up an evidentiary hearing. It also found that Dynegy had not manipulated the market to produce the high prices in southern Illinois. (See FERC Clears MISO 2015/16 Auction Results.)

The commission said a clearing price isn’t unjust simply because it’s higher than expected. However, the decision remains unsubstantiated because FERC didn’t make any evidence from the investigation public when it abruptly ended the probe.

Soon after the ruling, Public Citizen claimed FERC wrongfully dismissed complaints alleging Dynegy manipulated pricing in the auction, violating the Administrative Procedure Act for not providing explanation or summarizing evidence and abandoning its just and reasonable ratemaking responsibility under the Federal Power Act. (See Public Citizen Contests FERC Ruling on MISO Auction.)

The commission rebuffed those arguments in its March 19 order (EL15- 70), leading Commissioner Richard Glick to once again issue a dissent and separate statement over the transparency of FERC’s investigation.

FERC’s other two commissioners, Chairman Neil Chatterjee and Bernard McNamee, said they remained unpersuaded that results were underhanded because Dynegy’s bids were permitted under a “valid, market-based rate tariff” and the bids met criteria under the FERC-approved MISO Tariff at the time. They also said they have discretion in market manipulation investigations, though they again declined to reveal any specifics of the investigation into Dynegy and Zone 4 prices.

The commissioners said they were able to monitor Dynegy’s market-based rate through accurate quarterly reports, triennial market power updates and change-in-status updates. They also said they oversaw the market monitoring and mitigation rules in MISO’s Tariff.

Public Citizen had argued that just eight months after the auction, FERC found MISO’s 2015 market power provisions no longer just and reasonable and ordered MISO to reset its $155.79/MW-day maximum bid to about $25, while also directing the RTO to better gauge power exports. (See FERC Orders MISO to Change Auction Rules.) But the commission said those new policies were to be viewed on a going-forward basis.

Glick Hints at Unfinished Investigation

However, Glick said the order was another “sidestep” of the crux of the proceedings, failing to answer the question of whether the resulting prices were reasonable considering the allegations of market manipulation on Dynegy’s part.

“Rather than directly confronting that issue, the commission states that the relevant Tariff language was followed and that a non-public investigation was conducted and did not, in my colleagues’ view, uncover manipulative conduct. That enforcement proceeding, however, was terminated by the chairman without a vote by the commission and the details of that investigation remain confidential,” Glick wrote. “Accordingly, the commission has at no point provided Public Citizen with an adequate response to the concerns raised in its complaint or explained why, in light of those concerns, the auction results were just and reasonable.”

Glick added that following relevant tariffs does not create a “safe harbor” for market manipulation.

“I am not aware of any authority to support the proposition that a market participant can commit market manipulation with impunity so long as it does not violate the relevant tariff language,” Glick said. He also said that courts’ interpretations of the Securities Act of 1934 “have repeatedly recognized that a facially legal action can constitute manipulation when it is taken for an improper purpose.”

Glick also reiterated his displeasure that he was not consulted before Chairman Chatterjee closed the nonpublic investigation. He also hinted that there might have been evidence that Dynegy had committed wrongdoing.

“Had I been consulted, I would have argued against terminating the enforcement process. Because the details of the investigation remain non-public, I cannot explain why I believe that the chairman erred in terminating the enforcement process. Suffice it to say that I am confident that the evidence uncovered in that investigation was more-than-sufficient to press ahead,” he wrote.

Glick ended by echoing complaints that the commission’s decision “does not provide even the scantest reasoning to support its finding that the nearly 1,000% year-over-year increase in the MISO Zone 4 capacity price had nothing to do with market manipulation.

“Instead, all we have is the Commission’s unsubstantiated assurance that there is nothing to see here.”